أزمة سقف الدين الأمريكي

| أحداث هذه المقالة هي أحداث جارية. المعلومات المذكورة قد تتغير بسرعة مع تغير الحدث. |

|

| جزء من سلسلة مقالات عن |

| موضوعات العجز والدين للولايات المتحدة |

|---|

| الأبعاد الرئيسية |

|

الميزانية الفدرالية • الدين العام |

| البرامج |

| Medicare • Social Security |

| قضايا معاصرة |

|

اصلاح الرعاية الصحية • جدل الضمان الاجتماعي |

| مصطلحات |

| Inflation • ميزان المدفوعات |

أزمة سقف الدين الأمريكي United States debt ceiling crisis، هي أزمة مالية بدأت عندما زاد الجدل حول الحد القانوني المسموح به للمديونية الأمريكية، والذي يطلق عليه سقف الدين. وليس لوزارة الخزانة الأمريكية سلطة صرف أو تحمل سقف دين يحدده لها الكونگرس.

Since debt obligations tend to be promptly paid by the Treasury, the United States has extraordinary power to incur new debt through borrowing because of its excellent credit rating in global and domestic markets.

A failure to raise the debt ceiling meant that potentially certain debts would not be paid, and this would potentially affect the government's ability to borrow quickly or at lower cost, due to a perception of increased risk in loaning money to the US government. The economic impact could be large due to the US government's very large role in global markets.

If the debt ceiling were not raised, either government spending would have to be decreased, or debt would have to be paid later than promised, also known as a default.

The debate was contentious, with nearly all Republican legislators opposing any increase in taxes and the large majority of Democratic legislators viewing tax increases as necessary along with spending cuts. Supporters of the Tea Party movement pushed Republicans to reject any agreement that failed to incorporate large and immediate spending cuts or a completed balanced-budget constitutional amendment.[1][2]

The immediate crisis of 2011 ended when a complex deal imposing limits on both debt and government spending was reached on July 31. After the legislation was passed by both the House and Senate, President Barack Obama signed the Budget Control Act of 2011 into law on August 2, the day of the deadline.

خلفية

تعريف سقف الدين

If the Treasury does not collect enough in revenue to pay for expenditures by the federal government, it may be authorized by Congress to issue debt (in other words, borrow money) to pay for the federal budget deficit. Prior to 1917, Congress had to authorize each round of borrowing directly. In 1917, in order to provide more flexibility to finance the United States' involvement in الحرب العالمية الأولى, the Congress instituted the concept of "debt ceiling". Since then, the Treasury can only borrow money as long as the total debt (excepting some small special classes) does not exceed a ceiling stated by law.[بحاجة لمصدر] To change the debt ceiling, Congress must enact specific legislation and the President must sign it into law.

The process of setting the debt ceiling is separate and distinct from the regular process of financing government operations, and raising the debt ceiling neither directly increases nor decreases the budget deficit. The U.S. government passes a federal budget every year. This budget details projected tax collections and outlays and, therefore, the amount of borrowing the government would have to do in that fiscal year. A vote to increase the debt ceiling is, therefore, usually seen as a formality, needed to continue spending that has already been approved previously by the Congress and the President. The Government Accountability Office explains, "the debt limit does not control or limit the ability of the federal government to run deficits or incur obligations. Rather, it is a limit on the ability to pay obligations already incurred."[3] The apparent redundancy of the debt ceiling has led to suggestions that it should be abolished altogether.[4][5]

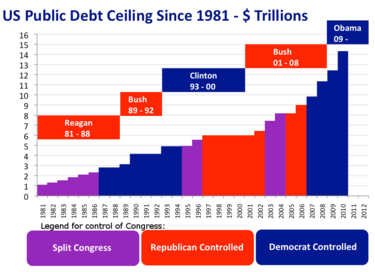

The United States has had public debt since its inception. Debts incurred during the الحرب الثورية الأمريكية and under the Articles of Confederation led to the first yearly report on the amount of the debt ($75,463,476.52 on January 1, 1791). Every President since Harry Truman has added to the national debt expressed in absolute dollars. The debt ceiling has been raised 74 times since March 1962,[6] including 18 times under Ronald Reagan, eight times under Bill Clinton, seven times under George W. Bush and three times (to August 2011) under Barack Obama.

اعتبارا من مايو 2011[تحديث], approximately 40 percent of US government spending relied on borrowed money.[7] Raising the debt ceiling would allow the federal government to continue to borrow money to support current spending levels. If the debt ceiling is not raised, the federal government would have to cut spending immediately by 40 percent, affecting many daily operations of the government.[7] The Treasury would determine what items would be paid.[8] If the interest payments on the national debt are not made, the United States would be in default, potentially causing catastrophic economic consequences for the U.S. and the wider world as well. (Effects outside the U.S. would be anticipated because the United States has a very high GDP. With the world's largest single national economy, the U.S. is a major trading partner to many countries, including other major world powers who hold its debt and could demand repayment.)

According to the US Treasury, "failing to increase the debt limit would . . . cause the government to default on its legal obligations – an unprecedented event in American history".[9] These legal obligations include paying Social Security and Medicare benefits, military salaries, interest on the debt and many other items. If the debt ceiling is not raised, then the Treasury will prioritize the items to pay with its ongoing revenue stream. Treasury could choose to pay interest so that the U.S. does not default on its sovereign debt.[10]

Then-Senator Obama opposed one of those increases to the debt ceiling under Bush and criticized Bush for a lack of leadership. "The fact that we are here today to debate raising America's debt limit is a sign of leadership failure. It is a sign that the U.S. Government can't pay its own bills," Obama said before a March 16, 2006, vote on raising the debt limit. The Senate narrowly approved raising the limit along partisan lines, 52–48, with all Democrats opposed.[11]

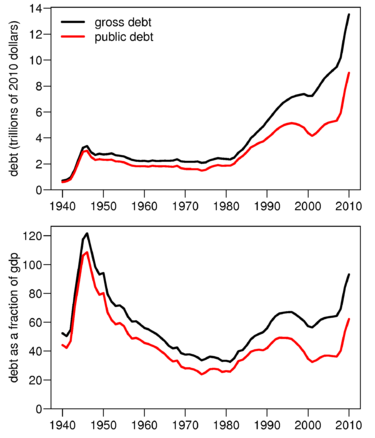

مشكلات عجز الميزانية والديون طويلة الأجل

Underlying the contentious debate over raising the debt ceiling has been a growing anxiety since 2008, about the large United States federal budget deficits and the increasing federal debt. According to the Congressional Budget Office (CBO): "At the end of 2008, that debt equaled 40 percent of the nation's annual economic output (a little above the 40-year average of 37 percent). Since then, the figure has shot upward: By the end of fiscal year 2011, the Congressional Budget Office (CBO) projects federal debt will reach roughly 70 percent of gross domestic product (GDP) – the highest percentage since shortly after World War II." The sharp rise in debt after 2008 stems largely from lower tax revenues and higher federal spending related to the severe recession and persistently high unemployment in 2008–11.[12][13]

- In 2009, the Tea Party movement emerged with a focus on reducing government spending and regulation.[14][15]

- In early 2010, Obama established the Bowles-Simpson Commission to propose recommendations to balance the budget by 2015.[16] The commission issued their report in December 2010, but the recommendations were never adopted.

