اقتصاد الولايات المتحدة-تنمية

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

الولايات المتحدة هي دولة عالية التقدم تتمتع باقتصاد سوق[32] ولديها أكبر الناتج المحلي الإجمالي الاسمي إجمالي الثروة في العالم. ولديها ثاني أكبر ناتج محلي إجمالي (ق.ش.م.) بعد الصين.[33] وكان لديها ثامن أكبر ناتج محلي إجمالي (اسمي) للفرد وتاسع أكبر ناتج محلي إجمالي (ق.ش.م.) للفرد عام 2022.[34] تمتلك الولايات المتحدة أقوى اقتصاداً مبتكراً في العالم من الناحية التكنولوجية. تحتل شركاتها موقع الصدارة أو بالقرب منه في التطورات التكنولوجية، لا سيما الذكاء الاصطناعي وأجهزة حاسوب والأدوية والطب والفضاء الجوي والعتاد العسكري.[35] الدولار الأمريكي هي العملة الأكثر استخدامًا في المعاملات الدولية وهي العملة الأولى في العملات الاحتياطية العالمية، مدعوماً باقتصادها، عسكريتها، نظام الپترودولار والمرتبط به باليورو-دولار وسوق سندات الخزانة الضخم.[36][37] تستخدمه العديد من البلدان كعملة رسمية لها وفي بلدان أخرى يكون عملة "الأمر الواقع".[38][39] أكبر الشركاء التجاريين للولايات المتحدة هم الصين، الاتحاد الأوروپي، كندا، المكسيك، الهند، اليابان، كوريا الجنوبية، المملكة المتحدة وتايوان.[40] الولايات المتحدة هي أكبر مستورد وثاني أكبر مصدر في العالم.[41] لديها اتفاقيات تجارة حرة مع عدة دول، بما في ذلك اتفاقية الولايات المتحدة والمكسيك وكندا وأستراليا وكوريا الجنوبية وسويسرا وإسرائيل والعديد من أخرى سارية المفعول أو قيد التفاوض.[42]

يغذي اقتصاد البلاد وفرة الموارد الطبيعية، والبنية التحتية المتطورة، والإنتاجية العالية.[43] كان لديها عام 2019 ثاني أعلى قيمة تقديرية إجمالية للموارد الطبيعية، بقيمة 44.98 تريليون دولار، على الرغم من اختلاف المصادر في تقديراتها.[44] يمتلك الأمريكيون أعلى متوسط دخل على مستوى الأسرة والموظفين بين الدول الأعضاء في منظمة التعاون والتنمية الاقتصادية.[45] عام 2013، كان لديه سادس أعلى متوسط دخل للأسرة، بعد تراجعها عن المركز الرابع عام 2010.[46][47]

بحلول عم 1890، تجاوزت الولايات المتحدة الإمبراطورية البريطانية باعتبارها الاقتصاد الأكثر إنتاجية في العالم.[48] وهي أكبر منتج للنفط والغاز الطبيعي في العالم.[49] عام 2016، كانت أكبر بلد تجاري في العالم[50] وكذلك ثالث أكبر مصنع، حيث تساهم بخمس الإنتاج الصناعي العالمي.[51] لا تمتلك الولايات المتحدة أكبر سوق داخلي للسلع فحسب، بل تهيمن أيضًا على تجارة الخدمات. بلغ إجمالي التجارة الأمريكية 4.2 تريليون دولار عام 2018.[52] من بين أكبر 500 شركة، يوجد 121 شركة مقرها الولايات المتحدة.[53] تمتلك الولايات المتحدة أكبر عدد من البليونيرات، بإجمالي ثروة تبلغ 3.0 تريليون دولار.[54][55] اعتباراًمن أغسطس 2020، كان لدى البنوك التجارية الأمريكية أصول قيمتها 20 تريليون دولار أمريكي.[56] تمتلك الولايات المتدة أصول عالمية تحت إدارتها بأكثر من 30 ريليون دولار.[57][58]

تعتبر بورصة نيويورك ونازداك أكبر بورصات العالم حسب القيمة السوقية وحجم التجارة.[59][60] بلغ إجمالي الاستثمارات الأجنبية ما يقرب من 4.0 تريليون دولار أمريكي،[61] بينما يبلغ إجمالي الاستثمارات في البلدان الأجنبية الأمريكية أكثر من 5.6 تريليون دولار.[62] يحتل الاقتصاد الأمريكي المرتبة الأولى في الترتيب الدولي من حيث رأس المال الاستثماري[63] وتمويل البحث والتنمية العالمي.[64] شكل إنفاق المستهلك 68% من الاقتصاد الأمريكي في 2018،[65] بينما بلغ نصيب العمالة من الدخل 43% في عام 2017.[66] للولايات المتحدة أكبر سوق مستهلك في العالم.[67] اجتذب سوق العمل في البلاد المهاجرين من جميع أنحاء العالم ويعد معدل الهجرة الصافي من بين أعلى المعدلات في العالم.[68] تعد الولايات المتحدة واحدة من أفضل الاقتصادات أداءً في دراسات مثل مؤشر سهولة ممارسة الأعمال وتقرير التنافسية العالمية وغيرها.[69] شهد الاقتصاد الأمريكي تباطؤًا اقتصاديًا خطيرًا أثناء الركود الكبير، والذي تم تعريفه على أنه ركود استمر من ديسمبر 2007 حتى يونيو 2009. ومع ذلك، استعاد إجمالي الناتج المحلي الحقيقي ذروته قبل الأزمة (أواخر 2007) بحلول عام 2011،[70] household net worth by Q2 2012,[71] الوظائف برواتب-الغير الزراعية بحلول مايو 2014،[72] ومعدل البطالة بحلول سبتمبر 2015.[73]

احتلت الولايات المتحدة المرتبة 41 في تفاوت الدخل من بين 156 دولة عام 2017،[74] وهو الأعلى مقارنة ببقية بلدان العالم الغربي.[75] استمر كل من هذه المتغيرات في منطقة ما بعد الركود بعد تلك التواريخ، حيث أصبح الانتعاش الأمريكي ثاني أطول فترة مسجلة بحلول أبريل 2018.[76]

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

التاريخ

الفترة الاستعمارية

بدأ التاريخ الاقتصادي للولايات المتحدة مع المستوطنات البريطانية على طول الساحل الشرقي في القرنين السابع عشر والثامن عشر. ارتفع عدد السكان في أمريكا بعد عام 1700 بسرعة ومعها نمت الواردات وكذلك الصادرات. ساهمت أفريقيا وآسيا وأوروبا في تجارة المستعمرات.[77] نالت هذه المستعمرات الثلاثة عشر استقلالها عن الإمبراطورية البريطانية في أواخر القرن الثامن عشر[78] وسرعان ما نمت من الاقتصادات الاستعمارية إلى اقتصاد يركز على الزراعة.[79]

القرن 19

في غضون 180 عامًا، نمت الولايات المتحدة إلى اقتصاد ضخم ومتكامل وصناعي كان يشكل حوالي خمس الاقتصاد العالمي. نتيجة لذلك، تقارب نصيب الفرد من الناتج المحلي الإجمالي للولايات المتحدة وتجاوز في النهاية مثيله في الإمبراطورية البريطانية، وكذلك البلدان الأخرى التي كانت تتبعها اقتصاديًا في السابق. حافظ الاقتصاد على أجور عالية، وجذب المهاجرين بالملايين من جميع أنحاء العالم.[80] في عشرينيات القرن التاسع عشر، الإنتاج الضخم الحرفيين بالمصانع. عززت اللوائح الحكومية الجديدة الرأسمالية ببراءات الاختراع.[81] في أوائل القرن التاسع عشر كانت الولايات المتحدة زراعية إلى حد كبير حيث كان أكثر من 80% من السكان يعملون في الزراعة. تركزت معظم عمليات التصنيع على المراحل الأولى من تحويل المواد الخام من خلال الأخشاب والمناشر والمنسوجات والأحذية والأحذية ذات الرقبة. ساهمت الثروات الغنية بالموارد في التوسع الاقتصادي السريع خلال القرن التاسع عشر. سمح توافر الأراضي الوافرة لعدد المزارعين بالاستمرار في النمو، لكن النشاط في التصنيع والخدمات والنقل والقطاعات الأخرى نما بوتيرة أسرع بكثير. وهكذا، بحلول عام 1860، انخفضت نسبة سكان الريف في الولايات المتحدة من أكثر من 80% إلى ما يقرب من 50%.[82]

في القرن التاسع عشر، تزامنت حالات الركود كثيرًا مع الأزمات المالية. أعقب هلع 1837 فترة ركود استمرت خمس سنوات، مع فشل البنوك ثم تسجيل مستويات بطالة قياسية.[83] بسبب التغيرات الكبيرة في الاقتصاد على مدار قرون، من الصعب مقارنة شدة حالات الركود الحديثة بنظيرتها المبكرة.[84] يبدو أن حالات الركود في أعقاب الحرب العالمية الثانية كانت أقل حدة من حالات الركود السابقة، لكن أسباب ذلك غير واضحة.[85]

القرن 20

في بداية القرن ، فتحت الابتكارات الجديدة والتحسينات في الابتكارات الحالية الباب لتحسين مستوى المعيشة بين المستهلكين الأمريكيين. نمت العديد من الشركات بشكل كبير من خلال الاستفادة من وفورات الحجم واتصالات أفضل لتشغيل العمليات على الصعيد الوطني. أثار التركيز في هذه الصناعات مخاوف من الاحتكار الذي من شأنه أن يدفع الأسعار إلى الأعلى وينخفض الإنتاج، لكن العديد من هذه الشركات كانت تخفض التكاليف بسرعة كبيرة لدرجة أن الاتجاهات كانت نحو انخفاض الأسعار وزيادة الإنتاج في هذه الصناعات. شارك العديد من العمال نجاح هذه الشركات الكبيرة، التي تقدم عادةً أعلى الأجور في العالم.[86]

كانت الولايات المتحدة أكبر اقتصاد وطني في العالم من حيث الناتج المحلي الإجمالي منذ العشرينيات على الأقل.[48] لسنوات عديدة بعد الكساد الكبير في الثلاثينيات، عندما بدا خطر الركود أكثر خطورة، عززت الحكومة الاقتصاد من خلال الإنفاق بشكل كبير على نفسها أو خفض الضرائب بحيث ينفق المستهلكون المزيد، ومن خلال تعزيز النمو في عرض النقود، مما شجع أيضًا على المزيد من الإنفاق. تغيرت الأفكار حول أفضل الأدوات لتحقيق الاستقرار في الاقتصاد بشكل كبير بين الثلاثينيات والثمانينيات. من حقبة الصفقة الجديدة التي بدأت عام 1933، إلى مبادرات المجتمع العظيم في الستينيات، اعتمد صانعو السياسة الوطنية بشكل أساسي على السياسة المالية للتأثير على الاقتصاد.[بحاجة لمصدر]

