داكس

(تم التحويل من داكس 30)

هذا الموضوع عن Dax. من أجل استخدامات أخرى، انظر داكس (توضيح).

| داكس DAX | |

|---|---|

| |

| رسم بياني لمؤشر داكس في بورصة فرانكفورت | |

| التأسيس | 1 يوليو 1988 |

| المشغل | Deutsche Börse |

| البورصات | بورصة فرانكفورت |

| Constituents | 30 |

| النوع | Large cap |

| قيمة رأس المال | €442.5 billion (end 2008)[1] |

| Weighting method | Market value-weighted |

| مؤشرات متعلقة | MDAX, TecDAX, ÖkoDAX |

| الموقع الإلكتروني | DAX homepage |

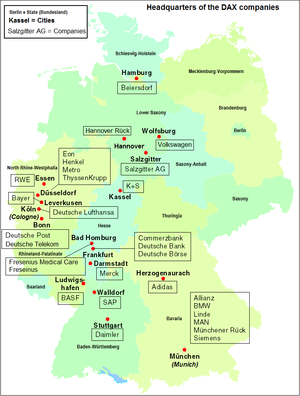

داكس (Deutscher Aktien IndeX, formerly Deutscher Aktien-Index، هوالمؤشر الرئيسي لبورصة فرانكفورت. ويضم أكبر 30 شركة تجارية ألمانية ضمن الشركات المدرجة في بورصة فرانكفورت.

الشركات

A BMW Z4.

The RWE-owned Niederaussem Power Station.

| الشركة | Prime Standard industry group | Ticker symbol | Index weighting (%)1 |

|---|---|---|---|

| أديداس | ملابس رياضية | ADS | 1.25 |

| أليانز | تأمين | ALV | 7.81 |

| BASF | كيماويات | BAS | 5.93 |

| باير | كيماويات | BAY | 7.77 |

| Beiersdorf | منتجات شخصية | BEI | 0.68 |

| بي إم دبليو | تصنيع سيارات | BMW | 1.90 |

| Commerzbank | مصارف إئتمانية | CBK | 0.49 |

| ديملر | تصينع سيارات | DAI | 4.91 |

| ديوتش بنك | مصارف إئتمانية | DBK | 4.29 |

| Deutsche Börse | سمسرة أوراق مالية | DB1 | 2.10 |

| لوفتهانزا | خطوط طيران | LHA | 0.99 |

| Deutsche Post | logistics | DPW | 1.71 |

| Deutsche Telekom | fixed-line telecommunication | DTE | 7.34 |

| E.ON | multi-utilities | EOA | 10.00 |

| Fresenius | رعاية صحية | FRE | 0.68 |

| Fresenius Medical Care | رعاية صحية | FME | 1.32 |

| Hannover Re | re-insurance | HNR1 | 0.40 |

| Henkel | personal products | HEN3 | 0.92 |

| K+S | commodity chemicals | SDF | 1.16 |

| Linde | industrial gases | LIN | 2.40 |

| MAN | diversified industrials | MAN | 0.85 |

| Merck | pharmaceuticals | MRK | 1.10 |

| Metro | multiline retail | MEO | 0.72 |

| Munich Re | re-insurance | MUV2 | 5.02 |

| RWE | multi-utilities | RWE | 5.78 |

| Salzgitter | steel and other metals | SZG | 0.45 |

| SAP | software | SAP | 6.20 |

| Siemens | diversified industrials | SIE | 9.73 |

| ThyssenKrupp | diversified industrials | TKA | 1.22 |

| Volkswagen Group | automobile manufacturers | VOW | 4.88 |

Note 1: - Weightings accurate at start of trade on 23 March 2009. Source: DAX Weighting 20.03.2009, Deutsche Börse.

