الركود الكبير

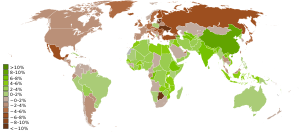

| ركود أواخر عقد 2000 حول العالم |

| جزء من سلسلة مقالات عن: |

| الأزمة المالية 2007–2010 |

|---|

ركود أواخر عقد 2000 أو الركود في أواخر القرن الحادي والعشرين أو الركود الكبير late-2000s recession،، Great Recession,[1][2] هو ركود اقتصادي بدأ في الولايات المتحدة في ديسمبر 2007[3] وانتهى في يونيو 2009 (كما حدده المكتب الأمريكي الوطني للبحوث الاقتصادية).[4] انتشر هذا الركود إلى الكثير من البلدان الصناعية، وتسبب في تباطؤ ملحوظ في النشاط الاقتصادي. حدث هذا الركود العالمي في بيئة اقتصادية تميزت باختلالات مختلفة ومن آثارها إندلاع الأزمة المالية 2007-2010. في يوليو 2009، أعلن عدد كبير من الاقتصاديين عن اعتقادهم بانتهاء الركود الكبير.[5][6] However, in the United States, the requisite two consecutive quarters of growth in the GDP did not actually occur until the end of 2009.

ارتبطت الأزمة المالية بممارسات الاقراض المتهورة التي مارستها المؤسسات المالية وبتزايد نمو التوريق في أسواق الرهن العقاري في الولايات المتحدة.[7][المصدر لا يؤكد ذلك] The US mortgage-backed securities, which had risks that were hard to assess, were marketed around the world. A more broad based credit boom fed a global speculative bubble in real estate and equities, which served to reinforce the risky lending practices.[8][9] The precarious financial situation was made more difficult by a sharp increase in oil and food prices. The emergence of Sub-prime loan losses in 2007 began the crisis and exposed other risky loans and over-inflated asset prices. With loan losses mounting and the fall of Lehman Brothers on September 15, 2008, a major panic broke out on the inter-bank loan market. As share and housing prices declined, many large and well established investment and commercial banks in the United States and Europe suffered huge losses and even faced bankruptcy, resulting in massive public financial assistance.

A global recession has resulted in a sharp drop in international trade, rising unemployment and slumping commodity prices. In December 2008, the National Bureau of Economic Research (NBER) declared that the United States had been in recession since December 2007.[10] Several economists have predicted that recovery may not appear until 2011 and that the recession will be the worst since the Great Depression of the 1930s.[11][12] Paul Robin Krugman, who won the Nobel Memorial Prize in Economics, once commented on this as seemingly the beginning of "a second Great Depression."[13] The conditions leading up to the crisis, characterized by an exorbitant rise in asset prices and associated boom in economic demand, are considered a result of the extended period of easily available credit,[14] inadequate regulation and oversight,[15] or increasing inequality.[16]

The recession has renewed interest in Keynesian economic ideas on how to combat recessionary conditions. Fiscal and monetary policies have been significantly eased to stem the recession and financial risks. Economists advise that the stimulus should be withdrawn as soon as the economies recover enough to "chart a path to sustainable growth".[17][18][19]

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

اختلالات ما قبل الركود الاقتصادي

The onset of the economic crisis took most people by surprise. A 2009 paper identifies twelve economists and commentators who, between 2000 and 2006, predicted a recession based on the collapse of the then-booming housing market in the U.S:[20] Dean Baker, Wynne Godley, Fred Harrison, Michael Hudson, Eric Janszen, Steve Keen, Jakob Brøchner Madsen & Jens Kjaer Sørensen, Kurt Richebächer, Nouriel Roubini, Peter Schiff and Robert Shiller.[20]

Among the various imbalances in which the U.S. monetary policy contributed by excessive money creation, leading to negative household savings and a huge U.S. trade deficit, dollar volatility and public deficits, a focus can be made on the following ones:

إرتفاع أسعار السلع الأساسية

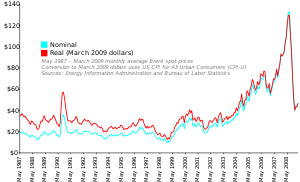

The decade of the 2000s saw a global explosion in prices, focused especially in commodities and housing, marking an end to the commodities recession of 1980–2000. In 2008, the prices of many commodities, notably oil and food, rose so high as to cause genuine economic damage, threatening stagflation and a reversal of globalization.[21]

In January 2008, oil prices surpassed $100 a barrel for the first time, the first of many price milestones to be passed in the course of the year.[22] In July 2008, oil peaked at $147.30[23] a barrel and a gallon of gasoline was more than $4 across most of the U.S.A. The economic contraction in the fourth quarter of 2008 caused a dramatic drop in demand and prices fell below $35 a barrel at the end of the year.[23] The high of 2008 may have been part of broader pattern of spiking instability in the price of oil over the preceding decade [24] This pattern of spiking instability in oil price may be a product of Peak Oil. There is concern that if the economy was to improve, oil prices might return to pre-recession levels.[25]

The food and fuel crises were both discussed at the 34th G8 summit in July 2008.[26]

Sulfuric acid (an important chemical commodity used in processes such as steel processing, copper production and bioethanol production) increased in price 3.5-fold in less than 1 year while producers of sodium hydroxide have declared force majeure due to flooding, precipitating similarly steep price increases.[27][28]

In the second half of 2008, the prices of most commodities fell dramatically on expectations of diminished demand in a world recession.[29]

أزمة الرهن العقاري

مقالة مفصلة: أزمة الرهن العقاري

مقالة مفصلة: أزمة الرهن العقاري

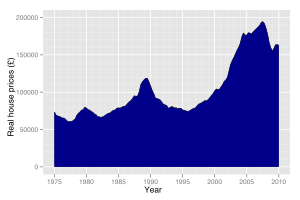

By 2007, real estate bubbles were still under way in many parts of the world,[30] especially in the United States, United Kingdom, United Arab Emirates, إيطاليا, Australia, New Zealand, Ireland, Spain, فرنسا, Poland,[31] South Africa, Israel, Greece, Bulgaria, Croatia,[32] كندا, Norway, Singapore, South Korea, Sweden, Finland, الأرجنتين,[33] Baltic states, الهند, Romania, روسيا, Ukraine and China.[34] U.S. Federal Reserve Chairman Alan Greenspan said in mid-2005 that "at a minimum, there's a little 'froth' (in the U.S. housing market) ... it's hard not to see that there are a lot of local bubbles".[35] The Economist magazine, writing at the same time, went further, saying "the worldwide rise in house prices is the biggest bubble in history".[36] Real estate bubbles are (by definition of the word "bubble") followed by a price decrease (also known as a housing price crash) that can result in many owners holding negative equity (a mortgage debt higher than the current value of the property).

التضخم

In February 2008, Reuters reported that global inflation was at historic levels, and that domestic inflation was at 10–20 year highs for many nations.[37] "Excess money supply around the globe, monetary easing by the Fed to tame financial crisis, growth surge supported by easy monetary policy in Asia, speculation in commodities, agricultural failure, rising cost of imports from China and rising demand of food and commodities in the fast growing emerging markets," have been named as possible reasons for the inflation.[38]

In mid-2007, IMF data indicated that inflation was highest in the oil-exporting countries, largely due to the unsterilized growth of foreign exchange reserves, the term "unsterilized" referring to a lack of monetary policy operations that could offset such a foreign exchange intervention in order to maintain a country's monetary policy target. However, inflation was also growing in countries classified by the IMF as "non-oil-exporting LDCs" (Least Developed Countries) and "Developing Asia", on account of the rise in oil and food prices.[39]

Inflation was also increasing in the developed countries,[40][41] but remained low compared to the developing world.

الأسباب

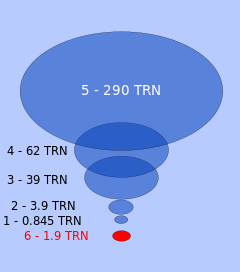

- Central banks' gold reserves – $0.845 tn.