أثناء الحروب العالمية في القرن العشرين، كان أداء الولايات المتحدة أفضل من بقية البلدان المقاتلة لأنه لم يتم خوض أي من الحرب العالمية الأولى والقليل نسبيًا من الحرب العالمية الثانية على الأراضي الأمريكية (ولم يتم خوض أي منها في الولايات الثماني والأربعين آنذاك). ومع ذلك، حتى في الولايات المتحدة، كانت الحروب تعني التضحية. خلال ذروة نشاط الحرب العالمية الثانية، تم تخصيص ما يقرب من 40% من الناتج المحلي الإجمالي للولايات المتحدة للإنتاج الحربي. أُتخذت القرارات حول قطاعات واسعة من الاقتصاد إلى حد كبير للأغراض العسكرية وخُصصت جميع المدخلات ذات الصلة تقريبًا للجهود الحربية. تم تقنين العديد من السلع، والسيطرة على الأسعار والأجور، ولم يعد يتم إنتاج العديد من السلع الاستهلاكية المعمرة. تم تجنيد شرائح كبيرة من القوى العاملة في الجيش، ودفع نصف الأجر ، وأُرسل نصف هؤلاء تقريبًا إلى التهلكة.[87]

هذا النهج، الذي قدمه الخبير الاقتصادي البريطاني جون مينارد كينز، أعطى المسؤولين المنتخبين دورًا رائدًا في توجيه الاقتصاد لأن الإنفاق والضرائب يتحكم فيهما رئيس الولايات المتحدة والكونگرس. شهدت "طفرة المواليد" زيادة كبيرة في الخصوبة في الفترة من 1942 حتى 1957. كان سببها تأخر الزواج والإنجاب خلال سنوات الكساد، وزيادة الازدهار، والطلب على منازل الأسرة الواحدة في الضواحي (على عكس الشقق داخل المدينة) والتفاؤل الجديد بشأن المستقبل. بلغ الازدهار ذروته حوالي عام 1957، ثم انخفض ببطء.[88] أدت فترة التضخم المرتفع وأسعار الفائدة والبطالة بعد عام 1973 إلى إضعاف الثقة في السياسة المالية كأداة لتنظيم الوتيرة الإجمالية للنشاط الاقتصادي.[89]

نما الاقتصاد الأمريكي بنسبة المتوسط بنسبة 3.8% من عام 1946 حتى 1973، بينما ارتفع معدل متوسط دخل الأسرة بنسبة 74% (أو 2.1% سنويًا).[90][91]

حدث أسوأ ركود في العقود الأخيرة، من حيث فقد الإنتاج، أثناء الأزمة المالية 2007-2008، عندما انخفض الناتج المحلي الإجمالي بنسبة 5.0% من ربيع 2008 حتى ربيع 2009. حدثت فترات ركود كبيرة أخرى في 1957-1958، عندما انخفض الناتج المحلي الإجمالي بنسبة 3.7%، في أعقاب أزمة النفط 1973، مع انخفاض بنسبة 3.1% من أواخر عام 1973 إلى أوائل عام 1975، وفي ركود 1981-1982، عندما انخفض الناتج المحلي الإجمالي بنسبة 2.9%.[92][93] وشملت حالات الركود المعتدلة الأخيرة الركود الاقتصادي في الفترة 1990-1991، عندما انخفض الإنتاج بنسبة 1.3%، والركود الاقتصادي عام 2001، حيث انخفض الناتج المحلي الإجمالي بنسبة 0.3%. استمر الانكماش الاقتصادي عام 2001 ثمانية أشهر فقط.[93] من ناحية أخرى، حدثت فترات النمو الأكثر قوة واستدامة من أوائل عام 1961 إلى منتصف عام 1969، مع توسع بنسبة 53% (5.1% سنويًا)، من منتصف عام 1991 إلى أواخر عام 2000، بنسبة 43% (3.8% سنويًا)، ومن أواخر عام 1982 إلى منتصف عام 1990، بنسبة 37% (4% سنويًا).[92]

في السبعينيات والثمانينيات، كان من الشائع في الولايات المتحدة الاعتقاد بأن اقتصاد اليابان سيتفوق على اقتصاد الولايات المتحدة، لكن هذا لم يحدث.[94]

منذ السبعينيات ، بدأت العديد من الدول الناشئة في سد الفجوة الاقتصادية مع الولايات المتحدة. في معظم الحالات، كان هذا بسبب نقل تصنيع البضائع التي كانت تُصنع سابقًا في الولايات المتحدة إلى البلدان التي يمكن تصنيعها فيها بأموال أقل بما يكفي لتغطية تكلفة الشحن بالإضافة إلى ربح أعلى. في حالات أخرى، تعلمت بعض البلدان تدريجيًا إنتاج نفس المنتجات والخدمات التي كانت في السابق فقط الولايات المتحدة وعدد قليل من الدول الأخرى التي كانت قادرة على إنتاجها. تباطأ نمو الدخل الحقيقي في الولايات المتحدة.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

القرن 21

عام 2011، شهد اقتصاد الولايات المتحدة ركودًا مع انتعاش بطيء غير عادي في الوظائف، وعدم عودة عدد الوظائف إلى مستوى فبراير 2001 حتى يناير 2005.[95] تداخل "الانتعاش بلا عودة الوظائف" هذا مع تشكل فقاعة الإسكان ويمكن القول إنها فقاعة ديون أوسع، حيث ارتفعت نسبة ديون الأسرة إلى الناتج المحلي الإجمالي من مستوى قياسي بلغ 70% في الربع الأول من عام 2001 إلى 99% في الربع الأول من عام 2008. كان أصحاب المنازل يقترضون مقابل منازلهم ذات الأسعار الفقاعية لتغذية الاستهلاك، مما أدى إلى ارتفاع مستويات ديونهم مع توفير دفعة غير مستدامة للناتج المحلي الإجمالي. عندما بدأت أسعار المساكن في الانخفاض عام 2006، انخفضت قيمة الأوراق المالية المدعومة بالرهون العقارية بشكل كبير، مما تسبب في ما يعادل تشغيل بنك في نظام مصرفي غير متضمن الإيداع والغير منظم بشكل أساسي، والذي تجاوز نظام الإيداع المصرفي التقليدي المنظم. واجهت العديد من شركات الرهن العقاري وغيرها من البنوك غير المودعة (مثل البنوك الاستثمارية) أزمة تزداد سوءًا في 2007-2008، حيث بلغت الأزمة المصرفية ذروتها في سبتمبر 2008، مع إفلاس ليمان براذرز وإنقاذ العديد من المؤسسات المالية الأخرى.[96]

طبقت إدارة بوش (2001-2009) وإدارات أوباما (2009-2017) برامج إنقاذ الخدمات المصرية والتحفيز الكينزي عن طريق العجز الحكومي المرتفع، في حين أن الحكومة الفدرالية حافظ الاحتياطي على أسعار فائدة تقترب من الصفر. ساعدت هذه الإجراءات الاقتصاد على التعافي، حيث سددت الأسر ديونها في الفترة 2009-2012، وهي السنوات الوحيدة منذ عام 1947 التي شهدت حدوث ذلك،[97] مما مثل عائقاً كبيراً أمام الانتعاش.[96] استعاد إجمالي الناتج المحلي الحقيقي ذروته قبل الأزمة (أواخر 2007) بحلول عام 2011، [70] صافي ثروة الأسرة بحلول الربع الثاني من عام 2012،[71] الوظائف مدفوعة الأجر الغير زراعية بحلول مايو 2014،[95] ومعدل البطالة بحلول سبتمبر 2015.[98] استمر كل من هذه المتغيرات في منطقة سجل ما بعد الركود بعد تلك التواريخ، حيث أصبح الانتعاش الأمريكي ثاني أطول فترة مسجلة في أبريل 2018.[99]

ارتفع الدين العام، وهو مقياس للديون الوطنية، طوال سنوات القرن الحادي والعشرين. ارتفعت من 31% في عام 2000 إلى 52% عام 2009، ووصلت إلى 77% من الناتج المحلي الإجمالي عام 2017، واحتلت الولايات المتحدة المرتبة 43 في أعلى الديون من بين 207 بلد. بلغ التفاوت في الدخل ذروته عام 2007 وانخفض خلال فترة الركود الكبير، ومع ذلك لا يزال يحتل المرتبة 41 من بين 156 بلد عام 2017 (أي أن 74% من البلدان لديها توزيع دخل أكثر مساواة).[100]

في الربعين الأولين من عام 2020 وسط تنصيب الرئيس الأمريكي دونالد ترمپ،[101] عانى الاقتصاد الأمريكي من نكسات كبيرة بدأت في مارس 2020، بسبب ڤيروس كورونا الجديد وتسببه في "إغلاق" القطاعات الرئيسية للاقتصاد الأمريكي.[102] اعتبارًا من مارس 2020، تراجعت صادرات الولايات المتحدة من السيارات والآلات الصناعية نتيجة للجائحة في جميع أنحاء العالم.[103] أدت تدابير التباعد الاجتماعي التي دخلت حيز التنفيذ في مارس 2020، والتي أثرت سلبًا على الطلب على السلع والخدمات، إلى تراجع الناتج المحلي الإجمالي الأمريكي عند المعدل السنوي 4.8% في الربع الأول، وهو أشد وتيرة انكماش في الإنتاج منذ الربع الأخير من عام 2008.[104] انخفضت مبيعات التجزئة الأمريكية بنسبة قياسية بلغت 8.7% في مارس وحده. كما تضررت صناعة الطيران الأمريكية بشدة، حيث شهدت انخفاضًا حادًا في إيراداتها.[105] على الرغم من أن ركود كوڤيد-19 وُصف على نطاق واسع بأنه أخطر تراجع اقتصادي عالمي منذ الكساد الكبير، و"أسوأ بكثير" من الركود الكبير.[106][107][108][109]

