الشركة الوطنية الإيرانية للنفط

| |

| |

| النوع | State-owned enterprise |

|---|---|

| الصناعة | النفط والغاز |

| تأسست | 1948 |

| المؤسس | محمد مصدق |

| المقر الرئيسي | طهران، إيران |

| نطاق الخدمة | جميع أنحاء العالم |

الأشخاص الرئيسيون | Javad Owji (Chairman) Mohsen Khojastemehr (CEO) |

| المنتجات | النفط، الغاز الطبيعي والپتروكيماويات |

| الدخل | ▲ US$110 بليون (2012)[1] |

| إجمالي الأصول | ▲ 200 بليون دولار (2012)[2] |

| المالك | الحكومة الإيرانية (100%) |

| الموظفون | 41,000 (2011)[بحاجة لمصدر] |

| الشركات التابعة | NISOC IOOC ICOFC NIDC NICO NITCO |

| الموقع الإلكتروني | en |

الشركة الوطنية الإيرانية للنفط (NIOC؛ فارسية: شرکت ملّی نفت ایران؛ إنگليزية: National Iranian Oil Company)، مؤسسة تملكها الحكومة تحت اشراف وزارة النفط الإيرانية، هي منتج وموزع نفط وغاز طبيعي مقرها في طهران. وقد تأسست في 1948.[3] ويبلغ ترتيب NIOC كثاني أكبر شركة نفط في العالم، بعد شركة أرامكو التي تملكها السعودية.[4]

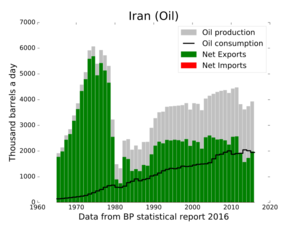

الشركة الوطنية هي المسئولة حصرياً عن استكشاف واستخراج ونقل وتصدير النفط الخام وكذلك استكشاف واستخراج وبيع الغاز الطبيعي والغاز الطبيعي المسال (LNG). وتصدِّر الشركة الوطنية فائض الانتاج حسب الاعتبارات التجارية في إطار الحصص المحددة من منظمة الدول المصدرة للبترول (أوپك) وبالأسعار السائدة في الأسواق العالمية. في مطلع 2005 كانت احتياطيات الهيدروكربون السائلة القابلة للاستخلاص تناهز 136.99 billion barrels (21.780 km3) (10% من إجمالي العالم) واحتياطيات الغاز القابل للاستخلاص 28.17×1012 م³ (15% من إجمالي العالم). القدرات الحالية لانتاج الشركة الوطنية تضم ما يزيد عن 4 million barrels (640×103 m3) من النفط الخام وما يزيد عن 500 مليون متر مكعب من الغاز الطبيعي يومياً.[3] إجمالي صادرات إيران من النفط الخام كان يُقدَّر بنحو 85 مليار دولار في 2010.[بحاجة لمصدر]

التاريخ

خلفية: 1901 - 1951

في مايو 1901، حصل وليام نوكس دارسي على امتياز من شاه إيران to search for oil, which he discovered in May 1908.[5] This was the first commercially significant find in the Middle East. وفي 1923, Burmah employed future Prime Minister, Winston Churchill as a paid consultant; to lobby the British government to allow the Anglo-Persian Oil Company (APOC) to have exclusive rights to Persian oil resources, which were successfully granted.[6]

وفي 1935، طلب رضا شاه من المجتمع الدولي أن يشيروا إلى "فارس" بإسم 'إيران'، وهو ما انعكس في تغيير اسم شركة النفط الأنگلو-فارسية (APOC) إلى شركة النفط الأنگلو-إيرانية (AIOC).[5] Following World War II, Iranian nationalism was on the rise, especially surrounding the Iranian natural resources being exploited by the foreign companies without adequately compensating Iranian taxpayers. AIOC and the pro western Iranian government led by Prime Minister Ali Razmara, initially resisted nationalist pressure to revise AIOC's concession terms still further in Iran's favour. In March 1951, Ali Razmara was assassinated; and محمد مصدق, a nationalist, was elected as the new prime minister by the مجلس إيران.[7][8]

NIOC: 1951–79

In April 1951, the Majlis nationalised the Iranian oil industry by unanimous vote, and the National Iranian Oil Company (NIOC) was formed, displacing the APOC.[9] The APOC withdrew its management from Iran, and organised an effective worldwide embargo of Iranian oil. The British government, which owned the APOC, contested the nationalisation at the International Court of Justice at The Hague, but its complaint was dismissed.[10]

