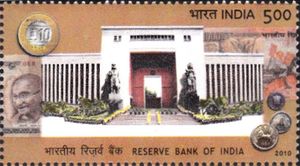

بنك الاحتياط الهندي

| |

| |

| المقر الرئيسي | Mumbai, Maharashtra, India |

|---|---|

| الإحداثيات | 18°55′58″N 72°50′13″E / 18.932679°N 72.836933°E |

| تأسس | 1 أبريل 1935 |

| Governor | Shaktikanta Das[1] |

| البنك المركزي لـ | India |

| العملة | Indian rupee (₹) |

| الاحتياطيات | ₹2٬837٬400 crore (يكافئ ₹38 trillion or 480 بليون US$ في 2023)[2][3] |

| معدل البنك | 5.40%[4] |

| الفائدة على الاحتياط | 4.00% (market determined)[5] |

| الموقع الإلكتروني | rbi |

The Reserve Bank of India (RBI) is India's central bank, which controls the issue and supply of the Indian rupee. RBI is the regulator of entire Banking in India. RBI plays an important part in the Development Strategy of the Government of India.

RBI regulates commercial banks and non-banking finance companies working in India.It serves as the leader of the banking system and the money market.It regulates money supply and credit in the country.The RBI carries out India's monetary policy and exercises supervision and control over banks and non-banking finance companies in India. RBI was set up in 1935 under the Reserve Bank of India Act,1934.

Until the Monetary Policy Committee was established in 2016,[6] it also controlled monetary policy in India.[7] It commenced its operations on 1 April 1935 in accordance with the Reserve Bank of India Act, 1934.[8] The original share capital was divided into shares of 100 each fully paid .[9] Following India's independence on 15 August 1947, the RBI was nationalised on 1 January 1949.[10]

It is a member bank of the Asian Clearing Union. The general superintendence and direction of the RBI is entrusted with the 21-member central board of directors: the governor; four deputy governors; two finance ministry representatives (usually the Economic Affairs Secretary and the Financial Services Secretary); ten government-nominated directors to represent important elements of India's economy; and four directors to represent local boards headquartered at Mumbai, Kolkata, Chennai and the capital New Delhi. Each of these local boards consists of five members who represent regional interests, the interests of co-operative and indigenous banks.

History

The Reserve Bank of India was established following the Reserve Bank of India Act of 1934.[11] Though privately owned initially, it was nationalised in 1949 and since then fully owned by Government of India (GoI).

1935–1949

Policy rates and reserve ratios

| Policy rates | |

|---|---|

| Policy repo rate | 5.15 % |

| Reverse repo rate | 4.90 % |

| Marginal standing facility rate | 5.40 % |

| Bank rate | 5.40 % |

| Reserve ratios | |

| Cash reserve ratio (CRR) | 4.00 % |

| Statutory liquidity ratio (SLR) | 18.50 % |

| Lending and deposit rates[13] | |

| Base rate | 8.95%–9.40% |

| Marginal Cost of funds-based overnight Lending Rate (MCLR) | 7.80%–8.30% |

| Savings deposit rate | 3.25%–3.50% |

| Term deposit rate for > 1 year | 6.25%–7.00% |

المراجع

- ^ "Shaktikanta Das is new Guv of RBI". United News of India. 11 December 2018. Retrieved 11 December 2018.

- ^ Reporter, B. S. (4 September 2015). "Forex reserves fall by $3.43 bn to $351.92 bn". Business Standard India.

- ^ Reserve Bank of India. Rbi.org.in (7 February 2005). Retrieved on 21 May 2014.

- ^ Reserve Bank of India – India's Central Bank. Rbi.org.in.

- ^ "Reserve Bank of India – India's Central Bank". rbi.org.in.

- ^ "All you wanted to know about Monetary Policy Committee". @businessline. Retrieved 13 July 2019.

- ^ Krishnan, Aarati (4 July 2016). "All you wanted to know about Monetary Policy Committee". The Hindu Business Line (in الإنجليزية). Retrieved 12 December 2018.

- ^ "Reserve Bank of India Act, 1934" (PDF). p. 115. Retrieved 6 August 2012.

- ^ "RESERVE BANK OF INDIA ACT, 1934 (As modified up to 27 February 2009)" (PDF). Reserve Bank of India (RBI). Retrieved 20 November 2010.

- ^ "RBI History – Reserve Bank of India Nationalisation Newspaper Clipping".

- ^ The Reserve Bank of India Act, 1934. rbi.org.in

- ^ "rbi-cuts-repo-rate-by-25-bps". thehindu. Retrieved 4 October 2019.

- ^ "Lending and deposit rates". rbi.org.in. December 2018.

Further reading

- S. L. N. Simha. History of the Reserve Bank of India, Volume 1: 1935–1951. RBI. 1970. ISBN 81-7596-247-X. (2005 reprint PDF)

- Reserve Bank of India: Functions and Working. RBI. 2005.(2005 reprint PDF )

- G. Balachandran. The Reserve Bank of India, 1951–1967. Oxford University Press. 1998. ISBN 0-19-564468-9. (PDF)

- A. Vasudevan et al. The Reserve Bank of India, Volume 3: 1967–1981. RBI. 2005. ISBN 81-7596-299-2. (PDF)

- Cecil Kisch: Review "The Monetary Policy of the Reserve Bank of India" by K. N. Raj. In: The Economic Journal. Vol. 59, No. 235 (Sep. 1949), pp. 436–438.

- Findlay G. Shirras: The Reserve Bank of India. In The Economic Journal. Vol. 44, No. 174 (Jun. 1934), pp. 258–274.

وصلات خارجية

Media related to بنك الاحتياط الهندي at Wikimedia Commons

Media related to بنك الاحتياط الهندي at Wikimedia Commons- Official website

- FAQ answers and Guidelines on Reserve Bank of India

- What the FAQ just happened! All your questions about Rs 500–1000 notes answered, India Today, 8 November 2016

- Ministry of Finance, Government of India

قالب:Banking in India قالب:Governors of Reserve Bank of India

- Pages using gadget WikiMiniAtlas

- Short description is different from Wikidata

- Coordinates not on Wikidata

- Pages with empty portal template

- Official website different in Wikidata and Wikipedia

- Central banks

- Reserve Bank of India

- Organisations based in Mumbai

- Banks established in 1935

- Financial regulatory authorities of India

- Financial services companies based in Mumbai

- 1935 establishments in India