في مايو 2020، قدمت سي إن إن تحليلاً بناءً على بيانات البطالة التي تفيد بأن الاقتصاد الأمريكي ربما كان أسوأ ما كان عليه منذ الثلاثينيات.[110] بحلول 8 مايو، وصلت الولايات المتحدة إلى معدل بطالة قياسي بلغ 14.7 في المائة، مع خسارة 20.5 مليون وظيفة في أبريل.[111] حذر رئيس الاحتياطي الفدرالي الأمريكي، جروم پاول، من أن الأمر قد يستغرق "وقتًا طويلاً" قبل أن يتعافى الاقتصاد الأمريكي بالكامل من ضعف النمو الاقتصادي، بسبب الجائحة، وذلك في المستقبل المنظور. المستقبل يمكن أن تتوقع الولايات المتحدة "نمو إنتاجية منخفض وركود في الدخل".[112] بحلول 31 مايو 2020، تقدم أكثر من أربعين مليون أمريكي للحصول على إعانات البطالة.[113]

بحلول يونيو 2020، أدى التراجع في الرحلات الجوية القارية الأمريكية بسبب جائحة كورونا إلى قيام حكومة الولايات المتحدة بإيقاف خدمة خمسة عشر شركة طيران أمريكية مؤقتًا إلى 75 مطارًا محليًا.[114] أفادت نيويورك تايمز في 10 يونيو 2020، أن "عجز ميزانية الولايات المتحدة نما إلى مستوى قياسي بلغ 1.88 تريليون دولار أمريكي في الأشهر الثمانية الأولى من هذه السنة المالية".[115]

زاد الاقتصاد الأمريكي بنسبة 5.7% عام 2021، وهو أفضل أداء له منذ رئاسة رونالد ريگان (1981-1989).[116]

بيانات

يوضح الجدول التالي المؤشرات الاقتصادية الرئيسية في 1980-2021 (مع تقديرات خبراء صندوق النقد الدولي في 2022-2027). التضخم أقل من 3% باللون الأخضر.[117]

| السنة | ن.م.إ.

(بالبليون US$ ق.ش.م.) |

ن.م.إ. للفرد

US$ ق.ش.م.) |

ن.م.إ.

(بالبليون US$ الاسمي) |

ن.م.إ. للفرد

(US$ الاسمي) |

نمو ن.م.إ.

(الحقيقي) |

معدل التضخم

(%) |

البطالة

(%) |

الدين الحكومي

(% من ن.م.إ.) |

|---|---|---|---|---|---|---|---|---|

| 1980 | 2.857.3 | 12.552.9 | 2.857.3 | 12.552.9 | ▲13.5% | 7.2% | n/a | |

| 1981 | ▲3.207.0 | ▲13.948.7 | ▲3.207.0 | ▲13.948.7 | ▲2.5% | ▲10.4% | ▲7.6% | n/a |

| 1982 | ▲3.343.8 | ▲14.405.0 | ▲3.343.8 | ▲14.405.0 | ▲6.2% | ▲9.7% | n/a | |

| 1983 | ▲3.634.0 | ▲15.513.7 | ▲3.634.0 | ▲15.513.7 | ▲4.6% | ▲3.2% | ▼9.6% | n/a |

| 1984 | ▲4.037.7 | ▲17.086.4 | ▲4.037.7 | ▲17.086.4 | ▲7.2% | ▲4.4% | ▼7.5% | n/a |

| 1985 | ▲4.339.0 | ▲18.199.3 | ▲4.339.0 | ▲18.199.3 | ▲4.2% | ▲3.5% | ▼7.2% | n/a |

| 1986 | ▲4.579.6 | ▲19.034.8 | ▲4.579.6 | ▲19.034.8 | ▲3.5% | ▲1.9% | ▼7.0% | n/a |

| 1987 | ▲4.855.3 | ▲20.001.0 | ▲4.855.3 | ▲20.001.0 | ▲3.5% | ▲3.6% | ▼6.2% | n/a |

| 1988 | ▲5.236.4 | ▲21.376.0 | ▲5.236.4 | ▲21.376.0 | ▲4.2% | ▲4.1% | ▼5.5% | n/a |

| 1989 | ▲5.641.6 | ▲22.814.1 | ▲5.641.6 | ▲22.814.1 | ▲3.7% | ▲4.8% | ▼5.3% | n/a |

| 1990 | ▲5.963.1 | ▲23.848.0 | ▲5.963.1 | ▲23.848.0 | ▲1.9% | ▲5.4% | ▲5.6% | n/a |

| 1991 | ▲6.158.1 | ▲24.302.8 | ▲6.158.1 | ▲24.302.8 | ▲4.2% | ▲6.9% | n/a | |

| 1992 | ▲6.520.3 | ▲25.392.9 | ▲6.520.3 | ▲25.392.9 | ▲3.5% | ▲3.0% | ▲7.5% | n/a |

| 1993 | ▲6.858.6 | ▲26.364.2 | ▲6.858.6 | ▲26.364.2 | ▲2.8% | ▲3.0% | ▼6.9% | n/a |

| 1994 | ▲7.287.3 | ▲27.674.0 | ▲7.287.3 | ▲27.674.0 | ▲4.0% | ▲2.6% | ▼6.1% | n/a |

| 1995 | ▲7.639.8 | ▲28.671.5 | ▲7.639.8 | ▲28.671.5 | ▲2.7% | ▲2.8% | ▼5.6% | n/a |

| 1996 | ▲8.073.1 | ▲29.947.0 | ▲8.073.1 | ▲29.947.0 | ▲3.8% | ▲2.9% | ▼5.4% | n/a |

| 1997 | ▲8.577.6 | ▲31.440.1 | ▲8.577.6 | ▲31.440.1 | ▲4.4% | ▲2.3% | ▼4.9% | n/a |

| 1998 | ▲9.062.8 | ▲32.833.7 | ▲9.062.8 | ▲32.833.7 | ▲4.5% | ▲1.5% | ▼4.5% | n/a |

| 1999 | ▲9.631.2 | ▲34.496.2 | ▲9.631.2 | ▲34.496.2 | ▲4.8% | ▲2.2% | ▼4.2% | n/a |

| 2000 | ▲10.251.0 | ▲36.312.8 | ▲10.251.0 | ▲36.312.8 | ▲4.1% | ▲3.4% | ▼4.0% | n/a |

| 2001 | ▲10.581.9 | ▲37.101.5 | ▲10.581.9 | ▲37.101.5 | ▲1.0% | ▲2.8% | ▲4.7% | 53.1% |

| 2002 | ▲10.929.1 | ▲37.945.8 | ▲10.929.1 | ▲37.945.8 | ▲1.7% | ▲1.6% | ▲5.8% | ▲55.5% |

| 2003 | ▲11.456.5 | ▲39.405.4 | ▲11.456.5 | ▲39.405.4 | ▲2.8% | ▲2.3% | ▲6.0% | ▲58.6% |

| 2004 | ▲12.217.2 | ▲41.641.6 | ▲12.217.2 | ▲41.641.6 | ▲3.9% | ▲2.7% | ▼5.5% | ▲66.1% |

| 2005 | ▲13.039.2 | ▲44.034.3 | ▲13.039.2 | ▲44.034.3 | ▲3.5% | ▲3.4% | ▼5.1% | ▼65.5% |

| 2006 | ▲13.815.6 | ▲46.216.9 | ▲13.815.6 | ▲46.216.9 | ▲2.8% | ▲3.2% | ▼4.6% | ▼64.2% |

| 2007 | ▲14.474.3 | ▲47.943.4 | ▲14.474.3 | ▲47.943.4 | ▲2.0% | ▲2.9% | ▲64.6% | |

| 2008 | ▲14.769.9 | ▲48.470.6 | ▲14.769.9 | ▲48.470.6 | ▲0.1% | ▲3.8% | ▲5.8% | ▲73.5% |

| 2009 | ▲-0.3% | ▲9.3% | ▲86.6% | |||||

| 2010 | ▲15.049.0 | ▲48.586.3 | ▲15.049.0 | ▲48.586.3 | ▲2.7% | ▲1.6% | ▲9.6% | ▲95.2% |

| 2011 | ▲15.599.7 | ▲50.008.1 | ▲15.599.7 | ▲50.008.1 | ▲1.6% | ▲3.1% | ▼8.9% | ▲99.5% |

| 2012 | ▲16.254.0 | ▲51.736.7 | ▲16.254.0 | ▲51.736.7 | ▲2.3% | ▲2.1% | ▼8.1% | ▲103.1% |

| 2013 | ▲16.843.2 | ▲53.245.5 | ▲16.843.2 | ▲53.245.5 | ▲1.8% | ▲1.5% | ▼7.4% | ▲104.6% |

| 2014 | ▲17.550.7 | ▲55.083.5 | ▲17.550.7 | ▲55.083.5 | ▲2.3% | ▲1.6% | ▼6.2% | ▼104.6% |

| 2015 | ▲18.206.0 | ▲56.729.7 | ▲18.206.0 | ▲56.729.7 | ▲2.7% | ▲0.1% | ▼5.3% | ▲105.1% |

| 2016 | ▲18.695.1 | ▲57.840.0 | ▲18.695.1 | ▲57.840.0 | ▲1.7% | ▲1.3% | ▼4.9% | ▲107.2% |

| 2017 | ▲19.479.6 | ▲59.885.7 | ▲19.479.6 | ▲59.885.7 | ▲2.3% | ▲2.1% | ▼4.4% | ▼106.2% |

| 2018 | ▲20.527.2 | ▲62.769.7 | ▲20.527.2 | ▲62.769.7 | ▲2.9% | ▲2.4% | ▼3.9% | ▲107.5% |

| 2019 | ▲21.372.6 | ▲65.051.9 | ▲21.372.6 | ▲65.051.9 | ▲2.3% | ▲1.8% | ▼3.7% | ▲108.8% |

| 2020 | ▲1.2% | ▲8.1% | ▲134.2% | |||||

| 2021 | ▲22.997.5 | ▲69.231.4 | ▲22.997.5 | ▲69.231.4 | ▲5.7% | ▲4.7% | ▼5.4% | ▼132.6% |

| 2022 | ▲25.346.8 | ▲76.027.0 | ▲25.346.8 | ▲76.027.0 | ▲3.7% | ▲7.7% | ▼3.5% | ▼125.6% |

| 2023 | ▲26.695.2 | ▲79.709.6 | ▲26.695.2 | ▲79.709.6 | ▲2.3% | ▲2.9% | ▼123.7% | |

| 2024 | ▲27.745.5 | ▲82.434.4 | ▲27.745.5 | ▲82.434.4 | ▲1.4% | ▲2.3% | ▲3.9% | ▲124.0% |

| 2025 | ▲28.790.4 | ▲85.110.5 | ▲28.790.4 | ▲85.110.5 | ▲1.7% | ▲2.0% | ▲4.0% | ▲125.1% |

| 2026 | ▲29.855.9 | ▲87.818.2 | ▲29.855.9 | ▲87.818.2 | ▲1.7% | ▲2.0% | ▲126.2% | |

| 2027 | ▲30.966.1 | ▲90.627.6 | ▲30.966.1 | ▲90.627.6 | ▲1.7% | ▲2.0% | ▲127.4% |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