By spring of 1953, incoming US President Dwight D. Eisenhower authorised the Central Intelligence Agency (CIA), to organise a coup against the Mossadeq government, known as the 1953 Iranian coup d'état.[11] In August 1953, the coup brought pro-Western general Fazlollah Zahedi as the new PM, along with the return of the Shah Mohammad Reza Pahlavi from his brief exile in Italy to Iran.[12] The anti-Mossadeq plan was orchestrated under the code-name 'Operation Ajax' by CIA, and 'Operation Boot' by SIS (MI6).[11][13][14]

احتياطيات النفط للشركة

According to OPEC, NIOC recoverable liquid hydrocarbon reserves at the end of 2006 was 1,384 billion barrels (2.200×1011 m3).[15]

Table 1- The five biggest NIOC oil fields;[16]

| الترتيب | اسم الحقل | التكوين | النفط المبدئي في مكانه (بليون برميل) |

الاحتياطيات المبدئية القابلة للاستخراج (بليون برميل) |

الانتاج

|

|---|---|---|---|---|---|

| 1 | حقل أهواز | Asmari & Bangestan | 65.5 | 25.5 | 945 |

| 2 | حقل مارون | أسمري | 46.7 | 21.9 | 520 |

| 3 | Aghajari Field | Asmari & Bangestan | 30.2 | 17.4 | 200 |

| 4 | Gachsaran Field | Asmari & Bangestan | 52.9 | 16.2 | 560 |

| 5 | Karanj Oil Field | Asmari & Bangestan | 11.2 | 5.7 | 200 |

| اسم الحقل | Thousand برميل/يوم |

ألف متر مكعب/يوم |

|---|---|---|

| (onshore) | ||

| Ahvaz Field (Asmari Formation) | 700 | 110 |

| Gachsaran Field | 560 | 89 |

| Marun Field | 520 | 83 |

| Bangestan | 245 | 39.0 |

| Aghajari Field | 200 | 32 |

| Karanj-Parsi Oil Field | 200 | 32 |

| Rag Safid Oil Field | 180 | 29 |

| بيبي حكيمة، حقل النفط | 130 | 21 |

| Darquin Oil Field | 100 | 16 |

| Paazanan Oil Field | 70 | 11 |

| (offshore) | ||

| Dorood Oil Field | 130 | 21 |

| Salman Field | 130 | 21 |

| Abuzar Oil Field | 125 | 19.9 |

| سري، حقل النفط | 95 | 15.1 |

| سروش، حقل الغاز | 60 | 9.5 |

Gas reserves

NIOC holds about 1,000×1012 cu ft (28,000 km3) of proven Natural gas reserves of which 36% are as associated gas and 64% is in non associated gas fields. It stands for world's second largest reserves after Russia.[17]

NIOC’s ten biggest Non-Associated Gas Fields;

| Field's Name | Gas In Place Tcf | Recoverable Reserve Tcf |

|---|---|---|

| South Pars | 500 | 322 |

| North Pars[19] | 60 | 47 |

| Kish Gas Field[20] | 60 | 45 |

| Golshan Gas Field[21] | 55 | 25 - 45 |

| Tabnak Gas Field | NA | 21,2 |

| Kangan Gas Field | NA | 20,1 |

| Khangiran Gas Field | NA | 16,8 |

| Nar Gas Field | NA | 13 |

| Aghar Gas Field | NA | 11,6 |

| Farsi Field | NA | 11 - 22 |

الاكتشافات الحديثة

Since 1995, National Iranian Oil Company (NIOC) has made significant oil and gas discoveries, standing for some 84-billion-barrels (1.34×1010 m3) of oil in place and at least 175×1012 cu ft (5,000 km3) of gas in place, which are listed below.[22]