- The Tea Party helped usher in a wave of new Republican office-holders in the 2010 mid-term elections[17] whose major planks during the campaign included cutting federal spending[18] and stopping any tax increases.[19] These new Republicans and the new Republican House majority greatly affected the 2011 debt ceiling political debate.[20]

- Throughout 2011, Standard & Poor's and Moody's credit rating services issued warnings that United States could be downgraded because of the continued large deficits and increasing debt.[21][22][23][24]

- According to CBO's 2011 Long-Term Budget Outlook, without major policy changes the large budget deficits and growing debt would continue, which "would reduce national saving, leading to higher interest rates, more borrowing from abroad, and less domestic investment – which in turn would lower income growth in the United States."[12]

- Through 2010–2011, the European sovereign debt crisis was playing out, and there were concerns that the United States was on the same trajectory.[25]

- Critics have argued that the debt ceiling crisis is "self-inflicted,"[26] as Treasury bond interest rates were at historical lows and the U.S. had no market restrictions on its ability to obtain additional credit. The debt ceiling has been raised 68 times since 1960, and its increase was considered routine until this debate. The only other country with a debt limit is Denmark, which has set its debt ceiling so high that it is unlikely to be reached. Since Congress has authorized the spending that requires the debt increase, it is ironic that it now refuses to allow the borrowing to fund its own spending authorizations.[26] If raising the limit ceases to be routine, this may create uncertainty for global markets each time a debt ceiling increase is debated.[26] This crisis has also indicated that a party in control of only one chamber of Congress (in this case, Republicans in control of the House of Representatives but not the Senate or the Presidency) can have significant influence if it chooses to block the routine raising of the debt limit.[27]

تعليق إصدار الديون

The last time before the current crisis that Congress increased the debt limit was on February 12, 2010. At that time, the ceiling was set to $14.294 trillion.[28][29]

On April 15, 2011, Congress passed the last part of the 2011 United States federal budget, specifying federal government spending for the remainder of the 2011 fiscal year, which ends on September 30, 2011.[بحاجة لمصدر] The spending authorization allowed more spending than expected revenue, which meant there was a budget deficit. Having a budget deficit is very common (of the last 30 fiscal years, only one did not have a budget deficit[بحاجة لمصدر]) and deficits are expected to be accounted for by issuing debt; that is, by borrowing.

For the entire 2011 fiscal year, there was an estimated $3.82 trillion in expenditures with expected revenues of $2.17 trillion, leaving a deficit of $1.48 trillion.[بحاجة لمصدر] Therefore, soon after the final budget was passed, the debt ceiling was reached. When the debt ceiling is reached, the U.S. Treasury can declare a debt issuance suspension period and utilize methods other than issuing new debt to acquire funds to meet federal obligations.[بحاجة لمصدر]

Several of these methods are described in detail in an Appendix attached to Treasury Secretary Timothy Geithner's April 4, 2011, letter to Congress.[30] These "extraordinary measures" were implemented on May 16, 2011, (as the current debt ceiling was exceeded) when, in a letter to Congress, Geithner declared a "debt issuance suspension period", which provides the Secretary authority to sell assets from the Civil Service Retirement and Disability Fund and the G Fund of the Thrift Savings Plan. According to this letter, this period could "last until August 2, 2011, when the Department of the Treasury projects that the borrowing authority of the United States will be exhausted".[31] These methods have been used in several previous episodes in which federal debt neared its statutory limit.[32]

آراء بديلة حول الموعد النهائي

According to the Treasury Department, the deadline to increase the debt ceiling was August 2, 2011, when the U.S. government would run out of cash to pay all its bills.[33] According to Barclays Capital, the Treasury would run out of cash around August 10, when $8.5 billion in Social Security payments were due. According to Wall Street analysts, the U.S. Treasury would not be able borrow from the capital markets after August 2, but still would have enough incoming cash to meet its obligations until August 15. Analysts also predicted that the U.S. Treasury would be able to roll over the $90 billion in U.S. debt that matured on August 4, and gain additional time to avert the crisis.[34]

الآثار المترتبة على عدم رفع سقف الدين

After the United States Treasury exhausts alternate methods of funding (projected on August 2, 2011), the Treasury will have to choose which obligations to pay and which obligations not to pay with the income from tax revenues and other sources.[10] As an example, satisfying existing interest payments to bondholders, Medicare payments, Social Security payments, unemployment insurance and defense contractors would leave no remaining funds to pay active duty military, federal workers, taxpayers due refunds and many other obligations generally considered essential.[35]

Experts are divided on just how bad the effects of not raising the debt ceiling for a short period would be on the economy. While some leading economists, including Republican adviser Douglas Holtz-Eakin, have suggested even a brief failure to meet US obligations could have devastating long-term consequences, others have argued that the market would write it off as a Congressional temper tantrum and return to normal once the immediate crisis was resolved.[36] The worst outcome is if the U.S. fails to pay interest on the national debt to bondholders or, in other words, it defaults on its sovereign debt.[37] Former Treasury Secretary Lawrence Summers warned of serious consequences of a default in July 2011, including: (a) higher borrowing costs for the U.S. government (as much as one percent or $150 billion/year in additional interest costs); and (b) the equivalent of bank runs on the money and other financial markets, potentially as severe as those of September 2008.[38]

In January 2011, Treasury Secretary Timothy Geithner warned that "failure to raise the limit would precipitate a default by the United States. Default would effectively impose a significant and long-lasting tax on all Americans and all American businesses and could lead to the loss of millions of American jobs. Even a very short-term or limited default would have catastrophic economic consequences that would last for decades."[39]

Senators Pat Toomey and Jim DeMint expressed deep concern that administration officials were stating or implying that failure to raise the nation's debt limit would constitute a default on US debt and precipitate a financial crisis:[40] "We believe it is irresponsible and harmful for you to sow the seeds of doubt in the market regarding the full faith and credit of the United States and ask that you set the record straight – that you will use all available Treasury funds necessary to prevent default while Congress addresses the looming debt crisis."[41]

Geithner responded that prioritizing debt would require "cutting roughly 40 percent of all government payments", which could only be achieved by "selectively defaulting on obligations previously approved by Congress". He argues that this would harm the reputation of the United States so severely that there is "no guarantee that investors would continue to re-invest in new Treasury securities", forcing the government to repay the principal on existing debt as it matures, which it would be unable to do under any conceivable circumstances. He concluded: "There is no alternative to enactment of a timely increase in the debt limit."[42] On January 25, 2011, Senator Toomey introduced The Full Faith And Credit Act bill [S.163[43]] that would require the Treasury to prioritize payments to service the national debt over other obligations.[44]

Even if the Treasury were to prioritize payments on the debt above other spending and avoid formal default on its bonds, failure to raise the debt ceiling would force the government to reduce its spending by as much as ten percent of GDP overnight, leading to a corresponding fall in aggregate demand. Such a significant shock, if sustained, is thought to be able to reverse the recovery and send the country into a recession.[45][46]

حلول مقترحة

Congress considered whether and by how much to extend the debt ceiling (or eliminate it), and what long-term policy changes (if any) should be made concurrently.[47]

The Republican position on raising the debt ceiling:

- Dollar-for-dollar deal – raise the debt ceiling to match corresponding spending cuts[48]

- More of the budget cuts in the first two years[48]

- Spending caps[48]

- Balanced Budget Amendment – to pass Congress and be sent to states for ratification[49][50]

- No tax increases – tax reform could be considered[51]

(One representative, Ron Paul, proposed transferring $1.6 trillion of federal reserve assets to the government and destroying those bonds, thereby reducing the U.S. gross federal debt by the same amount.[52])

The Democratic position on raising the debt ceiling:

- Initially wanted a "clean" increase or unconditional raise to the debt ceiling with no spending cuts attached, as has historically been the norm for Congressional votes on the debt ceiling.[53][54]

- Tax increase on some to reduce deficits[55]

- Large debt limit increase to support borrowing into 2013[56]

- Opposed to any major cuts to Social Security, Medicare, or Medicaid[57][58]

(Some Democratic lawmakers[59][60][61] suggested that the President could declare that the debt ceiling violates the US Constitution and issue an Executive Order to direct the Treasury to issue more debt.[62])

The United States House of Representatives originally refused to raise the debt ceiling without deficit reduction, voting down a 'clean' bill to increase the debt ceiling without conditions. The May 31 vote was 318 to 97, with all 236 Republicans and 82 Democrats voting to defeat the bill.[63] The Republicans largely believed a deficit reduction deal should be based solely on spending cuts, including cuts to entitlements, without any tax increases, to reduce or solve the long-term issue of debt.[64] Obama and the Democrats in the US Congress wanted an increase in the debt ceiling to solve the short-term borrowing problem, and in exchange supported a decrease in the budget deficit to be funded by a combination of spending cuts and revenue increases.[65] Some prominent liberal economists, such as Paul Krugman, Larry Summers, and Brad DeLong, and prominent investors such as Bill Gross, went even further, and argued that not only should the debt ceiling be raised, but federal spending (and, therefore, the deficit) should be increased, which would stimulate the economy, reduce unemployment, and ultimately reduce the deficit in the medium to long term.[66][67]