- M0 (paper money) – - $3.9 tn.

- traditional (fractional reserve) banking assets – $39 tn.

- shadow banking assets – $62 tn.

- other assets – $290 tn.

- Bail-out money (early 2009) – $1.9 tn.

جدل حول الأصول

The central debate about the origin has been focused on the respective parts played by the public monetary policy (in the US notably) and by private financial institutions practices.

On October 15, 2008, Anthony Faiola, Ellen Nakashima, and Jill Drew wrote a lengthy article in The Washington Post titled, "What Went Wrong".[43] In their investigation, the authors claim that former Federal Reserve Board Chairman Alan Greenspan, Treasury Secretary Robert Rubin, and SEC Chairman Arthur Levitt vehemently opposed any regulation of financial instruments known as derivatives. They further claim that Greenspan actively sought to undermine the office of the Commodity Futures Trading Commission, specifically under the leadership of Brooksley E. Born, when the Commission sought to initiate regulation of derivatives. Ultimately, it was the collapse of a specific kind of derivative, the mortgage-backed security, that triggered the economic crisis of 2008.

While Greenspan's role as Chairman of the Federal Reserve has been widely discussed (the main point of controversy remains the lowering of Federal funds rate at only 1% for more than a year which, according to the Austrian School of economics, allowed huge amounts of "easy" credit-based money to be injected into the financial system and thus create an unsustainable economic boom),[44][45] there is also the argument that Greenspan's actions in the years 2002–2004 were actually motivated by the need to take the U.S. economy out of the early 2000s recession caused by the bursting of the dot-com bubble — although by doing so he did not help avert the crisis, but only postpone it.[46][47]

Some economists - those of the Austrian school and those predicting the recession such as Steve Keen - claim that the ultimate point of origin of the great financial crisis of 2007–2010 can be traced back to an extremely indebted US economy. The collapse of the real estate market in 2006 was the close point of origin of the crisis. The failure rates of subprime mortgages were the first symptom of a credit boom tuned to bust and of a real estate shock. But large default rates on subprime mortgages cannot account for the severity of the crisis. Rather, low-quality mortgages acted as an accelerant to the fire that spread through the entire financial system. The latter had become fragile as a result of several factors that are unique to this crisis: the transfer of assets from the balance sheets of banks to the markets, the creation of complex and opaque assets, the failure of ratings agencies to properly assess the risk of such assets, and the application of fair value accounting. To these novel factors, one must add the now standard failure of regulators and supervisors in spotting and correcting the emerging weaknesses.[48]

Robert Reich points out the amount of debt in the US economy can be traced to economic inequality, where middle class wages remain stagnant while wealth concentrates at the top, and households "pull equity from their homes and overload on debt to maintain living standards."[49]

الآثار

نظرة عامة

The late-2000s recession is shaping up to be the worst post-الحرب العالمية الثانية contraction on record:[50]

- Real gross domestic product (GDP) began contracting in the third quarter of 2008, and by early 2009 was falling at an annualized pace not seen since the 1950s.[51]

- Capital investment, which was in decline year-on-year since the final quarter of 2006, matched the 1957–58 post war record in the first quarter of 2009. The pace of collapse in residential investment picked up speed in the first quarter of 2009, dropping 23.2% year-on-year, nearly four percentage points faster than in the previous quarter.

- Domestic demand, in decline for five straight quarters, is still three months shy of the 1974–75 record, but the pace – down 2.6% per quarter vs. 1.9% in the earlier period – is a record-breaker already.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

استجابات السياسات العامة

The financial phase of the crisis led to emergency interventions in many national financial systems. As the crisis developed into genuine recession in many major economies, economic stimulus meant to revive economic growth became the most common policy tool. After having implemented rescue plans for the banking system, major developed and emerging countries announced plans to relieve their economies. In particular, economic stimulus plans were announced in China, the United States, and the European Union.[52] Bailouts of failing or threatened businesses were carried out or discussed in the USA, the EU, and India.[53] In the final quarter of 2008, the financial crisis saw the G-20 group of major economies assume a new significance as a focus of economic and financial crisis management.

توصيات صندوق النقد الدولي

The International Monetary Fund (I.M.F.) has stated that the financial crisis will not end without a major decrease in unemployment, as 30 million people are unemployed worldwide. The IMF urged governments to expand social safety nets and to generate job creation even as they are under pressure to cut spending. Governments should also invest in skills training for the unemployed and even governments of countries like Greece with major debt risk should first focus on long-term economic recovery by creating jobs.[54]

استجابات السياسات الأمريكية

The Federal Reserve, Treasury, and Securities and Exchange Commission took several steps on September 19 to intervene in the crisis. To stop the potential run on money market mutual funds, the Treasury also announced on September 19 a new $50 billion program to insure the investments, similar to the Federal Deposit Insurance Corporation (FDIC) program.[55] Part of the announcements included temporary exceptions to section 23A and 23B (Regulation W), allowing financial groups to more easily share funds within their group. The exceptions would expire on January 30, 2009, unless extended by the Federal Reserve Board.[56] The Securities and Exchange Commission announced termination of short-selling of 799 financial stocks, as well as action against naked short selling, as part of its reaction to the mortgage crisis.[57]

Market volatility within US 401(k) and retirement plans

The US Pension Protection Act of 2006 included a provision which changed the definition of Qualified Default Investments (QDI) for retirement plans from stable value investments, money market funds, and cash investments to investments which expose an individual to appropriate levels of stock and bond risk based on the years left to retirement. The Act required that Plan Sponsors move the assets of individuals who had never actively elected their investments and had their contributions in the default investment option. This meant that individuals who had defaulted into a cash fund with little fluctuation or growth would soon have their account balances moved to much more aggressive investments.

Starting in early 2008, most US employer-sponsored plans sent notices to their employees informing them that the plan default investment was changing from a cash/stable option to something new, such as a retirement date fund which had significant market exposure. Most participants ignored these notices until September and October, when the market crash was on every news station and media outlet. It was then that participants called their 401(k) and retirement plan providers and discovered losses in excess of 30% in some cases. Call centers for 401(k) providers experienced record call volume and wait times, as millions of inexperienced investors struggled to understand how their investments had been changed so fundamentally without their explicit consent, and reacted in a panic by liquidating everything with any stock or bond exposure, locking in huge losses in their accounts.

Due to the speculation and uncertainty in the market, discussion forums filled with questions about whether or not to liquidate assets[58] and financial gurus were swamped with questions about the right steps to take to protect what remained of their retirement accounts. During the third quarter of 2008, over $72 billion left mutual fund investments that invested in stocks or bonds and rushed into Stable Value investments in the month of October.[59] Against the advice of financial experts, and ignoring historical data illustrating that long-term balanced investing has produced positive returns in all types of markets,[60] investors with decades to retirement instead sold their holdings during one of the largest drops in stock market history.

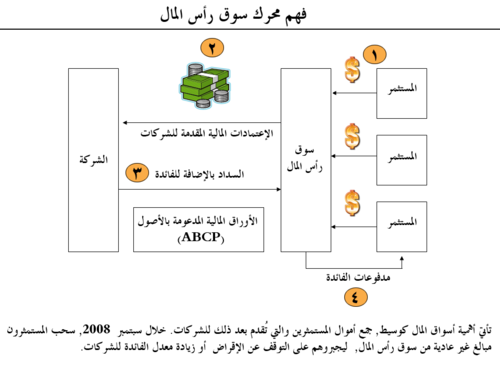

قروض البنوك لسندات مدعومة بأوراق مالية

During the week ending September 19, 2008, money market mutual funds had begun to experience significant withdrawals of funds by investors. This created a significant risk because money market funds are integral to the ongoing financing of corporations of all types. Individual investors lend money to money market funds, which then provide the funds to corporations in exchange for corporate short-term securities called asset-backed commercial paper (ABCP). However, a potential bank run had begun on certain money market funds. If this situation had worsened, the ability of major corporations to secure needed short-term financing through ABCP issuance would have been significantly affected. To assist with liquidity throughout the system, the US Treasury and Federal Reserve Bank announced that banks could obtain funds via the Federal Reserve's Discount Window using ABCP as collateral.[55][61]