| اسم الحقل | النفط في الموقع | النفط القابل للاستخراج | عام الاكتشاف |

|---|---|---|---|

| بليون برميل | بليون برميل | ||

| Azadegan Oil Field | 33.2 | 5.2 | |

| Yadavaran Oil Field | 17 | 3 | |

| Ramin Oil Field[24] | 7.398 | 1.11 | 2007 |

| South Pars Oil Layer | 6 | NA | |

| Band-E-Karkeh Oil Field[25][26] | 4.5 | NA | 2007 |

| MansourAbad Oil Field | 4.45 | NA | 2007 |

| Changoleh Oil Field[27] | 2.7 | NA | |

| Azar Oil Field[27][28] | 2.07 | NA | 2007 |

| Paranj Oil Field | 1.6 | NA | 2007 |

| Balaroud Oil Field[29] | 1.1 | 0.233 | 2007 |

| Binalood Oil Field[30] | 0.776 | 0.099 | 2008 |

| Mansouri Oil Field[28] | 0.760 | NA | |

| Jofeyr Oil Field[31][32] | 0.750 | NA | 2008 |

| Asaluyeh Oil Field[33] | 0.525 | NA | 2008 |

| Arvand Oil Field[34] | 0.500 | NA | 2008 |

| Tusan Oil Field | 0.470 | NA | 2006 |

| Arash Gas Field | 0.168 | NA | |

| Total | 83.967 | NA |

| Field's name | Gas in place | Recoverable gas reserve | ||

|---|---|---|---|---|

| Trillion cubic feet | Billion cubic meters | Trillion cubic feet | Billion cubic meters | |

| Kish Gas Field[20] | 59 | 1,700 | 47 | 1,300 |

| Tabnak Gas Field | 30 | 850 | NA | |

| Farsi Gas Field[36] | NA | 11-23 | 310-650 | |

| Sefid Zakhur Gas Field | 11.4 | 320 | 8.5 | 240 |

| Yadavaran Field | 9.75 | 276 | NA | |

| Lavan Gas Field | 9.1 | 260 | NA | |

| Balal Gas Field | 8.8 | 250 | NA | |

| Homa Gas Field | 7.6 | 220 | NA | |

| حقل مارون | 6.2 | 180 | NA | |

| Gardan Gas Field | 5.7 | 160 | NA | |

| Day Gas Field | 4.4 | 120 | NA | |

| Binak Field | 3.5 | 99 | NA | |

| Karanj Gas Field | 2.9 | 82 | NA | |

| Bibi Hakime Oil Field | 2.4 | 68 | NA | |

| Zireh Gas Field | 1 | 28 | NA | |

| Masjed Soleiman Field[37] | 1 | 28 | 0.739 | 20.9 |

| Arash Gas Field | 0.79 | 22 | NA | |

| KheyrAbad Gas Field | 0.17 | 4.8 | NA | |

| الاجمالي | 170 | 4,800 | NA | |

الهيكل التنظيمي

The company is completely owned by Iranian government. NIOC's General Assembly (GA) consists of:

- الرئيس،

- نائب الرئيس

- Director General of the Management and Planning Organization,

- Ministers of Oil,

The GA is its highest decision making body, determining the company's general policy guide lines, and approving the annual budgets, operations and financial statements and balance sheets. The company's Board of Directors has the authority and major responsibilities to approve the operational schemes within the general framework ratified by the General Assembly, approve transactions and contracts, and prepare budgets and Board reports and annual balance sheets for presentation to the General Assembly.

The Board supervises the implementation of general policy guidelines defined by the General Assembly, and pursues executive operations via the company's Managing Director.

أعضاء مجلس الادارة

| الاسم | المنصب | المنصب بمجلس الادارة |

|---|---|---|

| بیژن زنگنه | Minister of Petroleum | Chairman |

| ركن الدين جوادي | CEO | Vice Chairman |

| بیژن عالی پور | CEO of NISOC | Member of the board |

| عبدالمحمد دلپریش | Manager of Integrated Planning | Member of the board |

| محسن قمصري | Manager of International Affairs | Member of the board |

| قدیر موحدزاده | Director of Finance | Member of the board |

| Hormoz Ghalavand | Exploration Manager | Member of the board |

الشركات الفرعية

With appropriate division of tasks and delegation of responsibilities to subsidiaries- affiliates, NIOC has been able to establish acceptable degrees of coordination within its organizational set up. In fact, NIOC's Directors act primarily in policy making and supervision while subsidiaries act as their executive arm in coordinating an array of operations such as exploration, drilling, production and delivery of crude oil and natural gas, for export and domestic consumption.