Some Tea Party Caucus and other Republicans, however, (including, but not limited to, Senators Jim DeMint, Rand Paul, and Mike Lee, and Representatives Michele Bachmann, Ron Paul, and Allen West) expressed skepticism about raising the debt ceiling (with some suggesting the consequences of default are exaggerated), arguing that the debt ceiling should not be raised and "instead the federal debt [should] be 'capped' at the current limit,"[68] "although that would oblige the government to cut spending by almost half overnight."[65]

Jack Balkin, the Knight Professor of Constitutional Law and the First Amendment at Yale Law School, suggested two other ways to solve the debt ceiling crisis: he pointed out that the U.S. Treasury has the power to issue platinum coins in any denomination, so it could solve the debt ceiling crisis by simply issuing two platinum coins in denominations of $1 trillion each, depositing them into its account in the Federal Reserve, and writing checks on the proceeds. Another way to solve the debt ceiling crisis, Balkin suggested, would be for the federal government to sell the Federal Reserve an option to purchase government property for $2 trillion. The Fed would then credit the proceeds to the government's checking account. Once Congress lifts the debt ceiling, the president could buy back the option for a dollar, or the option could simply expire in 90 days.[69]

In a report issued by the credit rating agency Moody's, analyst Steven Hess suggested that the government should consider getting rid of the limit altogether, because the difficulty inherent in reaching an agreement to raise the debt ceiling "creates a high level of uncertainty" and an increased risk of default. As reported by The Washington Post, "without a limit dependent on congressional approval, the report said, the agency would worry less about the government's ability to meet its debt obligations."[70] Other public figures, including Democratic ex-President Bill Clinton and Republican ex-CBO director Douglas Holtz-Eakin, have also suggested eliminating the debt ceiling.[71]

أساليب مقترحة لتجاوز الأزمة

التعديل الرابع عشر

During the debate, some scholars, Democratic lawmakers,[59][60][61] and Treasury Secretary Tim Geithner[72] suggested that the President could declare that the debt ceiling violates the Constitution and issue an Executive Order to direct the Treasury to issue more debt.[62] They point to Section 4 of the Fourteenth Amendment to the U.S. Constitution, passed in the context of the Civil War Reconstruction, that states that the validity of the public debt shall not be questioned. Others rebutted this argument by pointing to Section 8 of Article 1 and Section 5 of Fourteenth Amendment which state that Congress has the power of the purse and the authority to enforce the Fourteenth Amendment.[73]

- Article I, Section 8. The Congress shall have power . . .To borrow Money on the credit of the United States;

- Amendment XIV, Section 4. The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned. But neither the United States nor any State shall assume or pay any debt or obligation incurred in aid of insurrection or rebellion against the United States, or any claim for the loss or emancipation of any slave; but all such debts, obligations and claims shall be held illegal and void.

- Amendment XIV, Section 5. The Congress shall have power to enforce, by appropriate legislation, the provisions of this article.

Arguments:

- Jack Balkin, looking into the Legislative History of the Fourteenth Amendment, argues that Section 4 was adopted precisely to guard against politically-determined default. Referencing the sponsor of the provision, Senator Benjamin Wade, Balkin argues that "the central rationale for Section Four . . . was to remove threats of default on federal debts from partisan struggle." Balkin quotes Wade: "every man who has property in the public funds will feel safer when he sees that the national debt is withdrawn from the power of a Congress to repudiate it and placed under the guardianship of the Constitution than he would feel if it were left at loose ends and subject to the varying majorities which may arise in Congress." According to Balkin, this reveals "an important structural principle. The threat of defaulting on government obligations is a powerful weapon, especially in a complex, interconnected world economy. Devoted partisans can use it to disrupt government, to roil ordinary politics, to undermine policies they do not like, even to seek political revenge. Section Four was placed in the Constitution to remove this weapon from ordinary politics."[74]

- Bruce Bartlett, a former adviser to President Ronald Reagan and columnist for The Fiscal Times, argues that Section 4 renders the debt ceiling unconstitutional, and that the President should disregard the debt limit.[75]

- In July 2011, The Nation editor Katrina vanden Heuvel argued that the President could use the public debt section of the Fourteenth Amendment to force the Treasury to continue paying its debts if an agreement to raise the debt ceiling is not reached.[76]

- Laurence Tribe, professor of Constitutional Law at Harvard Law School, has called the argument that the public debt clause can nullify the debt ceiling "false hope" and has noted that nothing in the Constitution enabled the President to "usurp legislative power" with regards to the debt. Tribe also notes that since Congress has means other than borrowing to pay the federal debt (including raising taxes, coining money, and selling federal assets), the argument that the President could seize the power to borrow could be extended to give the President the ability to seize those powers as well.[77]

- Garrett Epps counter-argued that the President would not be usurping Congressional power by invoking Section 4 to declare the debt ceiling unconstitutional, because the debt ceiling exceeds Congressional authority: calling it legislative "double-counting," as paraphrased in The New Republic, "because Congress already appropriated the funds in question, it is the executive branch's duty to enact those appropriations."[78] In other words, given Congress has appropriated money via federal programs, the Executive is obligated to enact and, therefore, fund them; the debt ceiling's limit on debt prevents the executive from carrying out those instructions given by Congress, on the constitutional authority to set appropriations, and is therefore unconstitutional.

- Former President Bill Clinton endorsed this counter-argument, saying he would eliminate the debt ceiling using the 14th amendment, calling it "crazy" that Congress is allowed to first appropriate funds and then gets a second vote on whether to pay for them.[79]

- Matthew Zeitlin added to the counter-argument that, were Section 4 invoked, members of Congress would not have standing to sue the President for allegedly usurping congressional authority, even if they were willing to do so; and those likely to have standing would be people "designed to elicit zero public sympathy: those who purchased credit default swaps which would pay off in the event of government default."[78] Relatedly, Matthew Steinglass argues that, because it would come down to the Supreme Court, the Court would not vote in the favor of anyone who could and would sue: it would rule the debt ceiling unconstitutional. This is because, for the Court to rule to uphold the debt ceiling, it would, in effect, be voting for the United States to default, with the consequences that would entail; and, Steinglass argues, the Court would not do that.[80]

- Michael Stern, Senior Counsel to the U.S. House of Representatives from 1996 to 2004, stated that Garrett Epps "had adopted an overly broad interpretation of the Public Debt Clause and that this interpretation, even if accepted, could not justify invalidating the debt limit" because "the President's duty to safeguard the national debt no more enables him to assume Congress's power of the purse than it would enable him to assume the judicial power when (in his opinion) the Supreme Court acts in an unconstitutional manner."[81]

- Rob Natelson, former Constitutional Law Professor at University of Montana, argues that "this is not some issue in the disputed boundaries between legislative and executive power." He continues "That's why the Constitution itself (Article I, Section 8, Clause 2) gives only Congress, not the President, the power "To borrow Money on the credit of the United States." In another argument, Natelson states that Bruce Bartlett "deftly omits a crucial part of the quote from the Fourteenth Amendment. It actually says, 'The validity of the public debt of the United States, AUTHORIZED BY LAW . . . shall not be questioned.' In other words, Congress has to approve the debt for it not to be questioned. And note that this language refers to existing debt, not to creating new debt. He also neglects to mention that Section 5 of the Fourteenth Amendment specifically grants to Congress, not to the President, authority to enforce the amendment."[73]

- Treasury Secretary Tim Geithner[72] implied that the debt ceiling may violate the Constitution but George Madison, General Counsel to the U.S. Treasury, wrote on July 8, 2011 that "Secretary Geithner has never argued that the 14th Amendment to the U.S. Constitution allows the President to disregard the statutory debt limit" and that "the Constitution explicitly places the borrowing authority with Congress." He additionally affirmed that "Secretary Geithner has always viewed the debt limit as a binding legal constraint that can only be raised by Congress."[82]