الناتج المحلي الإجمالي

U.S. nominal GDP was $19.5 trillion in 2017. Annualized, nominal GDP reached $20.1 trillion in Q1 2018, the first time it exceeded $20 trillion. About 70% of U.S. GDP is personal consumption, with business investment 18%, government 17% (federal, state and local but excluding transfer payments such as Social Security, which is in consumption) and net exports a negative 3% due to the U.S. trade deficit.[119] Real gross domestic product, a measure of both production and income, grew by 2.3% in 2017, vs. 1.5% in 2016 and 2.9% in 2015. Real GDP grew at a quarterly annualized rate of 2.2% in Q1 2018, 4.2% in Q2 2018, 3.4% in Q3 2018 and 2.2% in Q4 2018; the Q2 rate was the best growth rate since Q3 2014, and the overall yearly GDP growth of 2.9% in 2018 was the best performance of the economy in a decade.[120] In 2020, the growth rate of the GDP has started to drop as a result of the COVID-19 pandemic, resulting in the GDP shrinking at a quarterized annual growth rate of −5.0% in Q1 2020[بحاجة لمصدر] and −32.9% in Q2 2020,[بحاجة لمصدر] respectively.

As of 2014, China passed the U.S. as the largest economy in GDP terms, measured at purchasing power parity conversion rates. The U.S. was the largest economy for more than a century prior to that milestone; China has more than tripled the U.S. growth rate for each of the past 40 years. As of 2017, the European Union as an aggregate had a GDP roughly 5% larger than the U.S.[121]

Real GDP per capita (measured in 2009 dollars) was $52,444 in 2017 and has been growing each year since 2010. It grew 3.0% per year on average in the 1960s, 2.1% in the 1970s, 2.4% in the 1980s, 2.2% in the 1990s, 0.7% in the 2000s, and 0.9% from 2010 to 2017.[122] Reasons for slower growth since 2000 are debated by economists and may include aging demographics, slower population and growth in labor force, slower productivity growth, reduced corporate investment, greater income inequality reducing demand, lack of major innovations, and reduced labor power.[123] The U.S. ranked 20th out of 220 countries in GDP per capita in 2017.[124] Among the modern U.S. Presidents, Bill Clinton had the highest cumulative percent real GDP increase during his two terms, Reagan second and Obama third.[120]

The development of the nation's GDP according to World Bank:[125] U.S. real GDP grew by an average of 1.7% from 2000 to the first half of 2014, a rate around half the historical average up to 2000.[126]

حسب القطاع الاقتصادي

مكون قطاع ن.م.إ. الاسمي

Nominal GDP sector composition, 2015 (in millions of dollars) at 2005 constant prices[127]

| No. | Country/Economy | Real GDP | Agri. | Indus. | Serv. |

|---|---|---|---|---|---|

| – | World | 60,093,221 | 1,968,215 | 16,453,140 | 38,396,695 |

| 1 | 15,160,104 | 149,023 | 3,042,332 | 11,518,980 |

Nominal GDP Sector Composition, 2016 (in millions of dollars) at current prices.[128]

| No. | Country/Economy | Nominal GDP | Agri. | Indus. | Serv. |

|---|---|---|---|---|---|

| 1 | 18,624,450 | 204,868.95 | 3,613,143.3 | 14,806,437.75 | |

| *Percentages from CIA World Factbook[129] | |||||

التوظيف

There were approximately 160.4 million people in the U.S. labor force in 2017, the fourth largest labor force in the world behind China, India, and the European Union.[131] The government (federal, state and local) employed 22 million in 2010.[132] Small businesses are the nation's largest employer, representing 37% of American workers.[133] The second-largest share of employment belongs to large businesses employing 36% of the U.S. workforce.[133]

The nation's private sector employs 85% of working Americans. Government accounts for 14% of all U.S. workers. Over 99% of all private employing organizations in the U.S. are small businesses.[133] The 30 million small businesses in the U.S. account for 64% of newly created jobs (those created minus those lost).[133] Jobs in small businesses accounted for 70% of those created in the last decade.[134]

The proportion of Americans employed by small business versus large business has remained relatively the same year by year as some small businesses become large businesses and just over half of small businesses survive for more than five years.[133] Amongst large businesses, several of the largest companies and employers in the world are American companies. Amongst them are Walmart, which is both the largest company and the largest private sector employer in the world. Walmart employs 2.1 million people worldwide and 1.4 million in the U.S. alone.[135][136]

There are nearly thirty million small businesses in the U.S.. Minorities such as Hispanics, African Americans, Asian Americans, and Native Americans (35% of the country's population),[137] own 4.1 million of the nation's businesses. Minority-owned businesses generate almost $700 billion in revenue, and they employ almost five million workers in the U.S.[133][138] Americans have the highest average employee income among OECD nations.[47] The median household income in the U.S. as of 2008 is $52,029.[139] About 284,000 working people in the U.S. have two full-time jobs and 7.6 million have part-time ones in addition to their full-time employments.[132] Out of all working individuals in the U.S., 12% belong to a labor union and most union members work for the government.[132] The decline of union membership in the U.S. over the last several decades parallels that of labor's share of the economy.[140][141][142] The World Bank ranks the United States first in the ease of hiring and firing workers.[143] The United States is the only advanced economy that does not legally guarantee its workers paid vacation or paid sick days, and is one of just a few countries in the world without paid family leave as a legal right, with the others being Papua New Guinea, Suriname and Liberia.[144][145][146] In 2014 and again in 2020, the International Trade Union Confederation graded the U.S. a 4 out of 5+, its third-lowest score, on the subject of powers and rights granted to labor unions.[147][148] Some scholars, including business theorist Jeffrey Pfeffer and political scientist Daniel Kinderman, posit that contemporary employment practices in the United States relating to the increased performance pressure from management, and the hardships imposed on employees such as toxic working environments, precarity, and long hours, could be responsible for 120,000 excess deaths annually, making the workplace the fifth leading cause of death in the United States.[149][150][151]

البطالة

As of December 2017, the unemployment rate in the U.S. was 4.1%[152] or 6.6 million people.[153] The government's broader U-6 unemployment rate, which includes the part-time underemployed, was 8.1%[154] or 8.2 million people. These figures were calculated with a civilian labor force of approximately 160.6 million people,[155] relative to a U.S. population of approximately 327 million people.[156]

Between 2009 and 2010, following the Great Recession, the emerging problem of jobless recoveries resulted in record levels of long-term unemployment with more than six million workers looking for work for more than six months as of January 2010. This particularly affected older workers.[157] A year after the recession ended in June 2009, immigrants gained 656,000 jobs in the U.S., while U.S.-born workers lost more than a million jobs, due in part to an aging country (relatively more white retirees) and demographic shifts.[158] In April 2010, the official unemployment rate was 9.9%, but the government's broader U-6 unemployment rate was 17.1%.[159] Between February 2008 and February 2010, the number of people working part-time for economic reasons (i.e., would prefer to work full-time) increased by 4.0 million to 8.8 million, an 83% increase in part-time workers during the two-year period.[160]

By 2013, although the unemployment rate had fallen below 8%, the record proportion of long term unemployed and continued decreasing household income remained indicative of a jobless recovery.[161] However, the number of payroll jobs returned to its pre-recession (November 2007) level by May 2014 as the economy recovered.[162]

After being higher in the post-war period, the U.S. unemployment rate fell below the rising eurozone unemployment rate in the mid-1980s and has remained significantly lower almost continuously since.[163][164][165] In 1955, 55% of Americans worked in services, between 30% and 35% in industry, and between 10% and 15% in agriculture. By 1980, over 65% were employed in services, between 25% and 30% in industry, and less than 5% in agriculture.[166] Male unemployment continued to be significantly higher than those of females (at 9.8% vs. 7.5% in 2009). The unemployment among Caucasians continues being much lower than those for African-Americans (at 8.5% vs. 15.8% also in 2009).[167]

The youth unemployment rate was 18.5% in July 2009, the highest rate in that month since 1948.[168] The unemployment rate of young African Americans was 28.2% in May 2013.[169]

The unemployment rate reached an all-time high of 14.7% in April 2020 before falling back to 11.1% in June 2020. Due to the effects of the COVID-19 pandemic, Q2 GDP in the US fell 32.9% in 2020.[170][171][172] The unemployment rate continued its rapid decline falling to 3.9% in 2021.[173]

التوظيف حسب القطاع

U.S. employment, as estimated in 2012, is divided into 79.7% in the service sector, 19.2% in the manufacturing sector, and 1.1% in the agriculture sector.[174]

United States non-farm employment by industry sector February 2013.[175]

الدخل والثروة

مقاييس الدخل

Real (i.e., inflation-adjusted) median household income, a good measure of middle-class income, was $59,039 in 2016, a record level. However, it was just above the previous record set in 1998, indicating the purchasing power of middle-class family income has been stagnant or down for much of the past twenty years.[178] During 2013, employee compensation was $8.969 trillion, while gross private investment totals $2.781 trillion.[179]

Americans have the highest average household income among OECD nations, and in 2010 had the fourth-highest median household income, down from second-highest in 2007.[46][47] According to one analysis middle-class incomes in the United States fell into a tie with those in Canada in 2010, and may have fallen behind by 2014, while several other advanced economies have closed the gap in recent years.[180]

تفاوت الدخل

Income inequality has become a hotly debated topic globally. According to the CIA World Factbook, U.S. income inequality ranked 41st highest among 156 countries in 2017 (i.e., 74% of countries have a more equal income distribution).[181] According to the Congressional Budget Office, the top 1% of income households earned about a 9% share of the pre-tax income in 1979, versus 19% in 2007 and 17% in 2014. For after-tax income, these figures were 7%, 17%, and 13%, respectively. These figures indicate the share of income earned by top earners more than doubled between 1979 and 2007, then fell somewhat following the Great Recession, and the higher tax rates and re-distributive policies applied by President Barack Obama in 2013 (i.e., expiration of the Bush Tax Cuts for the top 1% and subsidies for lower income persons via the Affordable Care Act).[182] Recasting the 2012 income using the 1979 income distribution (representing the more egalitarian 1950–1980 period), the bottom 99% of families would have averaged about $7,100 more income.[183] Income inequality in the United States has grown from 2005 to 2012 in more than two out of three metropolitan areas.[184]