The NIOC's subsidiaries are as follows:

| Company Name | Activities[38] |

|---|---|

| Iranian Offshore Oil Company (IOOC) | in charge of offshore oil fields in the Persian Gulf offshore oil and gas fields with the exception of South Pars. It focuses mainly on production platforms, ancillary facilities, and installations. Massive corruption in the lease of offshore platforms reported by the Iranian media in 2015.[39][40] |

| Iranian Central Oil Fields Company (ICOFC) | supervises all upstream activities in the central oil and gas regions of the country, i.e. everything, excluding the oil-rich southern Khuzestan province, Caspian and offshore. As of 2015, it is the largest natural gas producer in Iran.[41] |

| National Iranian Gas Export Co. (NIGEC) | in charge of gas exports for the National Iranian Gas Company. Until May 2010, NIGEC was under the control of the NIOC, but the Petroleum Ministry transferred NIGEC, incorporating it under NIGC in an attempt to broaden responsibility for new natural gas projects.[42] See also: Persian pipeline and Peace pipeline. |

| National Iranian South Oil Company (NISOC) | in charge of onshore oilfields in southern Iran. Focuses on onshore upstream activity in the province of Khuzestan. As Khuzestan is the main oil and gas-producing province, this entity is among the most significant in the NIOC family. It produces approximately 80 percent of all crude oil produced in Iran.[42] |

| Khazar Oil Exploration and Production Company | in charge of Iran's Caspian Sea sector (onshore and offshore) |

| Karoon Oil and Gas Production Company (KOGPC) | Operating in Khouzestan, the company operates 538 wells and delivers natural gas to NIGC.[42] |

| Petroleum Engineering and Development Company (PEDEC) | is the most important NIOC offshoot company. The responsibility for all buy-back projects under operation, study or negotiation has been given to PEDEC. This company enjoys full authority to manage the projects. Further information: Foreign Direct Investment in Iran |

| Pars Oil and Gas Company (POGC) | National Iranian Gas Company does not play a role in awarding upstream gas projects; that task remains in the hands of the National Iranian Oil Company.[43] Pars Oil and Gas Co. is in charge of the offshore North and South Pars gas fields and responsible for awarding the contracts for the different phases. Since 2010, it has been raising capital on the domestic and international markets in order to finance its projects. |

| Pars Special Economic Energy Zone Co. | handles and organizes all activities in the Pars Special Economic-Energy Zone, located near the South Pars gas field (a subsidiary of Pars Oil & Gas Co.) |

| National Iranian Oil Terminals Company | has four transport hubs including facilities on the three islands of Kharg, Lavan and Sirri consisting of 17 jetties capable of berthing tankers of all sizes to lift and export its crude oil that load more than 2,000 oil tankers per year.[44] 2,000 of them dock in Bandar Abbas Port, 1,000 in Khark Island. Iran earned nearly $2 billion in 2009 from bunkering ships in the Persian Gulf (25% market share).[45] Projected bunkering sites by 2015: Bandar Abbas (two sites), Kish, Qeshm, Bushehr, Mahshahr, Assalouyeh, Khark and Chabahar.[46] Fujairah bunkering hub, UAE is Iran's main competitor in the Persian Gulf. The country's terminal storage capacity should soar to 100 million barrels by 2015 from the current 24 million barrels.[47] |

| National Iranian Drilling Company (NIDC) | in charge of all offshore and onshore drilling activities. NIDC provides more than 90 percent of drilling services needed by the oil companies inside the country. In 2011, NIDC, drilled or completed 192 oil and gas wells, drilled 454 thousand meters of wells and provided more than 8 thousand expert or technical services to customers.[48] As at 2012, 123 drilling rigs are in operation in Iran’s offshore and onshore.[49] |

| Ahwaz Pipe Mills Company | manufacturing oil and gas pipes and has a capacity of up to 420,000 tons per year. It operates three plants. |

| Iranian Fuel Conservation Organization | regimenting the fuel consumption in different sectors through review and survey of the current trend of consumption and executing conservation measures nationwide. See also: 2007 Gasoline Rationing Plan in Iran |

| National Iranian Tanker Company | controls the second largest fleet of tankers in OPEC. Despite having domestic manufacturing capacity, NITC purchases many VLCC abroad (e.g. China) for unknown reasons. |

| Exploration Service Company (ESC) | responsible for providing operational services in all facets of exploration and production activities within NIOC onshore regions. |

| Kala Naft (لندن) Ltd. | in charge of carrying out the procurement needs of the NIOC that cannot be met domestically. However, NIOC organizations can in theory also purchase directly from suppliers. |

| Kala Naft (Canada) Ltd. | in charge of carrying out the procurement needs of the NIOC that cannot be met domestically |