سك عملات معدنية

U.S. law does not place a limit on the denomination of minted coins, and specifically mentions that the Mint can create platinum coins of arbitrary value under the discretion of the Secretary of the Treasury.[83] Yale law professor Jack Balkin mentioned seigniorage as a solution,[69] although there had been speculation about the option online since January 2011.[84] Hence, it was suggested that (for instance) a US$5 trillion coin could be minted and deposited with the Federal Reserve and used to buy back debt, thus making funds available.[85]

تنقيد الذهب

A similar crisis was faced during the Eisenhower Administration in 1953. The debt ceiling was not raised until the spring of 1954.[86] To accommodate the gap, the Eisenhower administration increased its gold certificate deposits at the Federal Reserve, which it could do because the market price of gold had increased. According to experts,[87] the Secretary of the Treasury is still authorized to monetize 8,000 tons of gold, valued under the old law at approximately $42 per ounce, but with a market value worth over $1,600 per ounce.[88]

الاتفاقية

On July 31, 2011, President Obama announced that the leaders of both parties in both chambers had reached an agreement that would reduce the deficit and avoid default.[89] The same day, Speaker Boehner's office outlined the agreement for House Republicans.[90] According to the statement:

- The agreement cuts spending more than it increases the debt limit. In the first installment ("tranche"), $917 billion would be cut over 10 years in exchange for increasing the debt limit by $900 billion.

- The agreement establishes a joint committee of Congress that would produce debt reduction legislation by November 23, 2011, that would be immune from amendments or filibuster. The goal of the legislation is to cut at least $1.5 trillion over the coming 10 years and be passed by December 23, 2011. The committee would have 12 members, 6 from each party.

- Projected revenue from the committee's legislation must not exceed the revenue baseline produced by current law.[بحاجة لمصدر]

- The agreement specifies an incentive for Congress to act. If Congress fails to produce a deficit reduction bill with at least $1.2 trillion in cuts, then Congress can grant a $1.2 trillion increase in the debt ceiling but this would trigger across the board cuts ("sequestration") of spending equally split between defense and non defense programs. The across the board cuts would apply to mandatory and discretionary spending in the years 2013 to 2021 and be in an amount equal to the difference between $1.2 trillion and the amount of deficit reduction enacted from the joint committee. The sequestration mechanism is the same as the Balanced Budget Act of 1997. There are exemptions—across the board cuts would apply to Medicare, but not to Social Security, Medicaid, civil and military employee pay, or veterans.

- Congress must vote on a Balanced Budget Amendment between October 1, 2011, and the end of the year.

- The debt ceiling may be increased an additional $1.5 trillion if either one of the following two conditions are met:

- A balanced budget amendment is sent to the states

- The joint committee cuts spending by a greater amount than the requested debt ceiling increase.

Most of the $900 billion in cuts occur in future years and so will not remove significant capital from the economy in the current and following year.[بحاجة لمصدر] The across the board cuts could not take place until 2013 and if they are triggered, a new Congress could vote to eliminate or deepen all or part of them. Boehner was reported to be particularly concerned that any defense cuts could not go into effect until after 2013. The agreement contains the McConnell mechanism for the specified debt ceiling increases. The President may make the specified increases, but to stop them the Congress must pass a bill to disapprove of them by the two thirds majority needed to override a veto.[91]

The agreement, entitled the Budget Control Act of 2011,[92] passed the House on August 1, 2011, by a vote of 269–161; 174 Republicans and 95 Democrats voted for it, while 66 Republicans and 95 Democrats voted against it.[93] The Senate passed the agreement on August 2, 2011, by a vote of 74–26; seven Democrats and 19 Republicans voted against it.[94] Obama signed the bill shortly after it was passed by the Senate.[93]

ردود الفعل

رد فعل الكونگرس

- Senate Minority Leader Mitch McConnell, on the GOP: "I think some of our members may have thought the default issue was a hostage you might take a chance at shooting. Most of us didn't think that. What we did learn is this – it's a hostage that's worth ransoming. And it focuses the Congress on something that must be done."[95]

رد الفعل الأمريكي

The national debt rose $238 billion, the largest one day increase in the history of the United States,[96] without the corresponding sale or issuance of Treasury bonds.[97] US debt surpassed 100 percent of gross domestic product for the first time since الحرب العالمية الثانية.[98] According to the International Monetary Fund, US joined a group of countries whose public debt exceeds GDP, including Japan (229 percent), Greece (152 percent), Jamaica (137 percent), Lebanon (134 percent), إيطاليا (120 percent), Ireland (114 percent) and Iceland (103 percent).[99]

The US stock markets NASDAQ, S&P 100, and ASX lost up to four percent in value, the largest drop after that which occurred in July 2009, during the global financial crisis that was precipitated in part by a sharp decline in US housing prices prices and corresponding losses by holders of mortgages and mortgage-backed securities. The commodities market also took losses with average spot crude oil market prices falling below $US86 a barrel.[102] The price of gold fell as deepening losses on Wall Street prompted investors to sell.[103]

On August 5, 2011, Standard & Poor's credit rating agency downgraded the long-term credit rating of the United States government for the first time in its history from AAA to AA+:[104] "The downgrade reflects our opinion that the fiscal consolidation plan that Congress and the Administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government's medium-term debt dynamics".[105][106] The other two major credit rating agencies, Moody's and Fitch, continue to rate the federal government's bonds as AAA.[107]

In a joint press release from the Federal Reserve System, the Federal Deposit Insurance Corporation, the National Credit Union Administration and the Office of the Comptroller of the Currency, federally regulated institutions were told that for risk-based capital purposes, the debt of the United States was still considered to be risk free.[108]

رد الفعل الدولي

The international community characterized the political bickering in Washington as playing a game of chicken and criticized the US government for acting "dangerously irresponsible."[109]

International reaction to the US credit rating downgrade has been mixed. Australian Prime Minister Julia Gillard urged calm over the downgrade, since only one major agency made that decision.[110] On August 6, 2011, just hours after the rating agency Standard & Poor's downgraded America's long-term debt, China, the largest foreign holder of United States debt, said that Washington needed to "cure its addiction to debts" and "live within its means".[111] The official Xinhua News Agency was critical of the US government, questioned whether the US dollar should continue to be the global reserve currency, and called for international supervision over the issue of US dollar.[112]

The downgrade started a sell off in every major stock market index around the world,[113] threatening an international markets meltdown.[114][115] The G7 finance ministers scheduled a meeting to discuss the "global financial crisis that concerns all countries."[116]

خط زمني

Although the US has raised its debt ceiling many times before 2011,[117] these increases were not generally coupled with an ongoing global economic crisis.[بحاجة لمصدر] To better understand this timeline, see : History of US debt ceiling increases

- December 16, 2009. The debt ceiling is exceeded. To avoid default, the Treasury Department uses "extraordinary accounting tools" to enable the Treasury to make an additional $150 billion available to meet the necessary federal obligations.[117]

- February 12, 2010. The most recent increase in the debt ceiling was signed into law by President Obama, after being passed by the Democratic 111th United States Congress. It increased the debt ceiling by $1.9 trillion from $12.394 trillion to $14.294 trillion.[28][118]

- February 18, 2010. Obama issues an Executive Order to establish the National Commission on Fiscal Responsibility and Reform, also known as the Bowles-Simpson Commission. The mission of the Commission was to propose recommendations designed to balance the budget, excluding interest payments on the debt, by 2015. It was tasked to issue a report with a set of recommendations by December 1, 2010.[16]

- November 2, 2010. United States midterm elections: The Republican Party gained 63 seats in the U.S. House of Representatives, recapturing the majority by 242–193 in the 112th Congress.[119] Major planks for the House Republicans during the election campaign were cutting federal spending[120] and stopping any tax increases.[121]

- December 1, 2010. The Bowles-Simpson Commission on Fiscal Responsibility and Reform issues its report but the recommendations fail to win support of at least 14 of the 18 members necessary to adopt it formally.[122][123] The recommendations were never adopted by Congress nor President Obama.