معدلات تغير نظام الإحتياط الفدرالي

| معدلات تغير نظام الإحتياط الفدرالي (التاريخ حتى 1 يناير، 2008 ) | |||||

| التاريخ | سعر الخصم | سعر الخصم | سعر الخصم | أموال الاحتياط الفدرالي | سعر أموال الاحتياط الفدرالي |

|---|---|---|---|---|---|

| أساسي | ثانوي | ||||

| سعر الصرف | سعر الفائدة الجديد | سعر الفائدة الجديد | سعر الصرف | سعر الفائدة الجديد | |

| 8 أكتوبر 2008* | -0.50% | 1.75% | 2.25% | -0.50% | 1.50% |

| 30 أكتوبر 2008 | -0.25% | 2.25% | 2.75% | -0.25% | 2.00% |

| 18 مارس 2008 | -0.75% | 2.50% | 3.00% | -0.75% | 2.25% |

| 16 مارس 2008 | -0.25% | 3.25% | 3.75% | ||

| 30 يناير 2008 | -0.50% | 3.50% | 4.00% | -0.50% | 3.00% |

| 22 يناير 2008 | -0.75% | 4.00% | 4.50% | -0.75% | 3.50% |

– * Part of a coordinated global rate cut of 50 basis point by main central banks.[62]

– See more detailed US federal discount rate chart:[63]

التشريعات

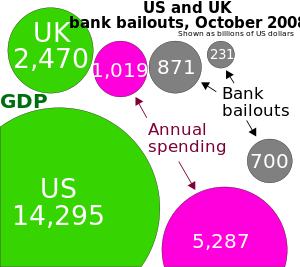

The Secretary of the United States Treasury, Henry Paulson and President George W. Bush proposed legislation for the government to purchase up to US$700 billion of "troubled mortgage-related assets" from financial firms in hopes of improving confidence in the mortgage-backed securities markets and the financial firms participating in it.[64] Discussion, hearings and meetings among legislative leaders and the administration later made clear that the proposal would undergo significant change before it could be approved by Congress.[65] On October 1, a revised compromise version was approved by the Senate with a 74–25 vote. The bill, HR1424 was passed by the House on October 3, 2008 and signed into law. The first half of the bailout money was primarily used to buy preferred stock in banks instead of troubled mortgage assets.[66]

In January 2009, the Obama administration announced a stimulus plan to revive the economy with the intention to create or save more than 3.6 million jobs in two years. The cost of this initial recovery plan was estimated at 825 billion dollars (5.8% of GDP). The plan included 365.5 billion dollars to be spent on major policy and reform of the health system, 275 billion (through tax rebates) to be redistributed to households and firms, notably those investing in renewable energy, 94 billion to be dedicated to social assistance for the unemployed and families, 87 billion of direct assistance to states to help them finance health expenditures of Medicaid, and finally 13 billion spent to improve access to digital technologies. The administration also attributed of 13.4 billion dollars aid to automobile manufacturers General Motors and Chrysler, but this plan is not included in the stimulus plan.

These plans are meant to abate further economic contraction, however, with the present economic conditions differing from past recessions, in, that, many tenets of the American economy such as manufacturing, textiles, and technological development have been outsourced to other countries. Public works projects associated with the economic recovery plan outlined by the Obama Administration have been degraded by the lack of road and bridge development projects that were highly abundant in the Great Depression but are now mostly constructed and are mostly in need of maintenance. Regulations to establish market stability and confidence have been neglected in the Obama plan and have yet to be incorporated.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

استجابات الاحتياط الفدرالي

In an effort to increase available funds for commercial banks and lower the fed funds rate, on September 29 the U.S. Federal Reserve announced plans to double its Term Auction Facility to $300 billion. Because there appeared to be a shortage of U.S. dollars in Europe at that time, the Federal Reserve also announced it would increase its swap facilities with foreign central banks from $290 billion to $620 billion.[67]

As of December 24, 2008, the Federal Reserve had used its independent authority to spend $1.2 trillion on purchasing various financial assets and making emergency loans to address the financial crisis, above and beyond the $700 billion authorized by Congress from the federal budget. This includes emergency loans to banks, credit card companies, and general businesses, temporary swaps of treasury bills for mortgage-backed securities, the sale of Bear Stearns, and the bailouts of American International Group (AIG), Fannie Mae and Freddie Mac, and Citigroup.[68]

الاستجابات السياسية لآسيا والمحيط الهادي

On September 15, 2008 China cut its interest rate for the first time since 2002. Indonesia reduced its overnight repo rate, at which commercial banks can borrow overnight funds from the central bank, by two percentage points to 10.25 percent. The Reserve Bank of Australia injected nearly $1.5 billion into the banking system, nearly three times as much as the market's estimated requirement. The Reserve Bank of India added almost $1.32 billion, through a refinance operation, its biggest in at least a month.[69] On November 9, 2008 the 2008 Chinese economic stimulus plan is a RMB¥ 4 trillion ($586 billion) stimulus package announced by the central government of the People's Republic of China in its biggest move to stop the global financial crisis from hitting the world's third largest economy. A statement on the government's website said the State Council had approved a plan to invest 4 trillion yuan ($586 billion) in infrastructure and social welfare by the end of 2010. The stimulus package will be invested in key areas such as housing, rural infrastructure, transportation, health and education, environment, industry, disaster rebuilding, income-building, tax cuts, and finance.

China's export driven economy is starting to feel the impact of the economic slowdown in the United States and Europe, and the government has already cut key interest rates three times in less than two months in a bid to spur economic expansion. On November 28, 2008, the Ministry of Finance of the People's Republic of China and the State Administration of Taxation jointly announced a rise in export tax rebate rates on some labor-intensive goods. These additional tax rebates will take place on December 1, 2008.[70]

The stimulus package was welcomed by world leaders and analysts as larger than expected and a sign that by boosting its own economy, China is helping to stabilize the global economy. News of the announcement of the stimulus package sent markets up across the world. However, Marc Faber January 16 said that China according to him was in recession.

In Taiwan, the central bank on September 16, 2008 said it would cut its required reserve ratios for the first time in eight years. The central bank added $3.59 billion into the foreign-currency interbank market the same day. Bank of Japan pumped $29.3 billion into the financial system on September 17, 2008 and the Reserve Bank of Australia added $3.45 billion the same day.[71]

In developing and emerging economies, responses to the global crisis mainly consisted in low-rates monetary policy (Asia and the Middle East mainly) coupled with the depreciation of the currency against the dollar. There were also stimulus plans in some Asian countries, in the Middle East and in Argentina. In Asia, plans generally amounted to 1 to 3% of GDP, with the notable exception of China, which announced a plan accounting for 16% of GDP (6% of GDP per year).

الاستجابات السياسية الاوروبية

Until September 2008, European policy measures were limited to a small number of countries (Spain and Italy). In both countries, the measures were dedicated to households (tax rebates) reform of the taxation system to support specific sectors such as housing. The European Commission proposed a €200 billion stimulus plan to be implemented at the European level by the countries. At the beginning of 2009, the UK and Spain completed their initial plans, while Germany announced a new plan.

On September 29, 2008 the Belgian, Luxembourg and Dutch authorities partially nationalized Fortis. The German government bailed out Hypo Real Estate.

On 8 October 2008 the British Government announced a bank rescue package of around £500 billion[72] ($850 billion at the time). The plan comprises three parts. The first 200 billion euro would be made in regaurds to the banks in liquidity stack. The second part will consists of the state government increasing the capital market within the banks. Along with 50 billion euro will be made avilable if the banks needed, finally the government will write away any eligible lending between the British banks with a limit to 250 billion euro.