The top 1 percent of income-earners accounted for 52 percent of the income gains from 2009 to 2015, where income is defined as market income excluding government transfers,[185] while their share of total income has more than doubled from nine percent in 1976 to twenty percent in 2011.[186] According to a 2014 OECD report, 80% of total pre-tax market income growth went to the top 10% from 1975 to 2007.[187]

A number of economists and others have expressed growing concern about income inequality, calling it "deeply worrying",[188] unjust,[189] a danger to democracy/social stability,[190][191][192] or a sign of national decline.[193] Yale professor Robert Shiller has said, "The most important problem that we are facing now today, I think, is rising inequality in the United States and elsewhere in the world."[194] Thomas Piketty of the Paris School of Economics argues that the post-1980 increase in inequality played a role in the 2008 crisis by contributing to the nation's financial instability.[195] In 2016, the economists Peter H. Lindert and Jeffrey G. Williamson claimed that inequality is the highest it has been since the nation's founding.[196] In 2018, income inequality was at the highest level ever recorded by the Census Bureau, with a Gini index of 0.485.[197]

Others disagree, saying that the inequality issue is a political distraction from what they consider real problems like chronic unemployment and sluggish growth.[198][199] George Mason University economics professor Tyler Cowen has called inequality a "red herring",[200] saying that factors driving its increase within a nation can simultaneously be driving its reduction globally, and arguing that redistributive policies intended to reduce inequality can do more harm than good regarding the real problem of stagnant wages.[201] Robert Lucas Jr. has argued that the salient problem American living standards face is a government that has grown too much, and that recent policy shifts in the direction of European-style taxation, welfare spending, and regulation may be indefinitely putting the U.S. on a significantly lower, European level income trajectory.[202][203] Some researchers have disputed the accuracy of the underlying data regarding claims about inequality trends,[204][205] and economists Michael Bordo and Christopher M. Meissner have argued that inequality cannot be blamed for the 2008 financial crisis.[206]

According to a report by the Congressional Research Service, decreased progressiveness in capital gains taxes was the largest contributor to the increase in overall income inequality in the U.S. from 1996 to 2006.[207]

As of 2010 The U.S. had the fourth-widest income distribution among OECD nations, behind Turkey, Mexico, and Chile.[208][209][210] The Brookings Institution said in March 2013 that income inequality was increasing and becoming permanent, sharply reducing social mobility in the US.[211] The OECD ranks the U.S. 10th in social mobility, behind the Nordic countries, Australia, Canada, Germany, Spain, and France.[212] Of the major developed nations, only Italy and Great Britain have lower mobility.[213] This has been partly attributed to the depth of American poverty, which leaves poor children economically disadvantaged,[214] though others have observed that a relative rise in the U.S. is mathematically harder due to its higher and more widely distributed income range than in nations with artificial income compression, even if one enjoys more absolute mobility in the U.S., and have questioned how meaningful such international comparisons are.[215]

There has been a widening gap between productivity and median incomes since the 1970s.[216] The primary cause for the gap between productivity and income growth is the decline in per capita hours worked.[217] Other causes include the rise in non-cash benefits as a share of worker compensation (which aren't counted in CPS income data), immigrants entering the labor force, statistical distortions including the use of different inflation adjusters by the BLS and CPS, productivity gains being skewed toward less labor-intensive sectors, income shifting from labor to capital, a skill gap-driven wage disparity, productivity being falsely inflated by hidden technology-driven depreciation increases and import price measurement problems, and/or a natural period of adjustment following an income surge during aberrational post-war circumstances.[198][218][219]

According to a 2018 study by the OECD, given that the unemployed and at-risk workers get almost no government support and are further set back by a very weak collective bargaining system, the U.S. has much higher income inequality and a larger percentage of low-income workers than almost any other developed nation.[220] According to a 2020 study by the RAND Corporation, the top 1% of U.S. income earners have taken $50 trillion from the bottom 90% between 1975 and 2018.[221][222]

صافي ثروة الأسرة وتفاوت الثروة

| Year | Wealth (billions in USD)

|

|---|---|

| 2006 | 67,704

|

| 2007 | 68,156

|

| 2008 | 58,070

|

| 2009 | 60,409

|

| 2010 | 64,702

|

| 2011 | 66,457

|

| 2012 | 72,316

|

| 2013 | 81,542

|

| 2014 | 86,927

|

| 2015 | 89,614

|

| 2016 | 95,101

|

| 2017 | 103,484

|

| 2018 | 104,329

|

As of Q4 2017, total household net worth in the United States was a record $99 trillion, an increase of $5.2 trillion from 2016. This increase reflects both stock market and housing price gains. This measure has been setting records since Q4 2012.[224] If divided evenly, the $99 trillion represents an average of $782,000 per household (for about 126.2 million households) or $302,000 per person. However, median household net worth (i.e., half of the families above and below this level) was $97,300 in 2016. The bottom 25% of families had a median net worth of zero, while the 25th to 50th percentile had a median net worth of $40,000.[225]

Wealth inequality is more unequal than income inequality, with the top 1% households owning approximately 42% of the net worth in 2012, versus 24% in 1979.[226] According to a September 2017 report by the Federal Reserve, wealth inequality is at record highs; the top 1% controlled 38.6% of the country's wealth in 2016.[227] The Boston Consulting Group posited in June 2017 report that 1% of the Americans will control 70% of country's wealth by 2021.[228]

The top 10% wealthiest possess 80% of all financial assets.[229] Wealth inequality in the U.S. is greater than in most developed countries other than Sweden.[230] Inherited wealth may help explain why many Americans who have become rich may have had a "substantial head start".[231][232] In September 2012, according to the Institute for Policy Studies, "over 60 percent" of the Forbes richest 400 Americans "grew up in substantial privilege".[233] Median household wealth fell 35% in the U.S., from $106,591 to $68,839 between 2005 and 2011, due to the Great Recession, but has since recovered as indicated above.[234]

About 30% of the entire world's millionaire population resides in the United States (اعتبارا من 2009[تحديث]).[235] The Economist Intelligence Unit estimated in 2008 that there were 16,600,000 millionaires in the U.S.[236] Furthermore, 34% of the world's billionaires are American (in 2011).[237][238]

ملكية المساكن

The U.S. home ownership rate in Q1 2018 was 64.2%, well below the all-time peak of 69.2% set in Q4 2004 during a housing bubble. Millions of homes were lost to foreclosure during the Great Recession of 2007–2009, bringing the ownership rate to a trough of 62.9% in Q2 2016. The average ownership rate from 1965 to 2017 was 65.3%.[239]

The average home in the United States has more than 700 square feet per person (65 square meters), which is 50%–100% more than the average in other high-income countries. Similarly, ownership rates of gadgets and amenities are relatively high compared to other countries.[240][241][242]

It was reported by Pew Research Center in 2016 that, for the first time in 130 years, Americans aged 18 to 34 are more likely to live with their parents than in any other housing situation.[243]

In one study by ATTOM Data Solutions, in 70% of the counties surveyed, homes are increasingly unaffordable for the average U.S. worker.[244]

As of 2018, the number of U.S. citizens residing in their vehicles because they can't find affordable housing has "exploded", particularly in cities with steep increases in the cost of housing such as Los Angeles, Portland and San Francisco.[245][246]

الأرباح والأجور

In 1970, wages represented more than 51% of the U.S. GDP and profits were less than 5%. But by 2013, wages had fallen to 44% of the economy, while profits had more than doubled to 11%.[247] Inflation-adjusted ("real") per capita disposable personal income rose steadily in the U.S. from 1945 to 2008, but has since remained generally level.[248][249]

In 2005, median personal income for those over the age of 18 ranged from $3,317 for an unemployed, married Asian American female[250] to $55,935 for a full-time, year-round employed Asian American male.[251] According to the U.S. Census men tended to have higher income than women while Asians and Whites earned more than African Americans and Hispanics. The overall median personal income for all individuals over the age of 18 was $24,062[252] ($32,140 for those age 25 or above) in the year 2005.[253]

As a reference point, the minimum wage rate in 2009 and 2017 was $7.25 per hour or $15,080 for the 2080 hours in a typical work year. The minimum wage is a little more than the poverty level for a single person unit and about 50% of the poverty level for a family of four.

According to an October 2014 report by the Pew Research Center, real wages have been flat or falling for the last five decades for most U.S. workers, regardless of job growth.[254] Bloomberg reported in July 2018 that real GDP per capita has grown substantially since the Great Recession, but real compensation per hour, including benefits, hasn't increased at all.[255]

An August 2017 survey by CareerBuilder found that eight out of ten U.S. workers live paycheck to paycheck. CareerBuilder spokesman Mike Erwin blamed "stagnant wages and the rising cost of everything from education to many consumer goods".[256] According to a survey by the federal Consumer Financial Protection Bureau on the financial well-being of U.S. citizens, roughly half have trouble paying bills, and more than one third have faced hardships such as not being able to afford a place to live, running out of food, or not having enough money to pay for medical care.[257] According to journalist and author Alissa Quart, the cost of living is rapidly outpacing the growth of salaries and wages, including those for traditionally secure professions such as teaching. She writes that "middle-class life is now 30% more expensive than it was 20 years ago."[258]

In February 2019, the Federal Reserve Bank of New York reported that seven million U.S. citizens are three months or more behind on their car payments, setting a record. This is considered a red flag by economists, that Americans are struggling to pay bills in spite of a low unemployment rate.[259] A May 2019 poll conducted by NPR found that among rural Americans, 40% struggle to pay for healthcare, food and housing, and 49% could not afford a $1,000 emergency.[260] Some experts assert that the US has experienced a "two-tier recovery", which has benefitted 60% of the population, while the other 40% on the "lower tier" have been struggling to pay bills as the result of stagnant wages, increases in the cost of housing, education and healthcare, and growing debts.[261]

A 2021 study by the National Low Income Housing Coalition found that workers would have to make at least $24.90 an hour to be able to afford (meaning 30% of a person's income or less) renting a standard two-bedroom home or $20.40 for a one-bedroom home anywhere in the US. The former is 3.4 times higher than the current federal minimum wage.[262]