- January 6, April 4 and May 2, 2011. Secretary of the Treasury Timothy Geithner sends three letters requesting an increase in the debt ceiling.[124][30][125]

- January 25, 2011. Senator Pat Toomey introduces the Full Faith And Credit Act bill[44] [S.163[43]] that would require the Treasury to prioritize payments to service the national debt over other obligations. The bill is never debated.

- January 28, 2011. Moody's Investors Service says it may place a "negative" outlook on the AAA rating of U.S. debt sooner than anticipated as the country's budget deficit widens.[126]

- February 14, 2011. Obama releases his budget proposal for fiscal year 2012.[127] Republicans criticize the budget for doing too little to rein in the burgeoning US deficit.[128] The CBO analysis released in April 2011, estimated that the budget would increase total deficits over 10 years by $2.7 trillion: from $6.7 trillion of the March 2011 baseline to $9.4 trillion with the proposed budget.[129] The Senate rejects the budget proposal on May 25, 2011 (see below).

- April 14, 2011. Both the House of Representatives and the Senate voted in favor of the 2011 US federal budget, 260–167 and 81–19 respectively. This budget projected the 2011 deficit to be $1.645 trillion, and therefore ensured that the debt ceiling would be hit during this fiscal year.

- April 15, 2011. On a party-line vote 235–193, the House of Representatives passed the Republican 2012 budget proposal aimed to reduce total spending by $5.8 trillion and reduce total deficits by $4.4 trillion over 10 years compared to the current-policy baseline.[130] It included reform to Medicare and Medicaid entitlement programs which the Democrats criticized as an attempt to leave seniors and poor holding the bag on health care costs. The criticism resonated with the many in the public who voiced opposition to the proposed changes.[131] The Senate rejects the budget proposal on May 25, 2011 (see below).

- April 18, 2011. Standard & Poor's Ratings Services revised its outlook on US to negative due to recent and expected further deterioration in the U.S. fiscal profile, and of the ability and willingness of the U.S. to soon reverse this trend. With the negative outlook, S&P believes there is a likelihood of at least one-in-three of a downward rating adjustment within two years.[22]

- May 16, 2011. The debt ceiling is reached. Treasury Secretary Timothy Geithner issues a debt issuance suspension period, directing the Treasury to utilize "extraordinary measures" to fund federal obligations.[31]

- May 18, 2011. Bipartisan deficit-reduction talks among the "Gang of Six" high-profile Senators are suspended when Republican Tom Coburn drops out.[132]

- May 24, 2011. Vice President Joe Biden and four Democratic lawmakers begin meeting with the Republican House Majority Leader Eric Cantor and the Republican Senate Minority Whip Jon Kyl, in an effort to continue the talks. Cantor says that these talks would lay the groundwork for further discussions between President Obama, Republican Speaker of the House John Boehner and other leaders of Congress.[133]

- May 25, 2011. The Senate rejects both the Republican House budget proposal by a vote of 57–40 and the Obama budget proposal by a vote of 97–0.[134]

- May 31, 2011. The House votes on a bill to raise the debt ceiling without any spending cuts tied to the increase. President Obama asked Congress to raise the debt ceiling in a 'clean' vote that included no other conditions. The bill, which would have raised the debt ceiling by $2.4 trillion, failed by a vote of 97–318. Democrats accused Republicans of playing politics by holding a vote they knew would fail.[135]

- June 23, 2011. Biden's negotiations on the debt ceiling are cut off when both Eric Cantor and Jon Kyl walk out over disagreements on taxes.[136]

- July 19, 2011. The Republican Majority in the House bring the Cut, Cap and Balance Act (H.R.2560),[137] their proposed solution to the crisis, to a vote. They pass the bill by a vote of 234–190, split closely along party lines: 229 Republicans and 5 Democrats 'for', 181 Democrats and 9 Republicans 'against'; it is sent to the Senate for consideration. The Bill authorized that the debt ceiling be raised by $2.4 trillion after a Balanced Budget Amendment was passed by Congress. Since Constitutional amendments require a two-thirds majority vote in both chambers of Congress to pass, a vote for a Balanced Budget Amendment would require more support than the Cut, Cap and Balance Act bill achieved in the House vote.[138]

- July 22, 2011. The Senate votes along party lines to table the Cut, Cap and Balance Act; 51 Democrats voting to table it and 46 Republicans voting to bring it to a debate.[139] Senate Majority Leader Harry Reid called the Act "one of the worst pieces of legislation to ever be placed on the floor of the United States Senate." Even had it passed Congress, Obama had promised to veto the bill.[140]

- July 25, 2011. Republicans and Democrats outlined separate deficit-reduction proposals.[2]

- July 25, 2011. Obama and Speaker of the House John Boehner addressed the nation separately over network television with regards to the debt ceiling.[141][142]

- July 25, 2011. The bond market is shaken by a single $850 million futures trade betting on US default.[143]

- July 29, 2011. The Budget Control Act of 2011 S. 627,[144] a Republican bill that immediately raises the debt ceiling by $900 billion and reduces spending by $917 billion, passes in the House on vote 218–210. No Democrats voted for it and it also drew 'no' votes from 22 Republicans who deemed it insufficiently tough on spending cuts.[145] It allows the President to request a second increase in the debt ceiling of up to $1.6 trillion upon passage of the balanced-budget amendment and a separate $1.8 trillion deficit reduction package, to be written by a new "joint committee of Congress."[146] Upon introduction into the Senate in the evening, the bill was immediately tabled on a 59–41 vote including some Republican votes.[147]

- July 30, 2011. The House of Representatives voted 173–246 to defeat Senate Majority Leader Harry Reid's $2.4 trillion plan to reduce the deficit and raise the debt ceiling.[148]

- July 31, 2011. President Barack Obama announces that leaders of both parties have reached an agreement to lift the debt ceiling and reduce the federal deficit, and separately, House Speaker John Boehner told Republicans that they have reached the framework for an agreement.[149] Boehner reveals details of the agreement in a presentation to the House Republicans.[150]

- August 1, 2011. The House passes a bipartisan bill by a vote of 269–161. 174 Republicans and 95 Democrats voted 'yes'; 66 Republicans and 95 Democrats voted 'no'.[151]

- August 2, 2011. The Senate passes the bill by a vote of 74–26. 28 Republicans, 45 Democrats, and 1 independent voted 'yes'; 19 Republicans, 6 Democrats, and 1 independent voted 'no'.[152] President Obama signed the debt ceiling bill the same day, thus ending fears of a default. Obama also declared that the bill is an "important first step to ensuring that as a nation we live within our means."[153]

- August 2, 2011. Date estimated by the Department of the Treasury that the borrowing authority of the U.S. would be exhausted.[31]

- August 5, 2011. Standard & Poor's lowered the credit rating of the United States from AAA to AA+,[104][105] deciding that the debt plan that was passed did not go far enough to address the country's debt. It also warned that it is pessimistic about the nation's fiscal outlook.[154]

Projected:

- August 15, 2011. $29 billion of debt interest becomes due. If this is not paid, the United States technically would be in sovereign default.[155][156]

انظر أيضا

- تاريخ تزايد سقف الدين الأمريكي

- الأزمة المالية العالمية

- United States federal government shutdown of 1995 and 1996

- أزمة الديون السيادية الاوروبية 2010

المصادر

- ^ Stephanie Condon (يوليو 27, 2011). "McCain blasts "bizarro" Tea Party debt limit demands". CBS News. Retrieved يوليو 30, 2011.

- ^ أ ب "Reid, Boehner Outline Competing Deficit Plans". Fox News. Associated Press. يوليو 25, 2011. Retrieved يوليو 29, 2011.

- ^ Government Accountability Office (فبراير 22, 2011). "Debt Limit: Delays Create Debt Management Challenges and Increase Uncertainty in the Treasury Market".

- ^ Lowrey, Annie (مايو 16, 2011). "Debt ceiling crisis: The debt ceiling is a pointless, dangerous relic, and it should be abolished". Slate. Retrieved أغسطس 1, 2011.

- ^ Epstein, Jennifer (يوليو 18, 2011). "Moody's: Abolish the debt limit". Politico. Retrieved أغسطس 1, 2011.