In early December German Finance Minister Peer Steinbrück indicated that he does not believe in a "Great Rescue Plan" and indicated reluctance to spend more money addressing the crisis.[73] In March 2009, The European Union Presidency confirms that the EU is strongly resisting the US pressure to increase European budget deficits.[74]

الاستجابات العالمية

Most political responses to the economic and financial crisis has been taken, as seen above, by individual nations. Some coordination took place at the European level, but the need to cooperate at the global level has led leaders to activate the G-20 major economies entity. A first summit dedicated to the crisis took place, at the Heads of state level in November 2008 (2008 G-20 Washington summit).

The G-20 countries met in a summit held on November 2008 in Washington to address the economic crisis. Apart from proposals on international financial regulation, they pledged to take measures to support their economy and to coordinate them, and refused any resort to protectionism.

Another G-20 summit was held in London on April 2009. Finance ministers and central banks leaders of the G-20 met in Horsham on March to prepare the summit, and pledged to restore global growth as soon as possible. They decided to coordinate their actions and to stimulate demand and employment. They also pledged to fight against all forms of protectionism and to maintain trade and foreign investments. They also committed to maintain the supply of credit by providing more liquidity and recapitalizing the banking system, and to implement rapidly the stimulus plans. As for central bankers, they pledged to maintain low-rates policies as long as necessary. Finally, the leaders decided to help emerging and developing countries, through a strengthening of the IMF.

بلدان حافظت على النمو أو تجنبته تقنيا

Poland is the only member of the European Union to have avoided a decline in GDP, meaning that in 2009 Poland has created the most GDP growth in the EU. As of December 2009 the Polish economy had not entered recession nor even contracted, while its IMF 2010 GDP growth forecast of 1.9 per cent is expected to be upgraded.[75][76][77] Analysts have identified several causes: Extremely low levels of bank lending and a relatively very small mortgage market; the relatively recent dismantling of EU trade barriers and the resulting surge in demand for Polish goods since 2004; the receipt of direct EU funding since 2004; lack of over-dependence on a single export sector; a tradition of government fiscal responsibility; a relatively large internal market; the free-floating Polish zloty; low labour costs attracting continued foreign direct investment; economic difficulties at the start of the decade which prompted austerity measures in advance of the world crisis; a government decision to refrain from Quantitative easing.

While China, الهند and Iran have experienced slowing growth, they have not entered recession.

South Korea narrowly avoided technical recession in the first quarter of 2009.[78] The International Energy Agency stated in mid September that South Korea could be the only large OECD country to avoid recession for the whole of 2009.[79] It was the only developed economy to expand in the first half of 2009. On October 6, Australia became the first G20 country to raise its main interest rate, with the Reserve Bank of Australia deciding to move rates up to 3.25% from 3.00%.[80]

Australia has avoided a technical recession after experiencing only one quarter of negative growth in the fourth quarter of 2008, with GDP returning to positive in the first quarter of 2009.[81][82]

بلدان في حالة ركود اقتصادي أو ضغوط

Many countries experienced recession in 2008.[83] The countries/territories currently in a technical recession are Estonia, Latvia, Ireland, New Zealand, Japan, Hong Kong, Singapore, Italy, Russia and Germany.

Denmark went into recession in the first quarter of 2008, but came out again in the second quarter.[84] Iceland fell into an economic depression in 2008 following the collapse of its banking system. (see Icelandic financial crisis)

The following countries went into recession in the second quarter of 2008: Estonia,[85] Latvia,[86] Ireland[87] and New Zealand.[88]

The following countries/territories went into recession in the third quarter of 2008: Japan,[89] Sweden,[90] Hong Kong,[91] Singapore,[92] Italy,[93] Turkey[83] and Germany.[94] As a whole the fifteen nations in the European Union that use the euro went into recession in the third quarter,[95] and the United Kingdom. In addition, the European Union, the G7, and the OECD all experienced negative growth in the third quarter.[83]

The following countries/territories went into technical recession in the fourth quarter of 2008: United States, Switzerland,[96] Spain,[97] and Taiwan.[98]

South Korea "miraculously" avoided recession with GDP returning positive at a 0.1% expansion in the first quarter of 2009.[99]

Of the seven largest economies in the world by GDP, only China and France avoided a recession in 2008. France experienced a 0.3% contraction in Q2 and 0.1% growth in Q3 of 2008. In the year to the third quarter of 2008 China grew by 9%. This is interesting as China has until recently considered 8% GDP growth to be required simply to create enough jobs for rural people moving to urban centres.[100] This figure may more accurately be considered to be 5–7% now that the main growth in working population is receding. Growth of between 5%–8% could well have the type of effect in China that a recession has elsewhere. Ukraine went into technical depression in January 2009 with a nominal annualized GDP growth of −20%.[101]

The recession in Japan intensified in the fourth quarter of 2008 with a nominal annualized GDP growth of −12.7%,[102] and deepened further in the first quarter of 2009 with a nominal annualized GDP growth of −15.2%.[103]

Major economies affected by the recession.[104]

|

توقعات الأطراف الرسمية في العالم

On March 2009, U.S. Fed Chairman Ben Bernanke said in an interview that he felt that if banks began lending more freely, allowing the financial markets to return to normal, the recession could end during 2009.[6][105] In that same interview, Bernanke said Green shoots of economic revival are already evident.[106] On February 18, 2009, the US Federal Reserve cut their economic forecast of 2009, expecting the US output to shrink between 0.5% and 1.5%, down from its forecast in October 2008 of output between +1.1% (growth) and −0.2% (contraction).[107]

The EU commission in Brussels updated their earlier predictions on January 19, 2009, expecting Germany to contract −2.25% and −1.8% on average for the 27 EU countries.[108] According to new forecasts by Deutsche Bank (end of November 2008), the economy of Germany will contract by more than 4% in 2009.[109]

On November 3, 2008, according to all newspapers, the European Commission in Brussels predicted for 2009 only an extremely low increase by 0.1% of the GDP, for the countries of the Euro zone (France, Germany, Italy, etc.).[110] They also predicted negative numbers for the UK (−1.0%), Ireland, Spain, and other countries of the EU. Three days later, the IMF at Washington, D.C., predicted for 2009 a worldwide decrease, −0.3%, of the same number, on average over the developed economies (−0.7% for the US, and −0.8% for Germany).[111] On April 22, 2009, the German ministers of finance and that of economy, in a common press conference, corrected again their numbers for 2009 downwards: this time the "prognosis" for Germany was a decrease of the GDP of at least −5%,[112] in agreement with a recent prediction of the IMF.[113]

On June 11, 2009, the World Bank Group predicted for 2009 for the first time a global contraction of the economic power, precisely by −3%.[114]

مقارنات الركود الكبير

في الولايات المتحدة

Although some casual comparisons between the late-2000s recession and the Great Depression have been made, there remain large differences between the two events.[115][116][117] The consensus among economists in March 2009 was that a depression was not likely to occur.[118] UCLA Anderson Forecast director Edward Leamer said on March 25, 2009 that there had not been any major predictions at that time which resembled a second Great Depression:

"We've frightened consumers to the point where they imagine there is a good prospect of a Great Depression. That certainly is not in the prospect. No reputable forecaster is producing anything like a Great Depression."[119]

Differences explicitly pointed out between the recession and the Great Depression include the facts that over the 79 years between 1929 and 2008, great changes occurred in economic philosophy and policy,[120] the stock market had not fallen as far as it did in 1932 or 1982, the 10-year price-to-earnings ratio of stocks was not as low as in the '30s or '80s, inflation-adjusted U.S. housing prices in March 2009 were higher than any time since 1890 (including the housing booms of the 1970s and '80s),[121] the recession of the early '30s lasted over three-and-a-half years,[120] and during the 1930s the supply of money (currency plus demand deposits) fell by 25% (where as in 2008 and 2009 the Fed "has taken an ultraloose credit stance").[122] Furthermore, the unemployment rate in 2008 and early 2009 and the rate at which it rose was comparable to most of the recessions occurring after الحرب العالمية الثانية, and was dwarfed by the 25% unemployment rate peak of the Great Depression.[120]