الفقر

Starting in the 1980s relative poverty rates have consistently exceeded those of other wealthy nations, though analyses using a common data set for comparisons tend to find that the U.S. has a lower absolute poverty rate by market income than most other wealthy nations.[210] Extreme poverty in the United States, meaning households living on less than $2 per day before government benefits, doubled from 1996 levels to 1.5 million households in 2011, including 2.8 million children.[263] In 2013, child poverty reached record high levels, with 16.7 million children living in food insecure households, about 35% more than 2007 levels.[264] As of 2015, 44 percent of children in the United States live with low-income families.[265]

In 2016, 12.7% of the U.S. population lived in poverty, down from 13.5% in 2015. The poverty rate rose from 12.5% in 2007 before the Great Recession to a 15.1% peak in 2010, before falling back to just above the 2007 level. In the 1959–1962 period, the poverty rate was over 20%, but declined to the all-time low of 11.1% in 1973 following the War on Poverty begun during the Lyndon Johnson presidency.[266] In June 2016, The IMF warned the United States that its high poverty rate needs to be tackled urgently.[267]

The population in extreme-poverty neighborhoods rose by one third from 2000 to 2009.[269] People living in such neighborhoods tend to suffer from inadequate access to quality education; higher crime rates; higher rates of physical and psychological ailment; limited access to credit and wealth accumulation; higher prices for goods and services; and constrained access to job opportunities.[269] As of 2013, 44% of America's poor are considered to be in "deep poverty", with an income 50% or more below the government's official poverty line.[270]

According to the US Department of Housing and Urban Development's Annual Homeless Assessment Report, اعتبارا من 2017[تحديث] there were around 554,000 homeless people in the United States on a given night,[271] or 0.17% of the population. Almost two thirds stayed in an emergency shelter or transitional housing program and the other third were living on the street, in an abandoned building, or another place not meant for human habitation. About 1.56 million people, or about 0.5% of the U.S. population, used an emergency shelter or a transitional housing program between October 1, 2008, and September 30, 2009.[272] Around 44% of homeless people are employed.[273]

The United States has one of the least extensive social safety nets in the developed world, reducing both relative poverty and absolute poverty by considerably less than the mean for wealthy nations.[274][275][276][277][278] Some experts posit that those in poverty live in conditions rivaling the developing world.[279][280] A May 2018 report by the U.N. Special Rapporteur on extreme poverty and human rights found that over five million people in the United States live "in 'Third World' conditions".[281] Over the last three decades the poor in America have been incarcerated at a much higher rate than their counterparts in other developed nations, with penal confinement being "commonplace for poor men of working age".[282] Some scholars contend that the shift to neoliberal social and economic policies starting in the late 1970s has expanded the penal state, retrenched the social welfare state, deregulated the economy and criminalized poverty, ultimately "transforming what it means to be poor in America".[283][284][285]

الرعاية الصحية

أجزاء من هذا المقال (أولئك المتعلقين بـ uninsured statistics) تحتاج أن تـُحدَّث. (October 2016) |

تغطية التأمين الصحي

The American system is a mix of public and private insurance. The government provides insurance coverage for approximately 53 million elderly via Medicare, 62 million lower-income persons via Medicaid, and 15 million military veterans via the Veteran's Administration. About 178 million employed by companies receive subsidized health insurance through their employer, while 52 million other persons directly purchase insurance either via the subsidized marketplace exchanges developed as part of the Affordable Care Act or directly from insurers. The private sector delivers healthcare services, with the exception of the Veteran's Administration, where doctors are employed by the government.[289]

Multiple surveys indicate the number of uninsured fell between 2013 and 2016 due to expanded Medicaid eligibility and health insurance exchanges established due to the Patient Protection and Affordable Care Act, also known as the "ACA" or "Obamacare". According to the United States Census Bureau, in 2012 there were 45.6 million people in the US (14.8% of the under-65 population) who were without health insurance. This figure fell by 18.3 million (40%) to 27.3 million (8.6% of the under-65 population) by 2016.[290]

However, under President Trump these gains in healthcare coverage have begun to reverse. The Commonwealth Fund estimated in May 2018 that the number of uninsured increased by four million from early 2016 to early 2018. The rate of those uninsured increased from 12.7% in 2016 to 15.5%. The impact was greater among lower-income adults, who had a higher uninsured rate than higher-income adults. Regionally, the South and West had higher uninsured rates than the North and East. Further, those 18 states that have not expanded Medicaid had a higher uninsured rate than those that did.[291]

According to Physicians for a National Health Program, this lack of insurance causes roughly 48,000 unnecessary deaths per year.[292] The group's methodology has been criticized by John C. Goodman for not looking at cause of death or tracking insurance status changes over time, including the time of death.[293] A 2009 study by former Clinton policy adviser Richard Kronick found no increased mortality from being uninsured after certain risk factors were controlled for.[294]

النتائج

The U.S. lags in overall healthcare performance but is a global leader in medical innovation. America solely developed or contributed significantly to nine of the top ten most important medical innovations since 1975 as ranked by a 2001 poll of physicians, while the EU and Switzerland together contributed to five. Since 1966, Americans have received more Nobel Prizes in Medicine than the rest of the world combined. From 1989 to 2002, four times more money was invested in private biotechnology companies in America than in Europe.[295][296]

Of 17 high-income countries studied by the National Institutes of Health in 2013, the United States ranked at or near the top in obesity rate, frequency of automobile use and accidents, homicides, infant mortality rate, incidence of heart and lung disease, sexually transmitted infections, adolescent pregnancies, recreational drug or alcohol deaths, injuries, and rates of disability. Together, such lifestyle and societal factors place the U.S. at the bottom of that list for life expectancy. On average, a U.S. male can be expected to live almost four fewer years than those in the top-ranked country, though Americans who reach age 75 live longer than those who reach that age in peer nations.[297] One consumption choice causing several of the maladies described above are cigarettes. Americans smoked 258 billion cigarettes in 2016.[298] Cigarettes cost the United States $326 billion each year in direct healthcare costs ($170 billion) and lost productivity ($156 billion).[298]

A comprehensive 2007 study by European doctors found the five-year cancer survival rate was significantly higher in the U.S. than in all 21 European nations studied, 66.3% for men versus the European mean of 47.3% and 62.9% versus 52.8% for women.[299][300] Americans undergo cancer screenings at significantly higher rates than people in other developed countries, and access MRI and CT scans at the highest rate of any OECD nation.[301] People in the U.S. diagnosed with high cholesterol or hypertension access pharmaceutical treatments at higher rates than those diagnosed in other developed nations, and are more likely to successfully control the conditions.[302][303] Diabetics are more likely to receive treatment and meet treatment targets in the U.S. than in Canada, England, or Scotland.[304][305]

According to a 2018 study of 2016 data by the Institute for Health Metrics and Evaluation, the U.S. was ranked 27th in the world for healthcare and education, down from 6th in 1990.[306]

التكلفة

U.S. healthcare costs are considerably higher than other countries as a share of GDP, among other measures. According to the OECD, U.S. healthcare costs in 2015 were 16.9% GDP, over 5% GDP higher than the next most expensive OECD country.[307] A gap of 5% GDP represents $1 trillion, about $3,000 per person or one-third higher relative to the next most expensive country.[308]

The high cost of health care in the United States is attributed variously to technological advance, administration costs, drug pricing, suppliers charging more for medical equipment, the receiving of more medical care than people in other countries, the high wages of doctors, government regulations, the impact of lawsuits, and third party payment systems insulating consumers from the full cost of treatments.[309][310][311] The lowest prices for pharmaceuticals, medical devices, and payments to physicians are in government plans. Americans tend to receive more medical care than people do in other countries, which is a notable contributor to higher costs. In the United States, a person is more likely to receive open heart surgery after a heart attack than in other countries. Medicaid pays less than Medicare for many prescription drugs due to the fact Medicaid discounts are set by law, whereas Medicare prices are negotiated by private insurers and drug companies.[310][312] Government plans often pay less than overhead, resulting in healthcare providers shifting the cost to the privately insured through higher prices.[313][314]

تكوين القطاعت الاقتصادي

The United States is the world's second-largest manufacturer, with a 2013 industrial output of US$2.4 trillion. Its manufacturing output is greater than of Germany, France, India, and Brazil combined.[315] Its main industries include petroleum, steel, automobiles, construction machinery, aerospace, agricultural machinery, telecommunications, chemicals, electronics, food processing, consumer goods, lumber, and mining.

The U.S. leads the world in airplane manufacturing,[316] which represents a large portion of U.S. industrial output. American companies such as Boeing, Cessna (see: Textron), Lockheed Martin (see: Skunk Works), and General Dynamics produce a majority of the world's civilian and military aircraft in factories across the United States.

The manufacturing sector of the U.S. economy has experienced substantial job losses over the past several years.[317][318] In January 2004, the number of such jobs stood at 14.3 million, down by 3.0 million jobs (17.5%) since July 2000 and about 5.2 million since the historical peak in 1979. Employment in manufacturing was its lowest since July 1950.[319] The number of steel workers fell from 500,000 in 1980 to 224,000 in 2000.[320]

The U.S. produces approximately 18% of the world's manufacturing output, a share that has declined as other nations developed competitive manufacturing industries.[322] The job loss during this continual volume growth is the result of multiple factors including increased productivity, trade, and secular economic trends.[323] In addition, growth in telecommunications, pharmaceuticals, aircraft, heavy machinery and other industries along with declines in low end, low skill industries such as clothing, toys, and other simple manufacturing have resulted in some U.S. jobs being more highly skilled and better paying. There has been much debate within the United States on whether the decline in manufacturing jobs are related to American unions, lower foreign wages, or both.[324][325][326]

Products include wheat, corn, other grains, fruits, vegetables, cotton; beef, pork, poultry, dairy products, forest products, and fish.