- ^ Sahadi, Jeanne (مايو 18, 2011). "Debt ceiling FAQs: What you need to know". CNN. Retrieved أغسطس 1, 2011.

- ^ أ ب Timothy Geitner (يونيو 28, 2011). "Letter to the Hon Jim DeMint" (PDF). U.S. Department of the Treasury. Retrieved يوليو 29, 2011.

- ^ Damian Paletta (يوليو 28, 2011). "Treasury Crafts a Plan: Who Gets Paid, Who Doesn't". The Wall Street Journal. Retrieved يوليو 29, 2011.

- ^ "Get the Facts: Raising the Debt Limit". U.S. Department of the Treasury. يوليو 20, 2011. Retrieved أغسطس 1, 2011.

- ^ أ ب "Treasury to Explain Who Gets Paid, Who Doesn't if Debt Cap Not Raised". Fox News. أبريل 7, 2010. Retrieved أغسطس 1, 2011.

- ^ "Obama says Reagan raised debt ceiling 18 times; George W. Bush seven times". PolitiFact. يوليو 25, 2011. Retrieved أغسطس 1, 2011.

- ^ أ ب "CBO's 2011 Long-Term Budget Outlook"

- ^ "America's Sea of Red Ink Was Years in the Making".

- ^ "Anti-tax-and-spend group throws "tea party" at Capitol". Deseret News. مارس 7, 2009. Retrieved أغسطس 1, 2011.

- ^ Berman, Russell (يوليو 5, 2010). "Gallup: Tea Party's top concerns are debt, size of government". The Hill. Retrieved أغسطس 1, 2011.

- ^ أ ب "Executive Order -- National Commission on Fiscal Responsibility and Reform" (Press release). The White House. فبراير 18, 2010. Retrieved يوليو 28, 2011.

- ^ "Republican wave swamps the U.S. in mid-term elections". Herald Sun. نوفمبر 4, 2010. Retrieved أغسطس 1, 2011.

- ^ "Cutting Spending". GOP.gov. Retrieved أغسطس 1, 2011.

- ^ "Creating Jobs". GOP.gov. Retrieved أغسطس 1, 2011.

- ^ "Tea party role in debt bill raises GOP eyebrows". CBS MoneyWatch. يوليو 27, 2011. Retrieved أغسطس 1, 2011.

- ^ "Moody's Threatens US With 'Negative' Debt Outlook". Moneynews.com. يناير 28, 2011. Retrieved أغسطس 1, 2011.

- ^ أ ب "Fiscal Challenges Weighing On The 'AAA' Sovereign Credit Rating On The Government Of The United States". Standard & Poor's. أبريل 18, 2011. Retrieved أغسطس 1, 2011.

- ^ "UPDATE 2-S&P-US deficit cuts of $4 trillion a good start". Reuters. يوليو 28, 2011. Retrieved أغسطس 1, 2011.

- ^ Schroeder, Peter (يوليو 28, 2011). "Moody's: Neither debt plan protects the nation's AAA rating". The Hill. Retrieved أغسطس 1, 2011.

- ^ Leonhardt, David (مايو 11, 2010). "In Greece, a Reflection of U.S. Debt Problems". The New York Times. Retrieved أغسطس 1, 2011.

- ^ أ ب ت "Interview with GM's Dan Akerson; Killing in the Name of the Knights Templar; Interview With Christine Lagarade". CNN. يوليو 31, 2011. Retrieved أغسطس 1, 2011.

- ^ CBPP-The Most Terrifying Result of the Debt Ceiling Crisis-August 2, 2011

- ^ أ ب "Bill Summary & Status – 111th Congress (2009–2010) – H.J.RES.45 – CRS Summary – THOMAS (Library of Congress)". Thomas.loc.gov. فبراير 4, 2010. Retrieved أغسطس 3, 2011.

- ^ "Obama signs debt limit-paygo bill into law". Reuters. فبراير 12, 2010. Retrieved يوليو 28, 2011.

- ^ أ ب "Secretary Geithner Sends Debt Limit Letter to Congress". U.S. Department of the Treasury. أبريل 4, 2011. Retrieved يوليو 28, 2011.

- ^ أ ب ت "As US Reaches Debt Limit, Geithner Implements Additional Extraordinary Measures to Allow Continued Funding of Government Obligations". U.S. Department of the Treasury. مايو 16, 2011. Retrieved يوليو 28, 2011.

- ^ Government Accountability Office, Delays Create Debt Management Challenges and Increase Uncertainty in the Treasury Market, GAO-11-203, February 2011.

- ^ "Business Groups Enter the Fray as Debt Deadline Looms". The Wall Street Journal. يوليو 27, 2011.

{{cite news}}: Unknown parameter|name=ignored (help) - ^ "Is US default deadline truly Aug 2? Analysts say no". Reuters. يوليو 26, 2011.

{{cite news}}: Unknown parameter|name=ignored (help) - ^ "Debt Ceiling: Chaos if Congress blows it". CNN. يوليو 14, 2011. Retrieved يوليو 29, 2011.

- ^ Sarlin, Benjy (يونيو 22, 2011). "Ex-IMF Chief Economist: Debt Ceiling Default Would Be "A Calamity"". Talking Points Memo. Retrieved يوليو 3, 2011.

- ^ Sahadi, Jeanne (يوليو 14, 2011). "Debt ceiling: Chaos if Congress blows it". CNN. Retrieved أغسطس 1, 2011.

- ^ "Ahmed Wali Karzai Assassinated; Interview with Larry Summers". CNN. يوليو 17, 2011. Retrieved يوليو 28, 2011.

- ^ "Secretary Geithner Sends Debt Limit Letter to Congress". U.S. Department of the Treasury. يناير 6, 2011. Retrieved أغسطس 1, 2011.

- ^ "Sen. Toomey Sends Letter to Secretary Geithner on the Debt Limit" (Press release). Pat Toomey. فبراير 2, 2011. Retrieved أغسطس 1, 2011.

- ^ Washington, D.C. (مايو 26, 2011). "Senate GOP to Geithner: Default Is Your Choice" (Press release). Demint.senate.gov. Retrieved أغسطس 1, 2011.

- ^ Timothy Geithner (يونيو 29, 2011). "Full Text: Geithner Letter Responding to Republicans on Debt Limit". The Wall Street Journal.

- ^ أ ب "Bill Summary & Status – 112th Congress (2011–2012) – S.163 – THOMAS (Library of Congress)". Thomas.loc.gov. يناير 26, 2011. Retrieved أغسطس 1, 2011.

- ^ أ ب "Sen. Toomey Introduces First Step To Curb Federal Spending: The Full Faith And Credit Act" (Press release). Pat Toomey. يناير 25, 2011. Retrieved أغسطس 1, 2011.

- ^ "The Outcome of the Debt Ceiling Battle Could Hurt the Economy".

- ^ "Analysts: Failure To Raise Debt Ceiling Means 44% Spending Cut, 10% Drop In GDP, Recession".

- ^ Calmes, Jackie (يناير 6, 2011). "Geithner asks Congress to raise U.S. debt limit quickly". The New York Times. Retrieved فبراير 9, 2011.

- ^ أ ب ت Charles Krauthammer (يونيو 3, 2011). "Our Salutary Debt-Ceiling Scare". National Review. Retrieved أغسطس 1, 2011.

- ^ Alec Jacobs (يوليو 23, 2011). "Cantor: Vote on balanced budget amendment 'likely' next week". The Daily Caller. Retrieved أغسطس 1, 2011.

- ^ "McConnell wants balanced budget amendment with debt ceiling talks". Digitaljournal.com. يوليو 16, 2011. Retrieved أغسطس 1, 2011.

- ^ "John Boehner: Tax Reform 'Under Discussion' In Debt Ceiling Talks". The Huffington Post. يوليو 7, 2011. Retrieved أغسطس 3, 2011.

- ^ "Ron Paul's Surprisingly Lucid Solution To The Debt Ceiling Impasse". The New Republic. يوليو 2, 2011. Retrieved أغسطس 1, 2011.