سوق الأوراق المالية

Price-to-earnings ratios have yet to drop as low as in previous recessions. On this issue, "it is critically important, though, to recognize that different analysts have different earnings expectations, and the consensus view is more often wrong than right."[123] Some argue that price-to-earnings ratios remain high because of unprecedented falls in earnings.[124]

Market strategist Phil Dow "said he believes distinctions exist between the current market malaise" and the Great Depression. The Dow's fall of over 50% in 17 months is similar to a 54.7% fall in the Great Depression, followed by a total drop of 89% over the next 16 months. "It's very troubling if you have a mirror image," said Dow.[125] Floyd Norris, chief financial correspondent of The New York Times, wrote in a blog entry in March 2009 that the decline has not been a mirror image of the Great Depression, explaining that although the decline amounts were nearly the same at the time, the rates of decline had started much faster in 2007, and that the past year had only ranked eighth among the worst recorded years of percentage drops in the Dow. The past two years ranked third however.[126]

البطالة

The chief economist of the I.M.F., Dr. Olivier Blanchard, stated that the percentage of workers laid off for long stints has been rising with each downturn for decades but the figures have surged this time. "Long-term unemployment is alarmingly high: in the US, half the unemployed have been out of work for over six months, something we have not seen since the Great Depression." The IMF also stated that a link between rising inequality within Western economies and deflating demand may exist. The last time that the wealth gap reached such skewed extremes was in 1928-1929.[127]

Three years into the Great Depression, unemployment reached a peak of 25% in the U.S.[128] The United States entered into recession in December 2007[129] and in March 2009, U-3 unemployment reached 8.5%.[130] In March 2009, statistician[131] John Williams "argue[d] that measurement changes implemented over the years make it impossible to compare the current unemployment rate with that seen during the Great Depression".[131]

مخاطر يفرضها التحرير الاقتصادي

Nobel Prize winning economist Paul Krugman predicted a series of depressions in his Return to Depression Economics (2000), based on "failures on the demand side of the economy." On January 5, 2009, he wrote that "preventing depressions isn't that easy after all" and that "the economy is still in free fall."[132] In March 2009, Krugman explained that a major difference in this situation is that the causes of this financial crisis were from the shadow banking system. "The crisis hasn't involved problems with deregulated institutions that took new risks... Instead, it involved risks taken by institutions that were never regulated in the first place."[133]

On February 22, NYU economics professor Nouriel Roubini said that the crisis was the worst since the Great Depression, and that without cooperation between political parties and foreign countries, and if poor fiscal policy decisions (such as support of zombie banks) are pursued, the situation "could become as bad as the Great Depression."[134] On April 27, 2009, Roubini expressed a more upbeat assessment by noting that "the bottom of the economy [will be seen] toward the beginning or middle of next year."[135]

On November 15, 2008, author and SMU economics professor Ravi Batra said he is "afraid the global financial debacle will turn into a steep recession and be the worst since the Great Depression, even worse than the painful slump of 1980–1982 that afflicted the whole world".[136] In 1978, Batra's book The Downfall of Capitalism and Communism was published. His first major prediction came true with the collapse of Soviet Communism in 1990. His second major prediction for a financial crisis to engulf the capitalist system seems to be unfolding since 2007 with increasing attention being paid to his work.[137][138][139]

On April 6, 2009 Vernon L. Smith and Steven Gjerstad offered the hypothesis "that a financial crisis that originates in consumer debt, especially consumer debt concentrated at the low end of the wealth and income distribution, can be transmitted quickly and forcefully into the financial system. It appears that we're witnessing the second great consumer debt crash, the end of a massive consumption binge."[140]

In his final press conference as president, George W. Bush claimed that in September 2008 his chief economic advisors had said that the economic situation could at some point become worse than the Great Depression.[141]

A tent city in Sacramento, كاليفورنيا was described as "images, hauntingly reminiscent of the iconic photos of the 1930s and the Great Depression" and "evocative Depression-era images."[142]

On April 17, 2009, head of the IMF Dominique Strauss-Kahn said that there was a chance that certain countries may not implement the proper policies to avoid feedback mechanisms that could eventually turn the recession into a depression. "The free-fall in the global economy may be starting to abate, with a recovery emerging in 2010, but this depends crucially on the right policies being adopted today." The IMF pointed out that unlike the Great Depression, this recession was synchronized by global integration of markets. Such synchronized recessions were explained to last longer than typical economic downturns and have slower recoveries.[143]

في جنوب أفريقيا

On February 11, South Africa's Finance Minister Trevor Manuel said that "what started as a financial crisis might well become a second Great Depression."[144]

في المملكة المتحدة

On February 10, 2009, Ed Balls, Secretary of State for Children, Schools and Families of the المملكة المتحدة, said that "I think that this is a financial crisis more extreme and more serious than that of the 1930s and we all remember how the politics of that era were shaped by the economy."[145] On January 24, 2009, Edmund Conway, Economics Editor for The Daily Telegraph, wrote that "The plight facing Britain is uncannily similar to the 1930s, since prices of many assets – from shares to house prices – are falling at record rates [in Britain], but the value of the debt against which they are held remains unchanged."[146]

في أيرلندا

The Republic of Ireland "technically" entered into an economic depression in 2009.[147] The ESRI (Economic and Social Research Institute) predict an economic contraction of 14% by 2010,[148] however this number may have already been exceeded with GDP dropping 7.1% quarter on quarter during the fourth quarter of 2008,[149] and a possible greater contraction in the first quarter of 2009 with the fall in all OECD countries with the exception of France exceeding the drop of the previous quarter.[150] Unemployment is up 8.75%[151] to 11.4%.[152][153][154] Government borrowing and the financial bailout and Nationalisation of one of Ireland's banks[155] which were loaded with debt due to the Irish property bubble.

فقدان الوظائف ومعدلات البطالة

Many jobs have been lost worldwide. In the US, job loss has been going on since December 2007, and it accelerated drastically starting in September 2008 following the bankruptcy of Lehman Brothers.[156] By February 2010, the American economy is reported to be more shaky than the economy of Canada. Many service industries have reported dropping their prices in order to maximize profit margins in an era where employment is fleeting and either underemployment or unemployment is a sure factor in life.

انظر أيضا

- 2008 Chinese economic stimulus plan

- 2008 United States bank failures

- عودة الكينزية 2008–2009

- الأزمة المالية اللاتيڤية 2008–2009

- الأزمة المالية الروسية 2008–2009

- American Recovery and Reinvestment Act of 2009

- أزمة سوق السيارات 2008–2009

- إفلاس ليمان براذرز

- Bear Stearns subprime mortgage hedge fund crisis

- Federal takeover of Fannie Mae and Freddie Mac

- الأزمة المالية 2007–2010

- الكساد الكبير

- List of entities involved in 2007–2008 financial crises

- Statistical Arbitrage Events of summer 2007

- Subprime crisis impact timeline

- United States bear market of 2007–2009

- الأزمة العقارية الأمريكية

- إصلاح سوق الرهن العقاري في الولايات المتحدة

- 2000s commodities boom

المصادر

- ^ See Great Recession for the origins and other uses of this label.

- ^ Wessel, David (2010-04-08). "Did 'Great Recession' Live Up to the Name?". The Wall Street Journal.

- ^ Mark Hulbert (July 15, 2010). "It's Dippy to Fret About a Double-Dip Recession".

- ^ Evans-Schaefer, Steve (2010-09-20). "Street Rallies Around Official Recession End".

- ^ Daniel Gross, The Recession Is... Over?, Newsweek, July 14, 2009.

- ^ أ ب V.I. Keilis-Borok et al., Pattern of Macroeconomic Indicators Preceding the End of an American Economic Recession. Journal of Pattern Recognition Research, JPRR Vol.3 (1) 2008.

- ^ Mishkin, Fredric S.. "How Should We Respond to Asset Price Bubbles?" (May 15, 2008). Retrieved on 2009-04-18.

- ^ Foldvary, Fred E. (September 18, 2007). The Depression of 2008 (PDF). The Gutenberg Press. ISBN 0-9603872-0-X. Retrieved 2009-01-04.