الطاقة، النقل، الاتصالات

النقل

البري

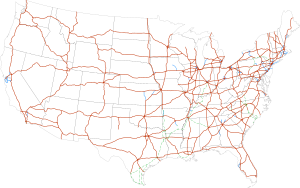

يعتمد الاقتصاد الأمريكي بشكل كبير على النقل البري لنقل الأشخاص والبضائع. تهيمن السيارات على النقل الشخصي، حيث تعمل على شبكة من 6.4 مليون كيلومتر من الطرق العامة،[328] يتضمن ذلك واحداً من أطول أنظمة الطرق السريعة بطول 91.700 كم.[329] ثاني أكبر سوق سيارات في العالم،[330] تتمتع الولايات المتحدة بأعلى معدل لملكية السيارات للفرد في العالم، حيث هناك 765 مركبة لكل 1000 أمريكي.[331] حوالي 40% من المركبات الشخصية عبارة عن شاحنات صغيرة، سيارات دفع رباعي، أو شاحنات خفيفة.[332]

السكك الحديدية

يمثل النقل الجماعي 9% من إجمالي رحلات العمل في الولايات المتحدة.[333][334]

نقل البضائع بالسكك الحديدية واسع النطاق، على الرغم من أن عدد الركاب المنخفض نسبيًا (حوالي 31 مليون سنويًا) لمستخدمي السكك الحديدية بين المدن للسفر، ويرجع ذلك جزئيًا إلى انخفاض الكثافة السكانية في معظم أنحاء البلاد.[335][336] ومع ذلك، نما عدد الركاب في أمتراك، نظام السكك الحديدية الوطنية للركاب بين المدن، بنسبة 37% تقريبًا بين عامي 2000 و2010.[337] كما زاد تطوير السكك الحديدية الخفيفة في السنوات الأخيرة.[338] تقوم ولاية كاليفورنيا حاليًا ببناء أول نظام سكك حديدية عالي السرعة.

خطوط الطيران

صناعة الخطوط الجوية المدنية مملوكة بالكامل للقطاع الخاص وجرى تحريرها بشكل كبير منذ عام 1978، بينما معظم المطارات الرئيسية ملكية عامة.[339] أكبر ثلاث شركات طيران في العالم من حيث نقل الركاب مقرها الولايات المتحدة؛ احتلت الخطوط الجوية الأمريكية المرتبة الأولى بعد اندماجها مع خطوط الولايات المتحدة الجوية عام 2013.[340] من بين أكثر ثلاثين مطارًا للركاب ازدحامًا في العالم، يوجد اثنا عشر مطارًا في الولايات المتحدة، بما في ذلك أكثر المطارات ازدحامًا، مطار هارتسفيلد-جاكسون أتلانتا الدولي.[341]

الطاقة

الولايات المتحدة هي ثاني أكبر مستهلك للطاقة من حيث الاستخدام الإجمالي.[342] تحتل الولايات المتحدة المرتبة السابعة في استهلاك الطاقة للفرد بعد كندا وعدد من البلدان الأخرى.[343][344] تُستمد غالبية هذه الطاقة من الوقود الأحفوري: عام 2005، قُدر أن 40% من طاقة البلاد تأتي من النفط، و23% من الفحم، و23$ من الغاز الطبيعي. بلغت مساهمة الطاقة النووية 8.4% والطاقة المتجددة 6.8%، والتي كانت بشكل أساسي من السدود الكهرومائية على الرغم من تضمين مصادر الطاقة المتجددة الأخرى.[345]

نما الاعتماد الأمريكي على واردات النفط من 24% عام 1970 إلى 65% بنهاية 2005.[346] النقل هو أعلى مستهلك للنفط، وهو ما يمثل حوالي 69% من النفط المستخدم في الولايات المتحدة عام 2006،[347] و55% من استخدام النفط العالمي بحسب ما هو موثق في تقرير هيرش.

عام 2013، استوردت الولايات المتحدة 2.808 مليار برميل من النفط الخام، مقارنة بـ 3.377 مليار برميل عام 2010.[348] في حين أن الولايات المتحدة هي أكبر مستورد للوقود ذكرت صحيفة وول ستريت جورنال عام 2011 أن البلاد كانت على وشك أن تصبح مصدرًا صافيًا للوقود لأول مرة منذ 62 عامًا. ذكرت الصحيفة توقعات بأن هذا سيستمر حتى عام 2020.[349] في الواقع، كان النفط هو الصادرات الرئيسية ب=للبلاد عام 2011.[350]

الاتصالات

جرى تطوير الإنترنت في الولايات المتحدة وتستضيف البلاد عدد من أكبر المحاور في العالم.[351]

التجارة الدولية

The United States is the world's second-largest trading nation.[353] There is a large amount of U.S. dollars in circulation all around the planet; about 60% of funds used in international trade are U.S. dollars. The dollar is also used as the standard unit of currency in international markets for commodities such as gold and petroleum.[354]

The North American Free Trade Agreement, or NAFTA, created one of the largest trade blocs in the world in 1994.[355][356]

Since 1976, the U.S. has sustained merchandise trade deficits with other nations, and since 1982, current account deficits. The nation's long-standing surplus in its trade in services was maintained, however, and reached a record US$231 billion in 2013.[357]

The U.S. trade deficit increased from $502 billion in 2016 to $552 billion in 2017, an increase of $50 billion or 10%.[358] During 2017, total imports were $2.90 trillion, while exports were $2.35 trillion. The net deficit in goods was $807 billion, while the net surplus in services was $255 billion.[359]

Americas ten largest trading partners are China, Canada, Mexico, Japan, Germany, South Korea, United Kingdom, France, India and Taiwan.[40] The goods trade deficit with China rose from $347 billion in 2016 to $376 billion in 2017, an increase of $30 billion or 8%. In 2017, the U.S. had a goods trade deficit of $71 billion with Mexico and $17 billion with Canada.[360]

According to the KOF Index of Globalization and the Globalization Index by A.T. Kearney/Foreign Policy Magazine, the U.S. has a relatively high degree of globalization. U.S. workers send a third of all remittances in the world.[361]

| Balance of Trade 2014 (goods only)[362] | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| China | Euro Area | Japan | Mexico | Pacific | Canada | Middle East | Lat. America | Total by Product | |

| Computer | −151.9 | 3.4 | −8.0 | −11.0 | −26.1 | 20.9 | 5.8 | 12.1 | -155.0

|

| Oil, Gas, Minerals | 1.9 | 6.4 | 2.4 | −20.8 | 1.1 | -79.8 | -45.1 | -15.9 | -149.7

|

| Transportation | 10.9 | -30.9 | −46.2 | −59.5 | −0.5 | −6.1 | 17.1 | 8.8 | -106.3

|

| Apparel | −56.3 | −4.9 | 0.6 | −4.2 | −6.3 | 2.5 | −0.3 | −1.1 | -69.9

|

| Electrical Equipment | −35.9 | −2.4 | −4.0 | −8.5 | −3.3 | 10.0 | 1.8 | 2.0 | -40.4

|

| Misc. Manufacturing | −35.3 | 4.9 | 2.7 | −2.8 | −1.4 | 5.8 | −1.5 | 1.8 | -25.8

|

| Furniture | -18.3 | −1.2 | 0.0 | −1.6 | −2.1 | 0.4 | 0.2 | 0.0 | -22.6

|

| Machinery | -19.9 | −27.0 | −18.8 | 3.9 | 7.6 | 18.1 | 4.5 | 9.1 | -22.4

|

| Primary Metals | −3.1 | 3.1 | −1.8 | 1.0 | 1.9 | −8.9 | −0.9 | −10.4 | -19.1

|

| Fabricated Metals | -17.9 | −5.9 | −3.5 | 2.8 | −4.3 | 7.3 | 1.2 | 1.9 | -18.5

|

| Plastics | −15.7 | −1.9 | −2.0 | 5.7 | −4.1 | 2.6 | −0.1 | 0.5 | -15.0

|

| Textile | −12.3 | −1.1 | −0.3 | 2.8 | −4.6 | 1.5 | −0.9 | 0.2 | -14.7

|

| Beverages, Tobacco | 1.3 | −9.9 | 0.6 | −3.3 | 0.0 | 1.0 | 0.2 | −0.6 | -10.6

|

| Nonmetallic Minerals | −6.1 | −1.9 | −0.4 | −1.2 | 0.1 | 1.9 | −0.5 | −0.8 | -8.9

|

| Paper | −2.7 | 1.2 | 1.1 | 4.3 | 1.2 | −9.8 | 0.9 | −1.9 | -5.8

|

| Chemical | −3.9 | −39.5 | −1.5 | 19.1 | 3.2 | 4.6 | −2.4 | 15.8 | -4.7

|

| Food | 0.7 | −3.6 | 6.1 | 4.9 | 0.9 | 0.1 | 1.4 | −1.1 | 9.5

|

| Agriculture | 17.8 | 6.2 | 7.3 | −3.0 | 5.7 | −0.8 | 2.8 | −6.5 | 29.5

|

| Petroleum | 0.6 | −1.2 | 0.1 | 16.6 | −2.0 | −0.1 | 0.6 | 18.3 | 32.9

|

| Total by Country/Area | −346.1 | −106.1 | -65.6 | −54.9 | −33.0 | −29.0 | −15.1 | 32.3 | |

الموقف المالي

U.S. household and non-profit net worth exceeded $100 trillion for the first time in Q1 2018; it has been setting records since Q4 2012.[363] The U.S. federal government or "national debt" was $21.1 trillion in May 2018, just over 100% GDP.[364] Using a subset of the national debt called "debt held by the public", U.S. debt was approximately 77% GDP in 2017. By this measure, the U.S. ranked 43rd highest among 2017 nations.[365] Debt held by the public rose considerably as a result of the Great Recession and its aftermath. It is expected to continue rising as the country ages towards 100% GDP by 2028.[366]

The U.S. public debt was $909 billion in 1980, an amount equal to 33% of America's gross domestic product (GDP); by 1990, that number had more than tripled to $3.2 trillion – 56% of GDP.[367] In 2001 the national debt was $5.7 trillion; however, the debt-to-GDP ratio remained at 1990 levels.[368] Debt levels rose quickly in the following decade, and on January 28, 2010, the U.S. debt ceiling was raised to $14.3 trillion.[369] Based on the 2010 United States federal budget, total national debt will grow to nearly 100% of GDP, versus a level of approximately 80% in early 2009.[370] The White House estimates that the government's tab for servicing the debt will exceed $700 billion a year in 2019,[371] up from $202 billion in 2009.[372]

The U.S. Treasury statistics indicate that, at the end of 2006, non-US citizens and institutions held 44% of federal debt held by the public.[373] اعتبارا من 2014[تحديث], China, holding $1.26 trillion in treasury bonds, is the largest foreign financier of the U.S. public debt.[374]

The overall financial position of the United States as of 2014 includes $269.6 trillion of assets owned by households, businesses, and governments within its borders, representing more than 15.7 times the annual gross domestic product of the United States. Debts owed during this same period amounted to $145.8 trillion, about 8.5 times the annual gross domestic product.[375][376]

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt.[377] Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk.[378][379] Lawrence Summers and others state that at such low rates, government debt borrowing saves taxpayer money, and improves creditworthiness.[380]