- ^ Schroeder, Peter (أبريل 15, 2011). "White House: Obama hasn't changed on 'clean' debt vote". The Hill. Retrieved أغسطس 1, 2011.

- ^ Meredith Shiner (أبريل 14, 2011). "Harry Reid calls for clean debt ceiling vote". Politico. Retrieved أغسطس 1, 2011.

- ^ "Debt Ceiling: Tax Increases Have Democrats And Republicans In War Of Words". The Huffington Post. يوليو 13, 2011. Retrieved أغسطس 1, 2011.

- ^ Neil Munro (يوليو 25, 2011). "Obama focuses on 2013 debt ceiling goal". The Daily Caller. Retrieved أغسطس 1, 2011.

- ^ Quinn Bowman (يوليو 7, 2011). "Pelosi: House Democrats Won't Support Entitlement Cuts in Debt-Limit Deal". PBS. Retrieved أغسطس 1, 2011.

- ^ "Review & Outlook: The Road to a Downgrade". The Wall Street Journal. يوليو 28, 2011. Retrieved أغسطس 1, 2011.

- ^ أ ب Cohn, Alicia M. (يوليو 7, 2011). "Schumer threatens 14th Amendment solution for 'next round' of debt-ceiling talks". The Hill. Retrieved أغسطس 1, 2011.

- ^ أ ب "House Democratic Leaders To Obama: Use The 14th Amendment". The Huffington Post. يوليو 27, 2011. Retrieved أغسطس 1, 2011.

- ^ أ ب Wednesday (يوليو 27, 2011). "House Democrats Support Executive Order On Debt Limit – News – Talk Radio News Service: News, Politics, Media". Talkradionews.com. Retrieved أغسطس 1, 2011.

- ^ أ ب Sahadi, Jeanne (يونيو 30, 2011). "Is the debt ceiling really unconstitutional?". CNN. Retrieved أغسطس 1, 2011.

- ^ "Congress rejects 'clean' U.S. debt ceiling hike". MarketWatch. مايو 31, 2011. Retrieved يوليو 28, 2011.

- ^ "House GOP Votes Down Clean Debt Limit Increase, Eyes Medicare In Deal". The Huffington Post. مايو 31, 2011.

- ^ أ ب "Scheme, stonewall and fulminate". The Economist. يوليو 21, 2011.

- ^ "PIMCO Founder To Deficit-Obsessed Congress: Get Back To Reality". Talking Points Memo. يونيو 21, 2011.

- ^ "Right Now Contractionary Fiscal Policy (Probably) Makes the Long-Run Debt Problem Worse". يوليو 14, 2011.

- ^ Timothy Geithner (يونيو 29, 2011). "Geithner Letter Responding to Republicans on Debt Limit". The Wall Street Journal.

- ^ أ ب Jack M. Balkin (يوليو 28, 2011). "3 ways Obama could bypass Congress". CNN. Retrieved أغسطس 1, 2011.

- ^ Hess, Steven (يوليو 18, 2011). "Eliminate the debt ceiling, Moody's suggests". The Washington Post.

- ^ Gorenstein, Peter (يوليو 25, 2011). "Former CBO Director: It's Time to Eliminate the Debt Ceiling". The Daily Ticker.

- ^ أ ب "Tim Geithner: 14th Amendment Says Debt 'Shall Not Be Questioned'". The Huffington Post. يونيو 30, 2011. Retrieved أغسطس 1, 2011.

- ^ أ ب [1][dead link]

- ^ Jack Balkin (يونيو 30, 2011). "The Legislative History of Section Four of the Fourteenth Amendment".

- ^ Bruce Bartlett (أبريل 29, 2011). "The Debt Limit Option President Obama Can Use". The Fiscal Times. Retrieved مايو 3, 2011.

- ^ Katrina vanden Heuvel (يوليو 5, 2011). "Invoke the 14th – and end the debt standoff". The Washington Post. Retrieved يوليو 7, 2011.

- ^ Laurence Tribe (يوليو 8, 2011). "A Ceiling We Can't Wish Away". The New York Times.

- ^ أ ب Zeitlin, Matthew (يونيو 24, 2011). "The Debt Ceiling: Why Obama Should Just Ignore It". The New Republic.

- ^ "Bill Clinton Says He'd Raise The Debt Ceiling Using 14th Amendment". NPR. يوليو 19, 2011.

- ^ Steinglass, Matthew (يونيو 30, 2011). "The Debt Ceiling: The Constitutional Option". The Economist.

- ^ [2][dead link]

- ^ "Fact Check: Treasury General Counsel George Madison Responds to New York Times Op-Ed on 14th Amendment". U.S. Department of the Treasury. يوليو 8, 2011. Retrieved أغسطس 3, 2011.

- ^ United States Code: Title 31,5112. Denominations, specifications, and design of coins | LII / Legal Information Institute

- ^ Coin Seigniorage and the Irrelevance of the Debt Limit, "beowulf" on my.firedoglake.com, Monday January 3, 2011, Retrieved July 31, 2011

- ^ The $5 Trillion Coin. Gimmicks the government could use to resolve the debt-ceiling debacle., Anne Lowrey, Slate, July 29, 2011, Retrieved July 31, 2011

- ^ Meltzer, Allan (2010). A History of the Federal Reserve. Volume 2, Book 1: University Of Chicago Press. pp. 110 and 168. ISBN 978-0226520018.

{{cite book}}: CS1 maint: location (link) - ^ Alex J. Pollock (يوليو 27, 2011). "The Government Debt Ceiling: What Did Eisenhower Do?". The Government Debt Ceiling: What Did Eisenhower Do?. American Enterprise Institute. Retrieved يوليو 29, 2011.

{{cite web}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ "Live Gold Prices – Gold Price – Silver Prices – Price of Silver and Gold". Monex.com. Retrieved أغسطس 1, 2011.[التحقق مطلوب]

- ^ DeFrank, Thomas (يوليو 31, 2011). "President Obama says Republican, Dem leaders have reached agreement with him to raise debt ceiling". Daily News.

- ^ "Boehner's Debt Ceiling Agreement Presentation". The New York Times. يوليو 31, 2011.

- ^ Lisa Mascaro; Kathleen Hennessey (يوليو 31, 2011). "U.S. leaders strike debt deal to avoid default". Los Angeles Times.

{{cite news}}: Cite has empty unknown parameter:|1=(help) - ^ "Debt-Ceiling Deal: President Obama Signs Bill as Next Fight Looms". ABC News. أغسطس 2, 2011. Retrieved أغسطس 2, 2011.

- ^ أ ب "Obama Signs Debt-Ceiling Plan Hours Before Deadline". Fox News. أبريل 7, 2010. Retrieved أغسطس 3, 2011.

- ^ Frank Thorp (أغسطس 2, 2011). "Senate passes debt deal, 74-26". NBC News. Retrieved أغسطس 3, 2011.

- ^ In debt deal, the triumph of the old Washington - The Washington Post

- ^ "U.S. eats up most of debt limit in one day". The Washington Times. August 3, 2011.

- ^ "Daily Treasury Statement" (PDF). U.S. Department of the Treasury. أغسطس 2, 2011. Retrieved أغسطس 3, 2011.

- ^ U.S. Debt Reaches 100 percent of Country's GDP

- ^ US borrowing tops 100% of GDP: Treasury. AFP.

- ^ "S&P | Ratings Sovereigns Ratings List | Americas". Standardandpoors.com. Retrieved أغسطس 7, 2011.

- ^ Reference for the United States: "United States of America Long-Term Rating Lowered To 'AA+' On Political Risks And Rising Debt Burden; Outlook Negative". standardandpoors.com. Retrieved أغسطس 5, 2011.

- ^ Hyam, Rebecca. "Market dives to two-year low on recession fears". Retrieved أغسطس 5, 2011.

{{cite web}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ "World stocks plunge on recession fears". ABC News. Retrieved أغسطس 5, 2011.

- ^ أ ب Binyamin Appelbaum (أغسطس 5, 2011). "S.& P. Downgrades Debt Rating of U.S. for the First Time". The New York Times. Retrieved أغسطس 6, 2011.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ أ ب "United States of America Long-Term Rating Lowered To 'AA+' On Political Risks And Rising Debt Burden; Outlook Negative" (PDF). Standard & Poor's. أغسطس 5, 2011. Retrieved أغسطس 6, 2011.