- ^ Nouriel Roubini (January 15, 2009). "A Global Breakdown Of The Recession In 2009".

- ^ Isidore, Chris (2008-12-01). "It's official: Recession since Dec '07". CNN Money. Retrieved 2009-04-10.

- ^ Congressional Budget Office compares downturn to Great Depression. By David Lightman. McClatchy Washington Bureau. January 27, 2009.

- ^ Finch, Julia (2009-01-26). "Twenty-five people at the heart of the meltdown ..." London: The Guardian. Retrieved 2009-04-10.

- ^ Krugman, Paul (2009-01-04). "Fighting Off Depression". The New York Times.

- ^ Wearden, Graeme (2008-06-03). "Oil prices: George Soros warns that speculators could trigger stock market crash". London: The Guardian. Retrieved 2009-04-10.

- ^ Andrews, Edmund L. (2008-10-24). "Greenspan Concedes Error on Regulation". New York Times. Retrieved 2009-04-18.

- ^ "Inequality and depression: Ravi Batra's original thesis on financial crisis". Forbes. 1987-09-27. Retrieved 2009-04-18.[dead link]

- ^ "IMF World Economic Outlook, April 2009: "Exit strategies will be needed to transition fiscal and monetary policies from extraordinary short-term support to sustainable medium-term frameworks." (p.38)" (PDF). Retrieved 2010-01-21.

- ^ "Blanchard, the chief economist of the International Monetary Fund, "is advising officials around the world to keep economic stimulus programs in place no longer than necessary to chart a path to sustainable growth."". Bloomberg.com. 2005-05-30. Retrieved 2010-01-21.

{{cite web}}: Text "Olivier" ignored (help) - ^ Cooke, Kristina (2009-08-21). "deficit poses potential systemic risk: Taylor, Reuters, August 21, 2009". Reuters.com. Retrieved 2010-01-21.

{{cite news}}: Text "U.S" ignored (help) - ^ أ ب Dirk J Bezemer: "No One Saw This Coming" Understanding Financial Crisis Through Accounting Models, available via: MPRA, esp. p. 9 and appendix.

- ^ Rubin, Jeff (May 27, 2008). "The New Inflation" (PDF). StrategEcon. CIBC World Markets. Retrieved 2009-01-04.

- ^ "Crude oil prices set record high 102.08 dollars per barrel".

- ^ أ ب "Light Crude Oil EmiNY (QM, NYMEX): Monthly Price Chart". Tfc-charts.com. Retrieved 2009-01-04.

- ^ Gail the Actuary - Was Volatility in the Price of Oil a Cause of the 2008 Financial Crisis?

- ^ Oil prices and future economic stability http://www.thestar.com/business/article/535378

- ^ "Africa's Plight Dominates First Day of G8 Summit".

- ^ "Sulfuric acid prices explode".

- ^ "Dow Declares Force Majeure for Caustic Soda".

- ^ "Commodities crash".

- ^ "From the subprime to the terrigenous: Recession begins at home". Land Values Research Group. June 2, 2009.

{{cite web}}: Check date values in:|date=(help) (A survey of recessions or expected recessions in 40 countries, 33 of which arguably had property bubbles.) - ^ "The end of Poland's house price boom". Global Property Guide. August 25, 2008.

{{cite web}}: Check date values in:|date=(help) - ^ "Real estate prices in Adriatic Coast up, Zagreb down". Global Property Guide. August 19, 2008.

{{cite web}}: Check date values in:|date=(help) - ^ "The good times are here again". Global Property Guide. February 28, 2008.

{{cite web}}: Check date values in:|date=(help) - ^ "Looming housing slump in China". Global Property Guide. September 1, 2008.

{{cite web}}: Check date values in:|date=(help) - ^ Monica Davey (December 25, 2005). "2005: In a Word". New York Times.

- ^ "The global housing boom". The Economist. June 16, 2005.

- ^ "Global inflation climbs to historic levels". International Herald Tribune. 2008-02-12. Retrieved 2008-07-11.

- ^ "Are emerging economies causing inflation?". Economic Times (India). 2008-07-08. Retrieved 2008-07-11.

- ^ "Prospects for Inflation outside America – Guest Post from Menzie Chinn". Jeff Frankel's Weblog. 2008-06-26. Retrieved 2008-07-11.

- ^ "EU slashes growth forecast, foresees inflation surge".

- ^ "EU cuts growth forecast".

- ^ Allen, Paddy (2009-01-29). "Global recession – where did all the money go?". London: The Guardian. Retrieved 2009-04-10.

- ^ "What Went Wrong". The Washington Post. 2008-10-15. Retrieved 2009-04-10.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Whitney, Mike (August 6, 2007). "Stock Market Meltdown". Global Research. Retrieved 2009-01-04.

- ^ Polleit, Thorsten (2007-12-13). "Manipulating the Interest Rate: a Recipe for Disaster". Mises Institute. Retrieved 2009-01-04.

- ^ Pettifor, Ann (16 September 2008). "America's financial meltdown: lessons and prospects". openDemocracy. Retrieved 2009-01-04.

- ^ Karlsson, Stefan (2004-11-08). "America's Unsustainable Boom". Mises Institute. Retrieved 2009-01-04.

- ^ Fratianni, M. and Marchionne, F. 2009. The Role of Banks in the Subprime Financial Crisis available on SSRN: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1383473

- ^ "How American Income Inequality Hit Levels Not Seen Since The Depression" (html). huffingtonpost.com. Retrieved 2010-10-24.

- ^ "News Release: Gross Domestic Product". Bea.gov. 2009-12-22. Retrieved 2010-01-21.

- ^ "U.S. Department of Commerce. Bureau of Economic Analysis". Bea.gov. 2009-12-22. Retrieved 2010-01-21.

- ^ "EU Proposes €200 Billion Stimulus Plan". Businessweek.com. 2008-11-26. Retrieved 2010-01-21.

- ^ Bailout Binge[dead link]

- ^ New York Times, 2010 Sept. 13, "I.M.F. Calls for Focus on Creating Jobs," http://www.nytimes.com/2010/09/14/business/global/14euro.html?_r=1&ref=global-home

- ^ أ ب Gullapalli, Diya and Anand, Shefali. "Bailout of Money Funds Seems to Stanch Outflow", The Wall Street Journal, September 20, 2008.

- ^ (Press Release) FRB: Board Approves Two Interim Final Rules, Federal Reserve Bank, September 19, 2008.

- ^ Boak, Joshua (Chicago Tribune). "SEC temporarily suspends short selling", San Jose Mercury News, September 19, 2008.

- ^ [1]. Tickerforum.com

- ^ Rosenwald, Michael S.; Landy, Heather (2008-12-26). "Investors Flee Stock Funds". washingtonpost.com. Retrieved 2010-01-21.

- ^ Trejos, Nancy (2007-01-15). "Retirement Wreck". washingtonpost.com. Retrieved 2010-01-21.

- ^ Bull, Alister. "Fed says to make loans to aid money market funds", Reuters, September 19, 2008.

- ^ "BBC NEWS | Business | Central banks cut interest rates". News.bbc.co.uk. Page last updated at 22:28 GMT, Wednesday, October 8, 2008 23:28 UK. Retrieved 2008-10-19.

{{cite news}}: Check date values in:|date=(help) - ^ "Historical Changes of the Target Federal Funds and Discount Rates – Federal Reserve Bank of New York". Newyorkfed.org. Retrieved 2008-10-19.

- ^ Herszenhorn, David M. (2008-09-20). "Administration Is Seeking $700 Billion for Wall Street". New York Times. Retrieved 2008-09-25.

- ^ House of Representatives Roll Call vote results. Library of Congress THOMAS website. Retrieved on September 29, 2008.

- ^ "Common (Stock) Sense about Risk-Shifting and Bank Bailouts". SSRN.com. December 29, 2009. Retrieved January 21, 2009.

- ^ "Fed Pumps Huge Wads of Cash Into System- page 2 of 2 - TheStreet.com". Thestreet.com. Retrieved 2008-10-19.