| Naftiran Intertrade Co. (NICO) (Switzerland) | handles trading & swaps operations on behalf of NIOC. Iran has swap arrangements with Azerbaijan, Turkmenistan, and Kazakhstan, under which it ships crude from the Central Asian producers to its Caspian ports in Neka. In exchange Iran delivers the equivalent barrels of crude on behalf of the three Central Asian producers to their customers in the Persian Gulf.[50] In October 2010, Iran asked for the terms of the contract to be re-negotiated because it claims it has lost money because of it.[51] On 2 July 2011, NIOC resumed oil swaps with Caspian states.[52] NaftIran also buys the vast majority of Iran's gasoline imports.[53] Naftiran is a key player in Iran's energy sector. |

| Petropars | General contractor for the oil & gas industry (a subsidiary of Naftiran Intertrade Co.) |

| Petroiran Development Company (aka PetroIran or PEDCO) | General offshore contractor (a subsidiary of Naftiran Intertrade Co.). PetroIran was initially formed to be the Iranian partner of foreign contractors with a 10% share in each buy-back contract. |

| Iranian Oil Company (UK) | in charge of Rhum gasfield (a subsidiary of Naftiran Intertrade Co.) |

| Iranian Offshore Engineering and Construction Company (IOEC) | First Iranian general contractor to the oil and gas industries. Joint venture with IDRO |

| Arvandan Oil & Gas Company (AOGC) | responsible for the development of the Arvandan oil & gas fields. AOGC was established in 2004 working as the main operator in oil and gas production from Azadegan, Yadavaran, Darquain, Jufeyr, Moshtagh, Khorramshahr, Arvand, Susangerd, Band-e-Karkheh, Omid and other fields which are located in west of Karun River.[54] |

| Research Institute of Petroleum Industry (RIPI) | NIOC will implement 69 research projects between 2010 and 2015 which include topics as enhancing recovery rate, modeling, control and management of reservoirs, production and exploitation, exploration, promotion and technology in drilling operations, establishment of an integrated data bank, industrial protection and environment, optimizing energy consumption, materials and equipments manufacturing, strategic and infrastructure studies, productivity and specialized maintenance.[48] Iran is expected to launch its first gas to liquids (GTL) plant by 2018.[55] See also: Science and technology in Iran. |

تكاليف الانتاج والاستثمارات

The cost of producing each barrel will rise to $30 or more from $7 in 2012.[56]

Iran currently allocates $20 billion a year to develop fields and $10 billion on maintaining output. In the next decade, maintaining production will cost $50 billion, with a similar sum required for development.[56] This does not include development and investment costs in related fields such as Petrochemicals.

المقاولون المحليون الرئيسيون

Although usually neglected and overlooked, Iran also has a number of very active private companies in the oil sector. The growing private sector activity is mainly active in projects involving the construction of oil field units, refinery equipment, tanks and pipelines,[57] as well as engineering. Iranian manufacturers will supply oil industry with $10 billion worth of domestically-made goods and equipment in 2012.[58]

Iranian companies are already outperforming foreign firms in South Pars.[59] NIOC produces 60-70% of its industrial equipment domestically including refineries, oil tankers, oil rigs, offshore platforms and exploration instruments.[60][61][62][63] Iran is also cooperating with foreign companies to transfer technology to Iranian oil industry.[64] The objective is to become self-sufficient by 85% before 2015.[65] The strategic goods include onshore and offshore drilling rigs, pumps, turbines and precision tools. Domestic production of 52 petrochemical catalysts will be started in 2013.[66] As of 2015, Iran had reached most of its above mentioned objectives in manufacturing.[67]

المشاركة في حقول غاز أجنبية

- تملك إيران 50% من حقل الغاز البحري "روم Rhum" في بحر الشمال، which is Britain's largest untapped gas field. It is a joint-venture with BP worth $1 million a day at 15 June 2010 spot prices.[53]

- Iran has another 10% joint-venture participation with BP and other foreign oil companies في حقل شاه دنيز للغاز الأذربيجاني، producing 8 billion cubic meters of gas per year, worth up to a reported $2.4 billion per year. The Iranian entity with which BP has partnered in these ventures is the Swiss-based Naftiran Intertrade, a subsidiary of NIOC.[53] Shah Deniz is not subject to US sanctions.[68]

السجل البيئي

According to geographer Richard Heede,[69] is 3rd on the list of companies with the highest level of CO2 emissions globally with 739 million tonnes (727,000,000 long tons; 815,000,000 short tons) in 2013, amounting to more than 3.1% of worldwide anthropogenic emissions.[70]

انظر أيضاً

- The nationalization of the Iran oil industry movement

- International rankings of Iran

- Petroleum industry in Iran

- Ministry of Petroleum of Iran

- Economy of Iran

- Iranian oil bourse

- Foreign Direct Investment in Iran

- Privatization in Iran

- Eilat Ashkelon Pipeline Company - used to be 50% in control of NIOC and the focus of a dispute between Israel and Iran.