- ^ U.S. Loses AAA Credit Rating as S&P Slams Debt – Bloomberg

- ^ World reacts to U.S. credit downgrade

- ^ "Agencies Issue Guidance on Federal Debt". August 5, 2011.

- ^ Cookon, John (يوليو 29, 2011). "World reacts to U.S. debt crisis". CNN. Retrieved يوليو 31, 2011.

- ^ World reacts to U.S. credit downgrade

- ^ "China Tells U.S. It Must 'Cure Its Addiction to Debt'"

- ^ World reacts to U.S. credit downgrade

- ^ Debt crisis: leaders in a rush to find common purpose

- ^ Talk of the Day -- U.S. debt crisis triggers global mobilization

- ^ G7 leaders race against new week of market drama

- ^ "G-7 finance chiefs to discuss crisis". August 6, 2011.

- ^ أ ب Knoller, Mark (ديسمبر 16, 2009). "U.S. National Debt Tops Debt Limit". CBS News. Retrieved أغسطس 1, 2011.

- ^ "Obama signs debt limit-paygo bill into law". Reuters. فبراير 12, 2010. Retrieved أغسطس 3, 2011.

- ^ Shearer, Geoffrey (نوفمبر 4, 2010). "Republican wave swamps the U.S. in mid-term elections". Herald Sun. Retrieved يوليو 28, 2011.

- ^ "Cutting Spending – A Pledge to America". GOP.gov. Retrieved يوليو 28, 2011.

- ^ "Creating Jobs – A Pledge to America". GOP.gov. Retrieved يوليو 28, 2011.

- ^ "The Moment of Truth: Report of the National Commission on Fiscal Responsibility and Reform". Fiscalcommission.gov. ديسمبر 1, 2010. Retrieved أغسطس 1, 2011.

- ^ Deficit Commission Report Fails to Advance to Congress. December 3, 2010. FoxNews.com

- ^ "Secretary Geithner Sends Debt Limit Letter to Congress". U.S. Department of the Treasury. يناير 6, 2011. Retrieved يوليو 28, 2011.

- ^ "Secretary Geithner Sends Debt Limit Letter to Congress". U.S. Department of the Treasury. مايو 2, 2011. Retrieved يوليو 28, 2011.

- ^ "Moody's Threatens US With 'Negative' Debt Outlook". Moneynews.com. Retrieved يوليو 28, 2011.

- ^ "President Obama's Budget and the Pending Budget Fight". ABC News. فبراير 14, 2011. Retrieved يوليو 28, 2011.

- ^ Khan, Huma (فبراير 15, 2011). "Obama Defends 2012 Budget, Addresses Deficit, Tax Overhaul in News Conference". ABC News. Retrieved يوليو 28, 2011.

- ^ http://www.cbo.gov/ftpdocs/121xx/doc12130/04-15-AnalysisPresidentsBudget.pdf

- ^ http://budget.house.gov/UploadedFiles/KeyFactsSummary.pdf

- ^ AP (أبريل 7, 2010). "House Approves GOP 2012 Budget on Party-Line Vote". Fox News. Retrieved يوليو 28, 2011.

- ^ Cowan, Richard; Sullivan, Andy. 'Gang of Six' budget talks founder in Senate. May 18, 2011. Reuters.

- ^ Bull, Alister. Debt Talks: Joe Biden Leads Third Round Of Deficit Negotiations. May 24, 2011. Reuters.

- ^ "Senate rejects budget measure containing Medicare overhaul". CNN. مايو 25, 2011. Retrieved يوليو 28, 2011.

- ^ "Congress rejects 'clean' U.S. debt ceiling hike". MarketWatch. مايو 31, 2011. Retrieved يوليو 28, 2011.

- ^ Parkinson, John R. and Miller, Sunlen. Top Republicans Walk Out of VP Biden's Debt Talks. June 23, 2011. ABC News.

- ^ "Bill Summary & Status – 112th Congress (2011–2012) – H.R.2560 – THOMAS (Library of Congress)". Thomas.loc.gov. Retrieved يوليو 28, 2011.

- ^ "Constitution of the United States of America – Wikisource". En.wikisource.org. يوليو 12, 2011. Retrieved أغسطس 1, 2011.

- ^ "Bill Summary & Status – 112th Congress (2011–2012) – H.R.2560 – All Congressional Actions – THOMAS (Library of Congress)". Thomas.loc.gov. Retrieved أغسطس 1, 2011.

- ^ Wong, Scott (يوليو 22, 2011). "Senate rejects 'Cut, Cap, Balance'". Politico.

- ^ "Transcript of Obama's speech: 'Make your voice heard'". CNN. Retrieved أغسطس 1, 2011.

- ^ "House Committee on Rules – Bills". Rules.house.gov. Retrieved أغسطس 1, 2011.

- ^ "US House passes debt bill, likely to die in Senate". Google. AFP. Retrieved أغسطس 1, 2011.

- ^ Russell, By. "House passes revised Boehner debt plan with 218–210 vote". The Hill. Retrieved أغسطس 1, 2011.

- ^ Memoli, Michael A. "Debt ceiling: Senate quickly acts to block House plan". Los Angeles Times. Retrieved أغسطس 1, 2011.

- ^ Susan Davis (يوليو 30, 2011). "House Votes Down Sen. Reid's Debt-Ceiling Plan". National Journal. Retrieved أغسطس 1, 2011.

- ^ Bendavid, Naftali. "Obama, Congress Reach Debt Deal". The Wall Street Journal. Retrieved أغسطس 1, 2011.

- ^ http://www.speaker.gov/UploadedFiles/3-7-31-11-Debt-Framework-Boehner.pdf

- ^ Berman, Russell (أغسطس 1, 2011). "House approves debt-ceiling bill as Giffords makes dramatic return". The Hill. News World Communications. Retrieved أغسطس 2, 2011.

- ^ "U.S. Senate Roll Call Votes 112th Congress - 1st Session On the Motion to Concur in the House Amendment to S. 365". أغسطس 2, 2011. Retrieved أغسطس 5, 2011.

- ^ Montopoli, Brian (أغسطس 2, 2011). "Obama signs debt limit bill after nasty fight". CBS News. Retrieved أغسطس 2, 2011.

- ^ Talev, Margaret; Faler, Brian (أغسطس 6, 2011). "S&P Action Clouds Obama Re-Election Bid – Bloomberg". Bloomberg L.P. Retrieved أغسطس 6, 2011.

- ^ "Fitch May Cut US Top Rating to 'Restricted Default'". Moneynews.com. يونيو 8, 2011. Retrieved أغسطس 3, 2011.

- ^ "Analysts: The True Debt Deadline is Aug. 15". Reuters. July, 27 2011. Retrieved July 30, 2011.

{{cite news}}: Check date values in:|date=(help)

وصلات خارجية

- "Apple now has more cash than the U.S. government". CNN. July 29, 2011.

- "Understanding the Federal Debt Limit". Concord Coalition. يوليو 8, 2011.

- "United States of America Long-Term Rating Lowered To 'AA+' On Political Risks And Rising Debt Burden; Outlook Negative" (PDF). Standard & Poor's. أغسطس 5, 2011.

- CS1 errors: unsupported parameter

- Articles with dead external links from August 2011

- CS1 maint: location

- مقالات بالمعرفة تحتاج تمحيص الحقائق from August 2011

- جميع الصفحات التي تحتاج تمحيص حقائق

- الأحداث الجارية

- Use mdy dates from August 2011

- Articles with unsourced statements from July 2011

- مقالات فيها عبارات متقادمة منذ مايو 2011

- جميع المقالات التي فيها عبارات متقادمة

- Articles with unsourced statements from August 2011

- Articles with hatnote templates targeting a nonexistent page

- 2011 في الولايات المتحدة

- اقتصاد الولايات المتحدة

- مالية حكومة الولايات المتحدة

- الميزانية الفدرالية الأمريكية