- ^ "Fed's spending is risky business". Marketplace. 2008-12-22. Retrieved 2009-01-12.

- ^ "Asian central banks spend billions to prevent crash". International Herald Tribune. 2008-09-16. Retrieved 2008-09-21.

- ^ "Chinese pharmaceutical exporters to benefit from latest tax rebates increases". Asia Manufacturing Pharma. 2008-12-01. Retrieved 2008-12-01.

- ^ "Germany Rescues Hypo Real Estate". Deutsche Welle. 2008-10-06.

{{cite news}}: Cite has empty unknown parameter:|coauthors=(help) - ^ "Gordon Brown should say 'sorry'". London: Telegraph.co.uk. 2009-03-09. Retrieved 2009-03-09.[dead link]

- ^ "It Doesn't Exist!". Newsweek.com. 2008-12-06. Retrieved 2008-12-15.

- ^ Waterfield, Bruno (2009-03-25). "EU resists deficits". London: Telegraph.co.uk. Retrieved 2010-01-21.

- ^ "Central Europe Risks Downgrades on Worsening Finances (Update1)". Bloomberg.com. 2009-09-21. Retrieved 2010-01-21.

- ^ "Zloty to Gain, Says LBBW, Most Accurate Forecaster (Update1)". Bloomberg.com. 2009-10-09. Retrieved 2010-01-21.

- ^ "Poland's Economic Outlook May Be Raised by IMF, PAP Reports". Bloomberg.com. 2009-12-15. Retrieved 2010-01-21.

- ^ "Business | S Korea avoids entering recession". BBC News. 2009-04-24. Retrieved 2010-01-21.

- ^ [2][dead link]

- ^ "Business | Australia raises interest rates". BBC News. 2009-10-06. Retrieved 2010-01-21.

- ^

{{cite news}}: Empty citation (help) - ^

{{cite news}}: Empty citation (help) - ^ أ ب ت http://stats.oecd.org/WBOS/Index.aspx?QueryName=350&QueryType=View&Lang=en

- ^ "Denmark". Oxford Economic Country Briefings. Findarticles.com. September 17, 2008. Retrieved 2009-01-04.

- ^ Mardiste, David (2008-08-13). "UPDATE 3-Estonia follows Denmark into recession in Q2". TALLINN: Reuters. Retrieved 2009-01-04.

- ^ "Latvia". Oxford Economic Country Briefings. Findarticles.com. September 26, 2008. Retrieved 2009-01-04.

- ^ Evans-Pritchard, Ambrose (2008-09-25). "Ireland leads eurozone into recession". London: Telegraph. Retrieved 2009-01-04.

- ^ "New Zealand falls into recession". BBC News. 2008-09-26. Retrieved 2009-01-04.

- ^ "HIGHLIGHTS: Crisis sends Japan into first recession in 7 years". TOKYO: Reuters. 2008-11-17. Retrieved 2009-01-04.

- ^ "Sweden stumbles into recession". The Local. 2008-11-28. Retrieved 2009-04-10.

- ^ "HK shares may fall; exporters may drop". HONG KONG: Reuters. 2008-11-16. Retrieved 2009-01-04.

- ^ Dunkley, Jamie (10 October 2008). "Singapore slides into recession". London: Telegraph. Retrieved 2009-01-04.

- ^ "OECD area GDP down 0.1% in the third quarter of 2008" (PDF). OECD. 2008-11-20. Retrieved 2009-04-10.

- ^ Fitzgibbons, Patrick (2008-11-14). "TOPWRAP 10-Germany, China, US feel pain of global downturn". NEW YORK: Reuters. Retrieved 2009-01-04.

- ^ Strupczewski, Jan (2008-11-14). "Euro zone in recession, December rate cut expected". BRUSSELS: Reuters.com. Retrieved 2009-01-04.

- ^ "SECO - Gross Domestic Product in Q2 2009". Seco.admin.ch. 2009-11-25. Retrieved 2010-01-21.

- ^ "Spain's economy enters recession". BBC News. 2009-01-28. Retrieved 2009-04-10.

- ^ "Taiwan in recession". 2009-02-18. Retrieved 2009-04-10.

- ^ By In-Soo Nam (2009-04-24). "South Korea Economy Avoids Recession, Grows 0.1% - WSJ.com". Online.wsj.com. Retrieved 2010-01-21.

- ^ "Reflating the dragon". Beijing: The Economist. November 13, 2008. Retrieved 2009-01-04.

- ^ "National Bank estimate: Ukraine GDP down 20 percent in January". Kyiv Post. 2009-02-17. Retrieved 2009-04-10.

- ^ Alford, Peter (2009-02-16). "Japan headed for longest, deepest post-war recession". The Austrailian. Retrieved 2009-04-10.

- ^ 8:16 p.m. ET (2009-05-19). "Japanese GDP falls at biggest rate since 1955 - World business- msnbc.com". MSNBC. Retrieved 2010-01-21.

{{cite web}}: CS1 maint: numeric names: authors list (link) - ^ http://stats.oecd.org/index.aspx?queryid=350 Quarterly National Accounts: Quarterly Growth Rates of real GDP, OECD. Accessed on September 4, 2010.

- ^ Aversa, Jeannine (2009-03-16). "Bernanke: Recession could end in '09". The Washington Times. Retrieved 2009-04-10.

- ^ (AFP) - March 15, 2009 (2009-03-15). "AFP: Bernanke sees 'green shoots' of US recovery". Google.com. Retrieved 2010-01-21.

{{cite web}}: CS1 maint: numeric names: authors list (link) - ^ "Fed cuts 2009 economic forecast". BBC News. 2009-02-18. Retrieved 2009-04-10.

- ^ "German Economy Could Improve by the End of 2009". Spiegel. 2009-01-22. Retrieved 2009-04-10.

- ^ Von Thomas Schmid (2008-12-07). "Abschwung: Vielleicht bald wieder sechs Millionen Arbeitslose[[Category:Articles containing ألمانية-language text]]" (in German). WELT ONLINE. Retrieved 2009-01-04.

{{cite web}}: URL–wikilink conflict (help)CS1 maint: unrecognized language (link) - ^ "Economic Forecast autumn 2008: growth comes to a standstill in the wake of the financial crisis". European Commission: Economic and Financial Affairs. 2008-11-03. Retrieved 2009-04-10.

- ^ "World Economic Outlook Update – Rapidly Weakening Prospects Call for New Policy Stimulus". International Monetary Fund. 2008-11-06. Retrieved 2009-04-10.

- ^ "See e.g. the radio news at the following German address". Dradio.de. 2009-04-22. Retrieved 2010-01-21.

- ^ "press conference from 21 April 2009". Imf.org. 2009-04-21. Retrieved 2010-01-21.

- ^ "As Global Slump is Set to Continue, Poor Countries Need More Help". Retrieved 2009-08-23.

- ^ Bagnall, James (2009-03-16). "Not the Great Depression". The Ottawa Citizen. Retrieved 2009-04-10.[dead link]

- ^ Collyns, Charles (December 2008). "The Crisis through the Lens of History". Finance and Development. 45 (4).

- ^ "Extremist nightmares". The Economist. March 5, 2009. Retrieved 2009-03-12.

{{cite news}}:|first=missing|last=(help) - ^ Isidore, Chris (2009-03-25). "The Great Recession". CNN Money. Retrieved 2009-04-10.

- ^ "The difficulty with economic forecasting". Marketplace. American Public Media. 2009-03-25. Retrieved 2009-03-26.

- ^ أ ب ت John Tatom (2 February 2009). The Superlative Recession and economic policies (PDF). MPRA Paper No. 13115.

- ^ Bajaj, Vikas (March 14, 2009). "Has the Economy Hit Bottom Yet?". New York Times. Retrieved 2009-03-15.

- ^ Steve H. Hanke (March 16, 2009). "Unconventional Wisdom". Forbes.

- ^ "When to get back into the market?". Theglobeandmail.com. Retrieved 2010-01-21.

- ^ Henry, David (2009-03-05). "Stock Markets: When Will the Bull Return?". BusinessWeek. Retrieved 2010-01-21.