In the late 1940s through the early 1970s, the US and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay so low.[378][381] In January 2012, the U.S. Treasury Borrowing Advisory Committee of the Securities Industry and Financial Markets Association unanimously recommended that government debt be allowed to auction even lower, at negative absolute interest rates.[382]

Currency and central bank

The United States dollar is the unit of currency of the United States. The U.S. dollar is the currency most used in international transactions.[383] Several countries use it as their official currency, and in many others it is the de facto currency.[384]

The federal government attempts to use both monetary policy (control of the money supply through mechanisms such as changes in interest rates) and fiscal policy (taxes and spending) to maintain low inflation, high economic growth, and low unemployment. A private central bank, known as the Federal Reserve, was formed in 1913 to provide a stable currency and monetary policy. The U.S. dollar has been regarded as one of the more stable currencies in the world and many nations back their own currency with U.S. dollar reserves.[36][38]

The U.S. dollar has maintained its position as the world's primary reserve currency, although it is gradually being challenged in that role.[385] Almost two thirds of currency reserves held around the world are held in U.S. dollars, compared to around 25% for the next most popular currency, the euro.[386] Rising U.S. national debt and quantitative easing has caused some to predict that the U.S. dollar will lose its status as the world's reserve currency; however, these predictions have not come to fruition.[387]

الفساد

عام 2019، احتلت الولايات المتحدة الترتيب 23 على مؤشر انطباعات الفساد الصادر عن منظمة الشفافية الدولية حيث أحرزت 69 من 100 نقطة.[388] ويمثل هذا تراجعاً عام 2018، حيث أحرزت 71 من 100 نقطة.[389]

الحكومة والقانون

The United States ranked 4th in the ease of doing business index in 2012, 18th in the Economic Freedom of the World index by the Fraser Institute in 2012, 10th in the Index of Economic Freedom by The Wall Street Journal and The Heritage Foundation in 2012, 15th in the 2014 Global Enabling Trade Report,[390] and 3rd on the Global Competitiveness Report.[391]

According to the 2014 Index of Economic Freedom, released by The Wall Street Journal and The Heritage Foundation, the U.S. has dropped out of the top ten most economically free countries. The U.S. has been on a steady seven-year economic freedom decline and is the only country to do so.[392] The index measures each nation's commitment to free enterprise on a scale of 0 to 100. Countries losing economic freedom and receiving low index scores are at risk of economic stagnation, high unemployment rates, and diminishing social conditions.[393][394] The 2014 Index of Economic Freedom gave the United States a score of 75.5 and is listed as the twelfth-freest economy in world. It dropped two rankings and its score is half a point lower than in 2013.[392]

اللوائح

The U.S. federal government regulates private enterprise in numerous ways. Regulation falls into two general categories.

Some efforts seek, either directly or indirectly, to control prices. Traditionally, the government has sought to create state-regulated monopolies such as electric utilities while allowing prices in the level that would ensure them normal profits. At times, the government has extended economic control to other kinds of industries as well. In the years following the Great Depression, it devised a complex system to stabilize prices for agricultural goods, which tend to fluctuate wildly in response to rapidly changing supply and demand. A number of other industries – trucking and, later, airlines – successfully sought regulation themselves to limit what they considered as harmful price-cutting, a process called regulatory capture.[396]

Another form of economic regulation, antitrust law, seeks to strengthen market forces so that direct regulation is unnecessary. The government – and, sometimes, private parties – have used antitrust law to prohibit practices or mergers that would unduly limit competition.[396]

Bank regulation in the United States is highly fragmented compared to other G10 countries where most countries have only one bank regulator. In the U.S., banking is regulated at both the federal and state level. The U.S. also has one of the most highly regulated banking environments in the world; however, many of the regulations are not soundness related, but are instead focused on privacy, disclosure, fraud prevention, anti-money laundering, anti-terrorism, anti-usury lending, and promoting lending to lower-income segments.

Since the 1970s, government has also exercised control over private companies to achieve social goals, such as improving the public's health and safety or maintaining a healthy environment. For example, the Occupational Safety and Health Administration provides and enforces standards for workplace safety, and the United States Environmental Protection Agency provides standards and regulations to maintain air, water, and land resources. The U.S. Food and Drug Administration regulates what drugs may reach the market, and also provides standards of disclosure for food products.[396]

American attitudes about regulation changed substantially during the final three decades of the 20th century. Beginning in the 1970s, policy makers grew increasingly convinced that economic regulation protected companies at the expense of consumers in industries such as airlines and trucking. At the same time, technological changes spawned new competitors in some industries, such as telecommunications, that once were considered natural monopolies. Both developments led to a succession of laws easing regulation.[396]

While leaders of America's two most influential political parties generally favored economic deregulation during the 1970s, 1980s, and 1990s, there was less agreement concerning regulations designed to achieve social goals. Social regulation had assumed growing importance in the years following the Depression and World War II, and again in the 1960s and 1970s. During the 1980s, the government relaxed labor, consumer and environmental rules based on the idea that such regulation interfered with free enterprise, increased the costs of doing business, and thus contributed to inflation. The response to such changes is mixed; many Americans continued to voice concerns about specific events or trends, prompting the government to issue new regulations in some areas, including environmental protection.[396]

Where legislative channels have been unresponsive, some citizens have turned to the courts to address social issues more quickly. For instance, in the 1990s, individuals, and eventually the government itself, sued tobacco companies over the health risks of cigarette smoking. The 1998 Tobacco Master Settlement Agreement provided states with long-term payments to cover medical costs to treat smoking-related illnesses.[396]

Between 2000 and 2008, economic regulation in the United States saw the most rapid expansion since the early 1970s. The number of new pages in the Federal Registry, a proxy for economic regulation, rose from 64,438 new pages in 2001 to 78,090 in new pages in 2007, a record amount of regulation. Economically significant regulations, defined as regulations which cost more than $100 million a year, increased by 70%. Spending on regulation increased by 62% from $26.4 billion to $42.7 billion.[397]

النظام الضريبي

Taxation in the United States is a complex system which may involve payment to at least four different levels of government and many methods of taxation. Taxes are levied by the federal government, by the state governments, and often by local governments, which may include counties, municipalities, township, school districts, and other special-purpose districts, which include fire, utility, and transit districts.[398]

Forms of taxation include taxes on income, property, sales, imports, payroll, estates and gifts, as well as various fees. When taxation by all government levels taken into consideration, the total taxation as percentage of GDP was approximately a quarter of GDP in 2011.[399] Share of black market in the U.S. economy is very low compared to other countries.[400]

Although a federal wealth tax is prohibited by the United States Constitution unless the receipts are distributed to the States by their populations, state and local government property tax amount to a wealth tax on real estate, and because capital gains are taxed on nominal instead of inflation-adjusted profits, the capital gains tax amounts to a wealth tax on the inflation rate.[401]

U.S. taxation is generally progressive, especially at the federal level, and is among the most progressive in the developed world.[402][403][404][405] There is debate over whether taxes should be more or less progressive.[401][406][407][408]

الإنفاق

The United States public-sector spending amounts to about 38% of GDP (federal is around 21%, state and local the remainder).[410] Each level of government provides many direct services. The federal government, for example, is responsible for national defense, research that often leads to the development of new products, conducts space exploration, and runs numerous programs designed to help workers develop workplace skills and find jobs (including higher education). Government spending has a significant effect on local and regional economies, and on the overall pace of economic activity.

State governments, meanwhile, are responsible for the construction and maintenance of most highways. State, county, or city governments play the leading role in financing and operating public schools. Local governments are primarily responsible for police and fire protection. In 2016, U.S. state and local governments owed $3 trillion and have another $5 trillion in unfunded liabilities.[411]

The welfare system in the United States began in the 1930s, during the Great Depression, with the passage of the New Deal. The welfare system was later expanded in the 1960s through Great Society legislation, which included Medicare, Medicaid, the Older Americans Act and federal education funding.

Overall, federal, state, and local spending accounted for almost 28% of gross domestic product in 1998.[412]

الميزانية الفدرالية والديون

During FY2017, the federal government spent $3.98 trillion on a budget or cash basis, up $128 billion or 3.3% vs. FY2016 spending of $3.85 trillion. Major categories of FY 2017 spending included: Healthcare such as Medicare and Medicaid ($1,077B or 27% of spending), Social Security ($939B or 24%), non-defense discretionary spending used to run federal Departments and Agencies ($610B or 15%), Defense Department ($590B or 15%), and interest ($263B or 7%).[409]

During FY2017, the federal government collected approximately $3.32 trillion in tax revenue, up $48 billion or 1.5% versus FY2016. Primary receipt categories included individual income taxes ($1,587 billion or 48% of total receipts), Social Security/Social Insurance taxes ($1,162 billion or 35%), and corporate taxes ($297 billion or 9%). Other revenue types included excise, estate and gift taxes. FY 2017 revenues were 17.3% of gross domestic product (GDP), versus 17.7% in FY 2016. Tax revenues averaged approximately 17.4% GDP over the 1980–2017 period.[409]

The federal budget deficit (i.e., expenses greater than revenues) was $665 billion in FY2017, versus $585 billion in 2016, an increase of $80 billion or 14%. The budget deficit was 3.5% GDP in 2017, versus 3.2% GDP in 2016. The budget deficit is forecast to rise to $804 billion in FY 2018, due significantly to the Tax Cuts and Jobs Act and other spending bills. An aging country and healthcare inflation are other drivers of deficits and debt over the long-run.[409]

Debt held by the public, a measure of national debt, was approximately $14.7 trillion or 77% of GDP in 2017, ranked the 43rd highest out of 207 countries.[413] This debt, as a percent of GDP, is roughly equivalent to those of many western European nations.[414]

ثقافة الأعمال

A central feature of the U.S. economy is the economic freedom afforded to the private sector by allowing the private sector to make the majority of economic decisions in determining the direction and scale of what the U.S. economy produces. This is enhanced by relatively low levels of regulation and government involvement,[415] as well as a court system that generally protects property rights and enforces contracts. Today, the United States is home to 29.6 million small businesses, thirty percent of the world's millionaires, forty percent of the world's billionaires, and 139 of the world's 500 largest companies.[133][237][416][417]

From its emergence as an independent nation, the United States has encouraged science and innovation. In the early 20th century, the research developed through informal cooperation between U.S. industry and academia grew rapidly and by the late 1930s exceeded the size of that taking place in Britain (although the quality of U.S. research was not yet on par with British and German research at the time). After World War II, federal spending on defense R&D and antitrust policy played a significant role in U.S. innovation.[418]