- William Knox D'Arcy

المراجع

- ^ "NIOC Chief: Annual oil revenues $110 billion in last Iranian calendar year, ended 20 March 2012". Iran Daily Brief. 6 February 2013.

- ^ http://www.tehrantimes.com/economy-and-business/95407-irans-nioc-assets-surpass-200-billion

- ^ أ ب Iran's foreign trade report Iran Trade

- ^ "PIW Ranks The World's Top Oil Companies". Energyintel. Retrieved 7 February 2012.

- ^ أ ب "Darcy William Knox". Australian Dictionary of Biography. Retrieved 5 June 2010.

- ^ Myers, Kevin (3 September 2009). "The greatest 20th century beneficiary of popular mythology has been the cad Churchill". Irish Independent.

- ^ The Cambridge History of Iran, Volume 7. Cambridge University Press. p. 665.

- ^ Yousof Mazandi, United Press, and Edwin Muller, Government by Assassination (Reader's Digest September 1951).

- ^ "Britain Fights Oil Nationalism". The New York Times. Retrieved 5 Jun 2010.

- ^ Sztucki, Jerzy; Interim measures in the Hague Court. Brill Archive. (1984). . p. 43. ISBN 978-90-6544-093-8.

- ^ أ ب "How a Plot Convulsed Iran in '53 (and in '79)". The New York Times. Retrieved 5 June 2010.

- ^ "New York Times article, 1953". The New York Times. 20 August 1953. Retrieved 5 Jun 2010.

- ^ Ends of British Imperialism: The Scramble for Empire, Suez, and Decolonization. I.B.Tauris. 2007. pp. 775

- ^ The C.I.A. in Iran: Britain Fights Oil Nationalism The New York Times

- ^ "OPEC Annual Statistical Bulletin 2006". OPEC. Retrieved 7 February 2012.

- ^ The 8th IIES International Conference "Energy Security and New Challenges", held in 29–30 November 2003, IRIB Conference Center, Tehran, Iran [1]

- ^ Iran Oil Ministry Annual Bulletin, 5th Edition, pages 190-193 (available in Persian) (كتاب نفت و توسعه).[2]

- ^ Iran Oil Ministry Annual Bulletin, 5th Edition, pages 190-193 (available in Persian) (كتاب نفت و توسعه).[3] and Iran Energy Balance Sheet (ترازنامه انرژی ایران ) (available in Persian) Published by; Iran’s Energy Ministry, Secretariat of Energy and Electricity,2000 [4]

- ^ "POGC Website". Pogc.ir. Retrieved 2012-02-07.

- ^ أ ب NIOC Website Archived 12 يونيو 2008 at the Wayback Machine

- ^ "POGC Website". Pogc.ir. Retrieved 2012-02-07.

- ^ Iran Oil Ministry Annual Bulletin, 5th Edition, pages 190-193 (available in Persian) (كتاب نفت و توسعه).[5] and Iran Energy Balance Sheet (ترازنامه انرژی ایران ) (available in Persian), pp. 132-175, Iran’s Energy Ministry, Secretariat of Energy and Electricity, 2006 [6]

- ^ Iran Oil Ministry Annual Bulletin, 5th Edition, pages 190-193 (available in Persian) (كتاب نفت و توسعه).[7] and Iran Energy Balance Sheet (ترازنامه انرژی ایران ) (available in Persian), Page 132, Published by; Iran’s Energy Ministry, Secretariat of Energy and Electricity,2006 [8]

- ^ SHANA (2005-04-23). "NIOC Official News Agency,(www.Shana.ir),April 23, 2005". www.Shana.ir. Retrieved 2012-02-07.

- ^ SHANA. "NIOC Official News Agency,(www.Shana.ir),25/4/2009". www.Shana.ir. Retrieved 2012-02-07.

- ^ SHANA (2009-04-25). "NIOC Official News Agency,(www.Shana.ir),25/4/2009". www.Shana.ir. Retrieved 2012-02-07.

- ^ أ ب SHANA (2007-10-15). "NIOC Official News Agency,(www.Sahan.ir),October 15, 2007". Shana.ir. Retrieved 2012-02-07.