- ^ Kawamoto, Dawn (2009-03-02). "Dow Jones decline rate mimics Great Depression | Business Tech - CNET News". News.cnet.com. Retrieved 2010-01-21.

- ^ "Plunging Markets, Then and Now - Floyd Norris Blog - NYTimes.com". Norris.blogs.nytimes.com. 2009-03-05. Retrieved 2010-01-21.

- ^ The Telegraph (UK), 2010 Sept. 14, "IMF Fears 'Social Explosion' From World Jobs Crisis: America and Europe face the worst jobs crisis since the 1930s and risk 'an explosion of social unrest' unless they tread carefully, the International Monetary Fund has warned," http://www.telegraph.co.uk/finance/financetopics/financialcrisis/8000561/IMF-fears-social-explosion-from-world-jobs-crisis.html

- ^ [3][dead link]

- ^ Font size Print E-mail Share 97 Comments (2008-12-01). "It's Official: U.S. In Yearlong Recession". CBS News. Retrieved 2010-01-21.

{{cite news}}: CS1 maint: numeric names: authors list (link) - ^ "Table A-12. Alternative measures of labor underutilization". Bls.gov. 2010-01-08. Retrieved 2010-01-21.

- ^ أ ب "Statician says US joblessness near Depression highs". Reuters. 2009-03-09. Retrieved 2010-01-21.

- ^ Krugman, Paul (2009-01-05). "Fighting Off Depression". The New York Times. Retrieved 2010-05-07.

- ^ "Not the Great Depression". Ottawacitizen.com. Retrieved 2010-01-21.[dead link]

- ^ "Roundtable: Nationalizing the Banks - ABC News". Abcnews.go.com. Retrieved 2010-01-21.

- ^ 'I Am Not Dr. Doom', Washington Post.

- ^ "Ravi Batra, "The Global Financial Crisis: What Caused it, Where it is heading?"". Ravibatra.com. 2008-11-15. Retrieved 2010-01-21.

- ^ "Not All Bad News – An Interview with economist and author Dr. Ravi Batra, December 2008 regarding his book: The New Golden Age: The Coming Revolution against Political Corruption and Economic Chaos". Watermarkfinancialgroup.com. 2008-11-25. Retrieved 2010-01-21.

- ^ "The Prophet of Boom (and Bust) – Now will they listen to Ravi Batra?". Dandelionsalad.wordpress.com. Retrieved 2010-01-21.

- ^ "Ravi Batra interviewed by Thom Hartmann". Youtube.com. 2009-12-09. Retrieved 2010-01-21.

- ^ Gjerstad, Steven (2009-04-06). "Steven Gjerstad and Vernon Smith Explain Why the Housing Crash Ruined the Financial System but the Dot-com Collapse Did Not - WSJ.com". Online.wsj.com. Retrieved 2010-01-21.

- ^ "George W. Bush Press Conference Transcript, January 12, 2009". Foxnews.com. 2009-01-12. Retrieved 2010-01-21.

- ^ "NBC Nightly News with Brian Williams: News and videos from the evening broadcast NBC Nightly News with Brian Williams: News and videos from the evening broadcast- msnbc.com". MSNBC. Retrieved 2010-01-21.

- ^ Evans, Ambrose (2009-04-16). "IMF warns over parallels to Great Depression". London: Telegraph.co.uk. Retrieved 2010-01-21.

- ^ "Breaking SA and World News, Sports, Business, Entertainment and more - TimesLIVE". Thetimes.co.za. 1970-01-01. Retrieved 2010-01-21.

- ^ "UK | UK Politics | Recession 'worst for 100 years'". BBC News. 2009-02-10. Retrieved 2010-01-21.

- ^ Conway, Edmund (2009-01-23). "Britain on the brink of an economic depression, say experts". London: Telegraph. Retrieved 2010-01-21.

- ^ "Ireland 'technically' in depression - The Irish Times - Wed, May 20, 2009". The Irish Times. 2009-05-20. Retrieved 2010-01-21.

- ^ London (2009-04-29). "ESRI predicts 14% economic decline over three years". Independent.ie. Retrieved 2010-01-21.

- ^ Health of euro in doubt as output slumps[dead link]

- ^ "Euro zone Q1 GDP shrinks 2.5 pct q/q, April CPI confirmed". Forbes.com. 2009-05-15. Retrieved 2010-01-21.

- ^ "Unemployment reaches 11% in Ireland". Outplacementservices.ie. 2009-04-03. Retrieved 2010-01-21.

- ^ McDonald, Henry (2009-04-29). "Ireland's unemployment rises to 11.4%". London: Guardian. Retrieved 2010-01-21.

- ^ "Irish unemployment at fresh highs". BBC News. 2009-04-01. Retrieved 2010-01-21.

- ^ "External Debt.vp" (PDF). Retrieved 2010-05-01.

- ^ "IMF warns Ireland will pay highest price to secure banks". Irishtimes.com. 2009-04-22. Retrieved 2010-01-21.

- ^ "Unemployment Spike – September 2008". Laidoffnation.com. Retrieved 2010-01-21.

قراءات إضافية

- Cohan, William D., The Last Tycoons. The Secret History of Lazard Frères & Co.. New York, Broadway Books (Doubleday), 2007. ISBN 9780385521772

- Cohan, William D., House of Cards: A Tale of Hubris and Wretched Excess on Wall Street, [a novel]. New York, Doubleday, 2009. ISBN 9780385528269

- Fengbo Zhang: 1.Perspective on the United States Sub-prime Mortgage Crisis , 2.Accurately Forecasting Trends of the Financial Crisis , 3.Stop Arguing about Socialism versus Capitalism .

- Funnell, Warwick N. In government we trust: market failure and the delusions of privatisation / Warwick Funnell, Robert Jupe and Jane Andrew. Sydney: University of New South Wales Press, 2009. ISBN 9780868409665 (pbk.)

- Harman, Chris Zombie Capitalism: Global Crisis and the Relevance of Marx / London: Bookmarks Publications 2009. ISBN 9781905192533

- Paulson, Hank, On the Brink. London, Headline, 2010. ISBN 9780755360543

- Read, Colin. Global financial meltdown: how we can avoid the next economic crisis / Colin Read. New York: Palgrave Macmillan, c2009. ISBN 9780230222182

- Woods, Thomas E. Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse / Washington DC: Regnery Publishing 2009. ISBN 1596985879

وصلات خارجية

- Tracking the Global Recession accurate and useful information from the Federal Reserve Bank of St. Louis

- Economic Crisis and Stimulus from UCB Libraries GovPubs

- Stimulus Watch – U.S. government responses to the financial and economic crisis

- Global Outlook, Uri Dadush, "International Economics Bulletin", June 2009.

- Global Recession ongoing coverage from BBC News

- Global Recession ongoing coverage from The Guardian

- ILO Job Crisis Observatory

- UN DESA - Financial and economic crisis

- Financial Transmission of the Crisis: What’s the Lesson? Shimelse Ali, Uri Dadush, Lauren Falcao, "International Economics Bulletin, June 2009.

- Some of aspects of state national economy evolution in the system of the international economic order.

- A Spectral Analysis of World GDP Dynamics: Kondratieff Waves, Kuznets Swings, Juglar and Kitchin Cycles in Global Economic Development, and the 2008–2009 Economic Crisis.

- The Regulated Depression

- Articles with dead external links from November 2010

- CS1 errors: unrecognized parameter

- CS1 errors: unsupported parameter

- Articles with dead external links from January 2010

- Articles with dead external links from August 2010

- CS1 errors: empty citation

- CS1 maint: numeric names: authors list

- CS1 errors: URL–wikilink conflict

- Articles with dead external links from September 2010

- CS1 errors: missing name

- مقالات ذات عبارات بحاجة لمصادر

- Articles with hatnote templates targeting a nonexistent page

- Portal templates with default image

- الكرود الكبير

- تاريخ اقتصادي في عقد 2000

- كوارث إقتصادية

- ركود اقتصادي