شركات سابقة في داكس

Following table lists the former components of DAX and the ones replaced them.

| التاريخ | Component excluded | Component included | Reason for exclusion/ Comments |

|---|---|---|---|

| 03.09.1990 | Feldmühle Nobel | Metallgesellschaft | Takeover of Feldmühle Nobel by Stora Enso |

| Nixdorf | Preussag (now TUI) | Merged with Siemens to form Siemens-Nixdorf | |

| 18.09.1995 | Deutsche Babcock | SAP | Replaced by SAP because of lower market capitalisation |

| 22.07.1996 | Kaufhof | METRO | Merger of Kaufhof and Metro Cash & Carry |

| 23.09.1996 | Continental | Münchener Rück | Continental was added back to the DAX on 22 September 2003, though it was demoted again in 2008 |

| 18.11.1996 | Metallgesellschaft | Deutsche Telekom | IPO of Deutsche Telekom |

| 22.06.1998 | Bayerische Hypotheken- und Wechselbank |

adidas | Merger of Vereinsbank and Hypobank to form HypoVereinsbank |

| Bayerische Vereinsbank | HypoVereinsbank | ||

| 21.12.1998 | Daimler-Benz | DaimlerChrysler (now Daimler) |

Merger of Daimler-Benz with Chrysler |

| 22.03.1999 | Degussa | Degussa-Hüls | Merger of Degussa AG with Hüls AG and renaming to Degussa-Hüls AG |

| 25.03.1999 | Thyssen | ThyssenKrupp | Merger of Thyssen and Krupp |

| 20.09.1999 | Hoechst | Fresenius Medical Care | Merger of Hoechst and Rhône-Poulenc with Aventis |

| 14.02.2000 | Mannesmann | Epcos | Takeover of Mannesmann by Vodafone |

| 19.06.2000 | Veba | E.ON | Merger of Veba and Viag to form E.ON |

| VIAG | Infineon | ||

| 18.12.2000 | Degussa-Hüls | Degussa | Merger of Degussa-Hüls AG and SKW Trostberg AG to new Degussa AG |

| 19.03.2001 | KarstadtQuelle | Deutsche Post | IPO of Deutsche Post |

| 23.07.2001 | Dresdner Bank | MLP Vz. | Takeover of Dresdner Bank by Allianz |

| 23.09.2002 | Degussa | Altana | Inadequate market capitalisation |

| 23.12.2002 | Epcos | Deutsche Börse | Fast-exit of Epcos, as Epcos' market capitalisation became inadequate.[2] |

| 22.09.2003 | MLP | Continental | Inadequate free float and market capitalisation. |

| 31.01.2005 | Lanxess | Lanxess was split off from Bayer. | |

| 01.02.2005 | Lanxess | ||

| 19.12.2005 | HypoVereinsbank | Hypo Real Estate | Takeover of HypoVereinsbank by UniCredit |

| 18.09.2006 | Schering | Postbank | Takeover of Schering by Bayer |

| 18.06.2007 | Altana | Merck | After the sale of Nycomed, inadequate market capitalisation[3] |

| 22.09.2008 | TUI | K+S | Fast-entry of K+S, inadequate market capitalisation of TUI[4] |

| 22.12.2008 | Continental | Beiersdorf | Fast-exit of Continental because of inadequate free-float market capitalisation after the acquisition by Schaeffler Group |

| 22.12.2008 | Hypo Real Estate | Salzgitter | Fast-Exit of Hypo Real Estate because of inadequate free-float market capitalisation after a stake by American investor JC Flowers, as well as huge decline in market capitalisation during the financial crisis of 2007–2009 |

| 23.03.2009 | Infineon Technologies | Fresenius SE | Inadequate market capitalisation |

| 23.03.2009 | Deutsche Postbank | Hannover Re | Inadequate market capitalisation |

المصادر

- ^ "DAX Weighting 30.12.2008". Deutsche Börse. 30 December 2008. Retrieved 2009-03-21.

- ^ Deutsche Börse: Deutsche Börse ab dem 23. Dezember im DAX Pressemitteilung, 12. November 2002

- ^ Frankfurter Allgemeine Zeitung: Merck ersetzt Altana im DAX

- ^ Deutsche Börse: K+S ersetzt TUI in DAX Pressemitteilung, 3rd September 2008