- ^ أ ب NIOC Official Web Site,(www.NIOC.ir) Archived 12 يونيو 2008 at the Wayback Machine

- ^ SHANA. "NIOC Official News Agency". www.Shana.ir. Retrieved 2012-02-07.

- ^ SHANA. "NIOC Official News Agency". www.Shana.ir. Retrieved 2012-02-07.

- ^ SHANA. "NIOC Official News Agency". www.Shana.ir. Retrieved 2012-02-07.

- ^ SHANA. "NIOC Official News Agency,(www.Shana.ir),July 02, 2008". www.Shana.ir. Retrieved 2012-02-07.

- ^ SHANA. "NIOC Official News Agency". www.Shana.ir. Retrieved 2012-02-07.

- ^ SHANA. "NIOC Official News Agency". www.Shana.ir. Retrieved 2012-02-07.

- ^ Iran Oil Ministry Annual Bulletin, 5th Edition, pages 190-193 (available in Persian) (كتاب نفت و توسعه).[9] and Iran Energy Balance Sheet (ترازنامه انرژی ایران ) (available in Persian), Page 175, Published by; Iran’s Energy Ministry, Secretariat of Energy and Electricity,2006 [10]

- ^ IHS International Oil Letter, Vol 24 issue 6, published 15 February 2008 [11]

- ^ SHANA. "Shana.ir, 2008 April 17". Shana.ir. Retrieved 2012-02-07.

- ^ "Internet Archive Wayback Machine". Web.archive.org. 2007-09-28. Archived from the original on 2007-09-28. Retrieved 2012-02-07.

{{cite web}}: Cite uses generic title (help) - ^ https://www.youtube.com/watch?v=SakDEQfY8xM

- ^ https://www.youtube.com/watch?v=zbsDDbMV6MA

- ^ http://www.eia.gov/countries/cab.cfm?fips=ir

- ^ أ ب ت http://www.eia.gov/countries/cab.cfm?fips=IR

- ^ Atieh Bahar: Oil & Gas in Iran (brief Study) Retrieved 4 May 2008

- ^ "Iran's oil terminals move to private hands". UPI.com. 2009-09-21. Retrieved 2012-02-07.

- ^ "Join Zawya Business Development & Solutions, Latest Intelligence on Industry". Zawya. Retrieved 2012-02-07.

- ^ "No. 3810 | Domestic Economy | Page 4". Irandaily. Retrieved 2012-02-07.

- ^ http://english.farsnews.com/newstext.php?nn=8101300295

- ^ أ ب http://www.iran-daily.com/1391/1/24/MainPaper/4207/Page/4/Index.htm#

- ^ خطأ استشهاد: وسم

<ref>غير صحيح؛ لا نص تم توفيره للمراجع المسماةtehrantimes1 - ^ "No Operation". Presstv.com. Retrieved 2012-02-07.

- ^ "Clouds on Iran's Caspian Horizon". Payvand.com. Retrieved 2012-02-07.

- ^ "Iran's Caspian oil swap to hit 500K bpd". PressTV. Retrieved 2012-02-07.

- ^ أ ب ت Calabresi, Massimo (2010-06-16). "Sleeping with the Enemy: BP's Deals with Iran". TIME. Retrieved 2012-02-07.

- ^ SHANA (2010-12-13). "AOGC Plans Increasing Oil Production to 550 Thousand B/D". Shana.ir. Retrieved 2012-02-07.

- ^ http://iran-daily.com/newspaper/page/4851/4/15434/0

- ^ أ ب "Iran's Oil-Output Costs to Quadruple in Coming Years, Paper Says". Bloomberg.

- ^ "IPS-M-190-2: 4 Line Pipe Standard Similar to API 5L". HYSP Steel Pipe.

- ^ http://tehrantimes.com/economy-and-business/96892-domestically-made-equipment-worth-10b-in-iran-oil-industry

- ^ "Iran outperforms foreign firms in S. Pars". PressTV. 2011-12-30. Retrieved 2012-02-07.

- ^ [12]

- ^ "Iran Daily - Domestic Economy - 04/29/07". Web.archive.org. 2008-06-12. Archived from the original on 2008-06-12. Retrieved 2012-02-07.

- ^ "::.. NIORDC - National Iranian Oil Refining & Distribution Company ..::". Niordc.ir. 2010-07-14. Retrieved 2012-02-07.

- ^ SHANA (2010-07-18). "Share of domestically made equipments on the rise". Shana.ir. Retrieved 2012-02-07.

- ^ http://www.steelguru.com/middle_east_news/Iran_signs_EUR_2_billion_oil_deal_with_Spanish_firm/262501.html

- ^ http://tehrantimes.com/economy-and-business/97026-official-sanctions-make-iran-oil-sector-85-self-sufficient-by-2015

- ^ http://www.tehrantimes.com/economy-and-business/100007-iran-seeking-self-sufficiency-in-strategic-oil-industry-goods

- ^ http://www.presstv.com/Detail/2015/07/23/421482/iran-electricity-turbine-power-

- ^ "BP exempted from US ban on Iran oil". PressTV. 2012-01-23. Retrieved 2012-02-07.

- ^ http://www.climatemitigation.com/rick-heede-bio.html

- ^ Douglas Starr (Aug 25, 2016). "Just 90 companies are to blame for most climate change, this 'carbon accountant' says". Science Magazine.

خطأ استشهاد: الوسم <ref> ذو الاسم "Stephen2003" المُعرّف في <references> غير مستخدم في النص السابق.

خطأ استشهاد: الوسم <ref> ذو الاسم "Ref-B-Lauterpacht1973" المُعرّف في <references> غير مستخدم في النص السابق.

خطأ استشهاد: الوسم <ref> ذو الاسم "Ref-B-Vassiliou2009" المُعرّف في <references> غير مستخدم في النص السابق.

<ref> ذو الاسم "Ref-B-Christine2008" المُعرّف في <references> غير مستخدم في النص السابق.للاستزادة

- Ferrier, R.W. (1982). The History of the British Petroleum Company: The Developing Years 1901–1932. Vol. vol. I. Cambridge: Cambridge University Press. ISBN 9780521246477.

{{cite book}}:|volume=has extra text (help) - Bamberg, James H (1994). The History of the British Petroleum Company: The Anglo-Iranian Years, 1928–1954. Vol. vol. II. Cambridge: Cambridge University Press. ISBN 9780521259507.

{{cite book}}:|volume=has extra text (help) - Bamberg, James H (2000). The History of the British Petroleum Company: British Petroleum and Global Oil, 1950–1975: The Challenge of Nationalism. Vol. vol. III. Cambridge: Cambridge University Press. ISBN 9780521785150.

{{cite book}}:|volume=has extra text (help) - Meyer, Karl E; Brysac, Shareen (2008). Kingmakers: The Invention of the Modern Middle East. New York: W.W. Norton. ISBN 9780393061994.

- Kinzer, Stephen (2003). All the Shah's Men: An American Coup and the Roots of Middle East Terror. Wiley. p. 272. ISBN 9780471265177.

- Louis, Wm. Roger (2007). Ends of British Imperialism: The Scramble for Empire, Suez, and Decolonization. I.B.Tauris. p. 1082. ISBN 9781845113476.

- Sztucki, Jerzy (1984). Interim measures in the Hague Court. Brill Archive. p. 43. ISBN 9789065440938.

- Vassiliou, Marius (2009). Historical Dictionary of the Petroleum Industry. Scarecrow Press. p. 662. ISBN 9780810859937.

- Lauterpacht, E. (1973). International Law Reports. Cambridge University Press. p. 560. ISBN 9780521463911.

- Strategies, Markets and Governance: Exploring Commercial and Regulatory Agendas. Cambridge University Press. 2008. p. 360. ISBN 9780521868457.

- The Cambridge History of Iran, Volume 7. Cambridge University Press. 1991. p. 1096. ISBN 9780521200950.

وصلات خارجية

- NIOC – official website (إنگليزية)

- Official News Service for Oil and Gas in Iran

- US Department of Energy - Iran's entry

- PEDEC – official website

- Oil & Gas Industry in Iran - 2003 Study (history, market overview, domestic suppliers, major projects, buy-backs)

- Australian Trade - Industry Profile for the Oil Sector in Iran

- Iran Oil & Gas Resources

- National Iranian Oil Company's Information Center & Central Library

- UN Comtrade – Iran crude oil exports stats

- CS1 errors: generic title

- Articles with unsourced statements from September 2015

- Articles containing فارسية-language text

- Articles containing إنگليزية-language text

- Pages using Lang-xx templates

- Articles with unsourced statements from March 2014

- Articles with hatnote templates targeting a nonexistent page

- Pages with empty portal template

- CS1 errors: extra text: volume

- الشركة الوطنية الإيرانية للنفط

- Iranian brands

- Non-renewable resource companies established in 1948